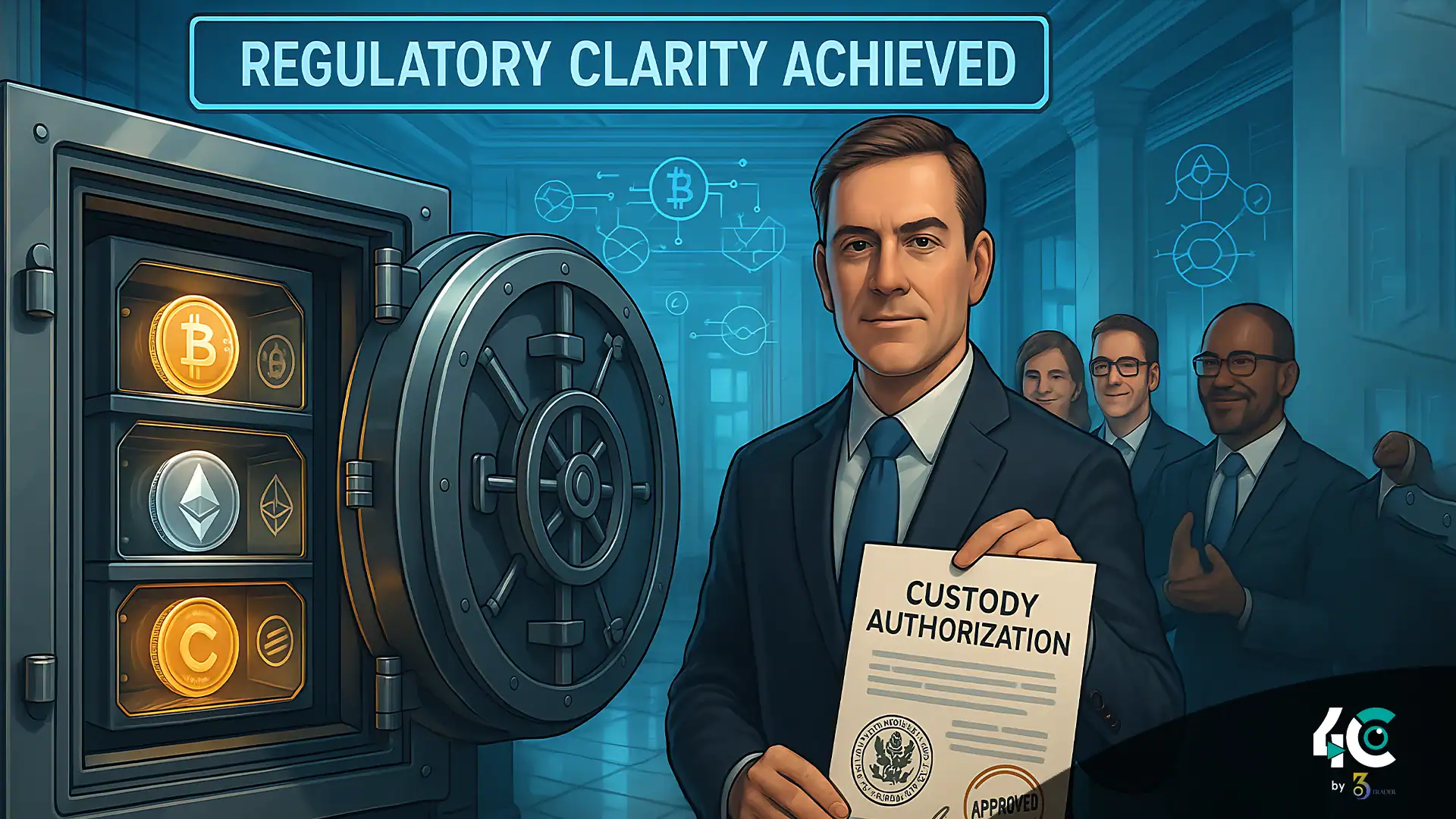

The Office of the Comptroller of the Currency (OCC) has issued new guidelines authorizing US banks to hold crypto assets. This move permits national banks to offer custody services for digital assets, which represents a major advance in integrating cryptocurrencies into the traditional banking system. The guidelines emphasize that banks must conduct these activities safely and soundly, adhering to applicable laws and regulations. This development aims to provide clarity and foster innovation in the financial sector by bridging the gap between conventional banking and the evolving digital asset landscape.

A New Era for Crypto in Traditional Banking

In a major development, US banks are now allowed to hold cryptocurrency for customers after federal regulators updated their guidance on the matter. The Office of the Comptroller of the Currency (OCC) has stressed that national banks, along with federal savings associations, can purchase and sell crypto assets and hold them at clients’ requests. This marks an important change in the way cryptocurrency is affecting the mainstream financial system.

According to Acting Comptroller Rodney Hood, financial institutions may contract with third parties to provide crypto services, including custody, trade execution, recordkeeping, tax reporting, and sub-custody, as long as these activities comply with the law and risk management. The flexibility helps banks to use specialized knowledge while remaining regulated.

This announcement signals a major change in the OCC’s tone as it appears to be more open to digital assets. Over 50 million Americans own some type of cryptocurrency. As a result, regulators are beginning to accept that cryptocurrencies may play a key role in the future of finance.

Industry Leaders Applaud the Move

The revised policy has found wide acceptance among leading industry players. They view it as a significant step to lower regulatory uncertainty and activate institutional participation in the crypto space.

Katherine Kirkpatrick Bos, general counsel at blockchain company StarkWare, claims that today’s guidance is a welcome change from the OCC. This clarity will ease concerns for traditional finance and allow wider adoption of digital assets.

Faryar Shirzad recognized that the banking sector needed direction, which is why he praised the move as very positive of the SEC. “This development is welcome and brings regulatory frameworks in line with the realities of the modern financial world,” Shirzad stated.

Building on Broader Regulatory Shifts

The guidance offered by the OCC is part of a general trend toward loosening restrictions around cryptocurrency, one driven in part by the Trump administration. Back in January 2022, the Federal Reserve modified its recommendations against banks engaging in digital asset activities. Also, President Trump’s recent reversal of a new rule would have obligated decentralized finance (DeFi) protocols to report to the IRS.

The acceptance of banking services for cryptocurrencies is increasing based on recent developments. Regulators are not only responding to the millions of crypto users but are also enabling the innovation of the digital asset industry by building a clearer regulatory path.

What This Means for the Future of Finance

The incorporation of cryptocurrency into traditional banking could create a plethora of new opportunities for both banks and consumers. Banking firms will soon be offering their clients services like crypto custody, crypto exchanges or trading platforms, and crypto wealth management. Customers can use the crypto coins in a more accessible and secure manner.

Furthermore, it would make the US a pioneer in the intersection of traditional finance technology and the highly disruptive world of blockchain technology. As banks start using these new capabilities, a stronger partnership between fintech innovators and traditional players is on the horizon.

In conclusion, this is a turning point for crypto adoption

The new guidance from the OCC indicates a shift between cryptocurrency and traditional banking. In letting banks manage and outsource crypto services, regulators are building a scheme that consumers have asked for. This will unleash the potential for innovation and inclusion.

As the gap shrinks between virtual and conventional finance, the future of money is clear: the future of money is transforming. The question is not if crypto will go mainstream, but how soon, as US banks are now ready to make it happen.