Circle turned its focus to going public and expanding through its IPO strategy, rejecting Ripple’s $5 billion acquisition offer.

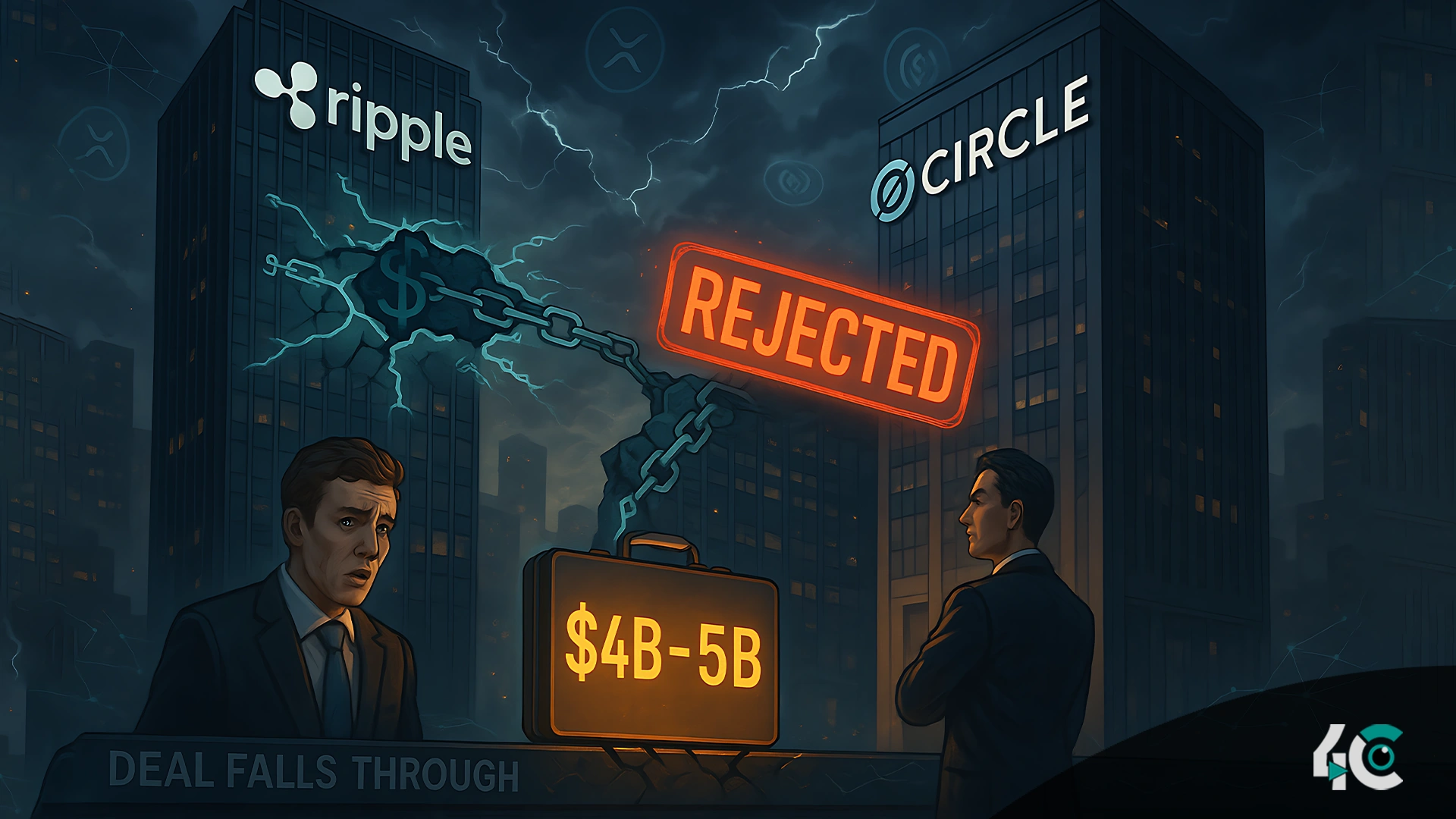

Ripple’s acquisition bid for Circle falls flat

Ripple’s attempt to acquire Circle, which developed the popular USDC stablecoin, is facing hurdles. Reports say Ripple had made an offer of around $4 billion to $5 billion for Circle. However, Circle rejected it, stating it was insufficient considering its current valuation and growth.

Soon after Circle sought a public listing in the US, it received a proposal for a takeover. However, the company rejected the offer, signaling its intent to go public. Ripple is still interested in acquiring Circle, but remains unsure if the proposal will be amended or increased.

Ripple’s Push into the Stablecoin Market

Ripple showing interest in Circle shows that it has plans to become a player in stablecoins. Ripple rolled out its stablecoin, RLUSD, earlier this year. Following the launch, the stablecoin saw a rally before stagnating. The current market capitalization of RLUSD is slightly above $300 million, whereas Circle’s USDC has an outstanding market cap of over $60 billion.

After acquiring prime brokerage firm Hidden Road for $1.25 billion, Ripple is attempting its hand at another acquisition that seems geared towards boosting the utility of XRP as well as Ripple’s foray into the global financial market. Ripple’s decision to purchase Fortress Trust demonstrates the crypto company’s commitment to institutional finance expansion.

We are emerging from legal challenges

As Ripple comes out of extensive legal wrangling with U.S. regulators, it seeks to expand its business. In 2020, the SEC brought a high-profile lawsuit, and it looks like it’s nearly over. Ripple and the SEC recently dropped their appeals, with Ripple agreeing to settle for a lesser penalty. This allows Ripple to refocus on innovation and expansion.

Circle’s Focus on an IPO

The decision of the circle to reject Ripple’s offer indicates the company’s focus on IPO. The leadership of the company is likely to see long-term value in an IPO, as stablecoins, such as USDC, play a vital role in evolution. Having already gained a substantial foothold in the stablecoin market and decentralized finance (DeFi), the USDC coin functions like a dollar, presenting new opportunities for Circle.

For Ripple, the denial is a short-term setback to its business expansion. As regulatory clarity slowly returns to the U.S. crypto space alongside increasing institutional interest, Ripple remains in an excellent position to capitalize on any chances within the emerging digital asset ecosystem.

What’s Next for Ripple?

Ripple’s unsuccessful attempt at buying Circle might not have gone through, but the launch of RLUSD and Hidden Road acquisition, as well as the lawsuits settlements, indicate Ripple’s seriousness about crypto. Ripple will work on its products in the future after its high stake in the stablecoin competition.

At present, Ripple is under intense scrutiny as it strives to leverage its strengths amidst a swiftly evolving regulatory and market landscape. Ripple clearly has big plans for the future, and whether via buyouts, partnerships, or its own growth, it looks as if it will be a major player.