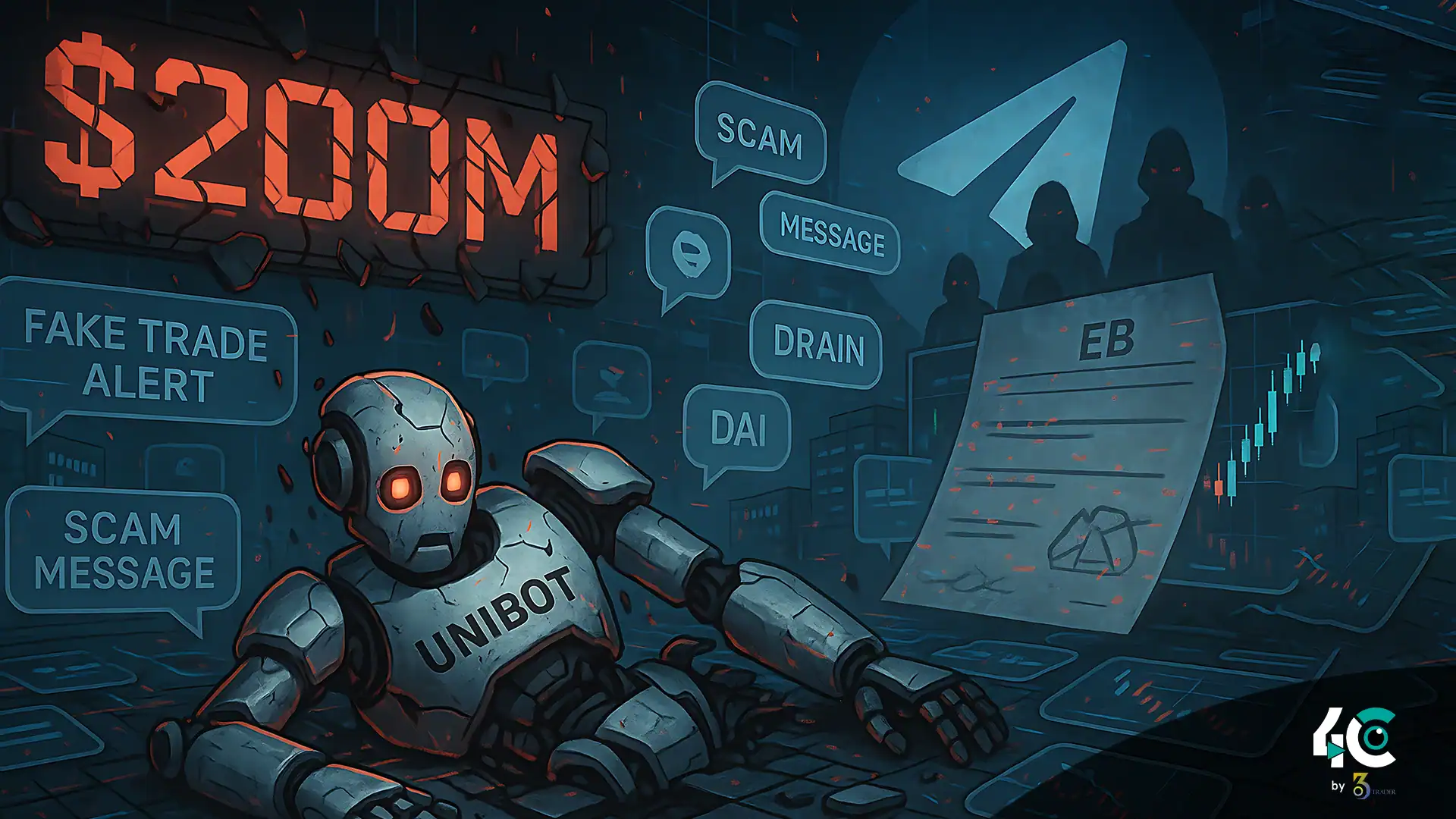

The Rise and Fall of Unibot

At its peak, Unibot promised:

- Guaranteed Fully Automated Profits via Crypto

- A $200 million valuation

- Influencer-driven hype claiming it was “the future of trading”

Then, reality struck:

- The token crashed 98%, falling from $240 to $4

- “Revenue sharing” dried up

- Team wallets dumped while retail holders were left holding the bag

Sadly, Unibot was not the only one. Dozens of similar bots use the same deceptive playbook.

The $200M Telegram Bot Scam Playbook

1. The Fake Utility Trap

These bots claim to offer “AI-powered trading.” In truth, most are glorified interfaces that simply auto-buy trending tokens or place limit orders with no edge.

- Example: The once-hyped “sniper” feature on Banana Gun faded when users realized it was just basic functionality.

2. The Ponzi-Like Revenue Model

Projects lure users with “fee-sharing” promises. But these models often mimic Ponzi schemes:

- Early users get rewards from new buyers

- When new inflows stop, rewards vanish

3. The Insider Dump Scheme

- Insiders (developers, VCs) often hold 50%+ of the token supply

- They slow-dump as influencers shill the project

- Unibot insiders reportedly made $40M+ before the collapse

Three Telegram Bots Now Facing Collapse

1. Bot A – The AI Arbitrage Mirage

- Promises: “Beat the market with AI!”

- Reality: Negative returns in backtests, no public trading performance

2. Bot B – The Revenue-Sharing Ghost Town

- Claims: “5% cut of all fees!”

- Truth: After insider exit, bot usage dropped, and fees fell 90%+

3. Bot C – The Imitator Scam

- Simply forked Unibot’s code

- Added no innovation

- Pumped by the same crypto influencers

How to Spot Telegram Bot Scams

- Anonymous teams with no LinkedIn profiles

- Tokenomics so complicated it hides dumping mechanisms

- Paid influencer promotions without transparency

- Claims of “guaranteed profits”—always false in trading

The Coming Mass Delisting

- As more bots fail like Unibot, crypto exchanges will delist their tokens

- Regulators may classify them as unregistered securities

- By 2025, 95% of Telegram bot tokens could be worthless

How to Protect Yourself

- Avoid investing in Telegram bot tokens—the house always wins

- You can use trading bots, but never buy their tokens

- If it offers revenue share, it’s likely a Ponzi scheme

The Bottom Line

Telegram trading bots can offer helpful functionality, but their tokens are often scams. Unibot’s crash wasn’t an accident—it was the result of a broken, exploitative model that’s now crumbling.

Don’t be the next exit liquidity. Stay cautious. Stay informed.