The Web3 identity crisis is deepening as decentralized identity systems confront traditional Know Your Customer (KYC) requirements. While Web3 promises privacy and user control, regulatory demands are pushing back, sparking debate over the future of identity in decentralized networks.

The Promise of Decentralized Identities (DIDs)

Web3’s vision for a user-centric internet includes decentralized identities as one of its cornerstones. DIDs, or decentralized identifiers, are built on a blockchain to give individuals control of their data without the use of a central authority, like a government or corporation.

Key Features of Decentralized Identities

- Users can control their identities without any middleman.

- Privacy by Design: Data is either on-chain or off-chain and is encrypted to minimize exposure.

- Interoperability: DIDs can be utilized across multiple platforms for seamless integration.

- Lower Fraud Risk: The inability to change records reduces the risk of identity theft.

Supporters say DIDs can give the user control of their identity, keep their information private, and fit the values of Web3: decentralization and trustlessness.

There is a growing demand for regulatory compliance with KYC and AML standards

On the other hand, authorities and financial institutions are accelerating their efforts to thwart fraud, money laundering, and terrorist financing. KYC and AML are at the center of these efforts. KYC refers to Know Your Customer, while AML means Anti-Money Laundering.

Why Regulators Insist on Verified Identities

- Stop wrongdoing: If you use an unverified identity, the criminal activity could include money laundering, tax fraud, and ransomware payments.

- In the digital realm, protecting consumers helps verify their identities to prevent scams.

- Global Standards International organizations like the FATF (Financial Action Task Force) stipulate financial systems and strict identification checks.

- The government needs to see what is happening in the economy so that it can enforce tax evasion laws.

Regulators are concerned about the anonymity inherent in decentralization technology, as it can be used for illicit reasons.

