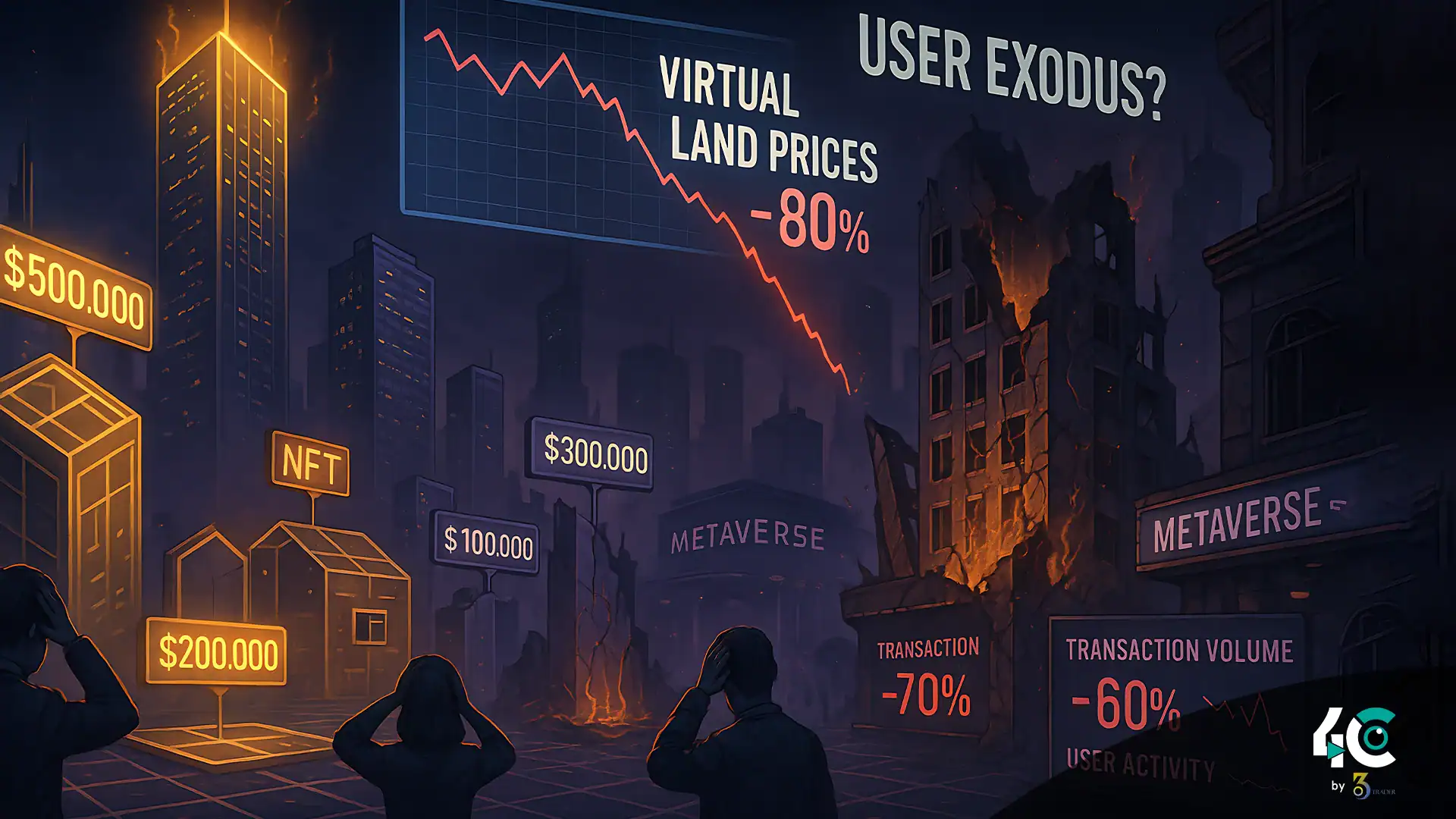

The metaverse real estate bubble may be on the verge of collapse, as dropping virtual land values raise red flags about the future of digital property investing.

The Metaverse Land Rush: Boom or Bubble?

The metaverse was hailed as the next digital frontier, where owning virtual land would mirror owning physical property. Platforms like Decentraland, The Sandbox, and Otherside saw land prices surge, with some plots selling for nearly $1 million. But as excitement wanes and user activity stalls, many are asking: Is this just another speculative bubble?

Why Virtual Land Prices Exploded

Several factors contributed to the metaverse real estate boom:

- Artificial scarcity: Platforms cap land supply to trigger FOMO

- Big brand interest: Companies like Adidas and Gucci made headlines with land purchases

- Speculation: NFT and crypto traders rushed in, chasing profits

- Hype-fueled visions: Buzzwords like “Web3” and “immersive worlds” drew uninformed buyers

Yet beneath the buzz, real engagement is minimal. For instance, Decentraland has fewer than 1,000 daily active users, casting doubt on its long-term value proposition.

3 Red Flags That Signal a Bubble

1. Prices Detached from Reality

Some virtual plots have sold for more than real-world homes, despite being mostly empty and commercially inactive.

2. Weak User Engagement

No matter how premium the land, its value depends on consistent user traffic. Event-driven spikes are short-lived, and user retention remains weak.

3. Historical Parallels

Just like the dot-com crash (2000) or the crypto winter (2018), early speculative interest far outpaced real-world use, leading to massive corrections.

What Could Trigger a Metaverse Real Estate Crash?

History shows bubbles burst when hype fails to meet real-world adoption. The following could set off a crash:

1. Macroeconomic Pressure

- Rising interest rates and recessions hit speculative assets first

- Investors may liquidate virtual land to cover losses elsewhere

2. Platform Decline

- If Decentraland, Sandbox, or Otherside stagnate, investor confidence will erode

- Poor performance or tech glitches could reduce user interest

3. Regulatory Action

- Governments might classify virtual land as securities

- Countries like China could ban or restrict NFTs altogether

4. Market Panic

- One major failure (e.g., a high-profile metaverse bankruptcy) could spark mass sell-offs

- If “whales” exit the market, retail panic could crash prices overnight

What a Crash Could Look Like

A collapse in metaverse land might occur in these stages:

- Stagnation: Buyers disappear, listings go unsold

- Forced Liquidations: Leveraged traders dump assets to avoid margin calls

- Capitulation: No buyers remain—land becomes essentially worthless

- Aftermath: Survivors consolidate, but it may take years to recover

Example:

- Decentraland land drops from $20,000 to $2,000

- Daily active users fall below 500

- Peak investors suffer 90%+ losses

How to Protect Yourself

For Investors:

- Only buy into platforms with real user activity

- Don’t invest more than you can afford to lose

- Track macro trends—crypto downturns usually lower metaverse valuations

For Regulators:

- Enforce transparency around land sales and user metrics

- Prevent pump-and-dump schemes in virtual real estate

The Bottom Line: Proceed with Caution

Metaverse land has all the signs of a bubble: sky-high prices, poor fundamentals, and speculative euphoria. While the metaverse holds promise in the long run, the current land rush appears more like a high-stakes gamble than a sound investment.