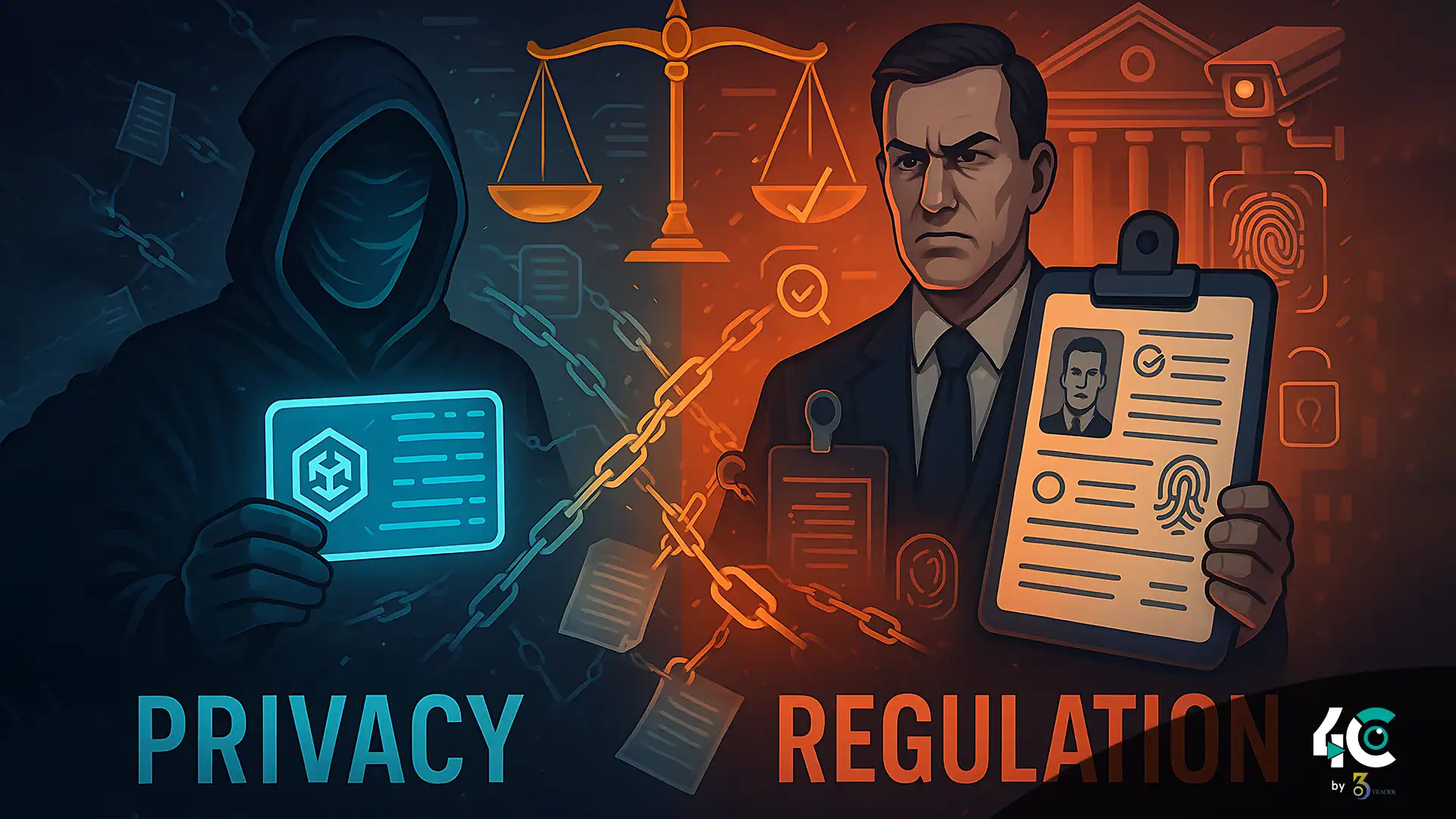

The Clash Between Privacy and Regulation

The decentralized identities and regulated KYC dilemma has two opposing philosophies.

1. Privacy vs. Surveillance

- Web3 advocates say privacy is a fundamental right. DIDs shield users from surveillance or exploitation by centralized entities.

- Regulators are worried about unverified identities allowing bad actors to corrupt the system and endanger public safety.

2. Autonomy vs. Accountability

- Web3 visionaries think DIDs are excellent tools for empowering individuals with autonomy over their data and actions.

- Governments: Make users accountable. Ensure all users are identifiable and held responsible for any illegal activity.

3. Innovation vs. Control

- Web3 developers argue that excessive regulation hinders technological innovation.

- Regulatory agencies are essential to control the systemic risk phenomenon in the interest of society.

The ideological divergence creates a dilemma. How will Web3 balance the principles of decentralization and privacy with the practical need to comply with regulations?

Potential Solutions to Bridge the Gap

While it may seem unfeasible, it is possible to harmonize decentralized identities with regulations.

1. Selective Disclosure Mechanisms

- Selective disclosure allows users to only reveal the necessary information for any transaction to satisfy the KYC requirements. For example.

- Zero-knowledge proofs (ZKPs) allow users to prove they meet certain requirements (like age or place of residence) while revealing no underlying information.

- Polygon ID and Spruce ID are already testing identities based on ZKP technology.

2. Hybrid Identity Models

- A hybrid approach combines decentralized and centralized elements, providing greater flexibility.

- Users could maintain anonymous DIDs for low-risk activities (e.g., gaming, social media).

- Risky cases, like DeFi lending and cross-border payments, would use verified identities.

3. On-Chain KYC Solutions

- New platforms are creating ways to conduct KYC without compromising the privacy of users.

- Users can securely store and present digital certificates issued by trusted authorities, known as verifiable credentials (VCs).

Chainalysis and Elliptic: Blockchain analytics firms offer tools to monitor illicit activities without intruding on individual privacy.

4. Regulatory Sandboxes

Governments have initiated regulatory sandboxes, allowing Web3 projects to test innovative ID solutions. These initiatives help innovators and regulators work together to create better policies.

Implications for the Web3 Ecosystem

The outcome of this identity crisis will determine the future of Web3.

1. Mass Adoption Hinges on Balance

Web3 will not become mainstream if it does not address regulations. On the other hand, an overregulatory Web3 could drive users away from the platform.

2. Fragmentation Risks

Without global standards, jurisdictions can impose contradicting rules and fragment. It may be hard for developers to build an identity system that works universally.

3. Technological Innovation Accelerates

The urgent need to solve this matter is accelerating progress in fields like cryptography, blockchain scalability, and identity management.

Cutting-edge technologies like ZKPs and VCs may have the potential to shape the future of digital identity.

Wrapping It Up: Navigating the Web3 Identity Crisis

The contrast between decentralized identities and regulations KYC highlights the challenges of the dreams and realities related to Web3. Neglecting regulatory realities could stunt the cannabis movement’s growth and legitimacy, even though privacy and autonomy remain significant.

To move forward, stakeholders must collaborate.

- We are developing identity solutions that are both scalable and compliant with privacy, to meet the needs of both customers and regulators.

- Regulators: Embrace adaptive frameworks that foster innovation and tackle real issues.

- Let us users have a say on how digital identity is going to shape in the future.

By reaching a consensus, the Web3 ecosystem could facilitate the widespread use of decentralized identities without compromising trust and security.

Conclusion

The Web3 identity crisis originates from the conflict between privacy-first DIDs and regulatory requirements for verified identities through KYC/AML-compliant systems. Selective disclosure mechanisms, hybrid identity models, on-chain KYC tools, and regulatory sandboxes can influence the launch of select projects. It is necessary to balance innovation and accountability to resolve this tension. To overcome this challenge, Web3 must be able to achieve mass adoption without compromising on its vision of decentralization and privacy.