Mastercard Crypto Credential Takes Aim at Simplifying Self-Custody Transfers

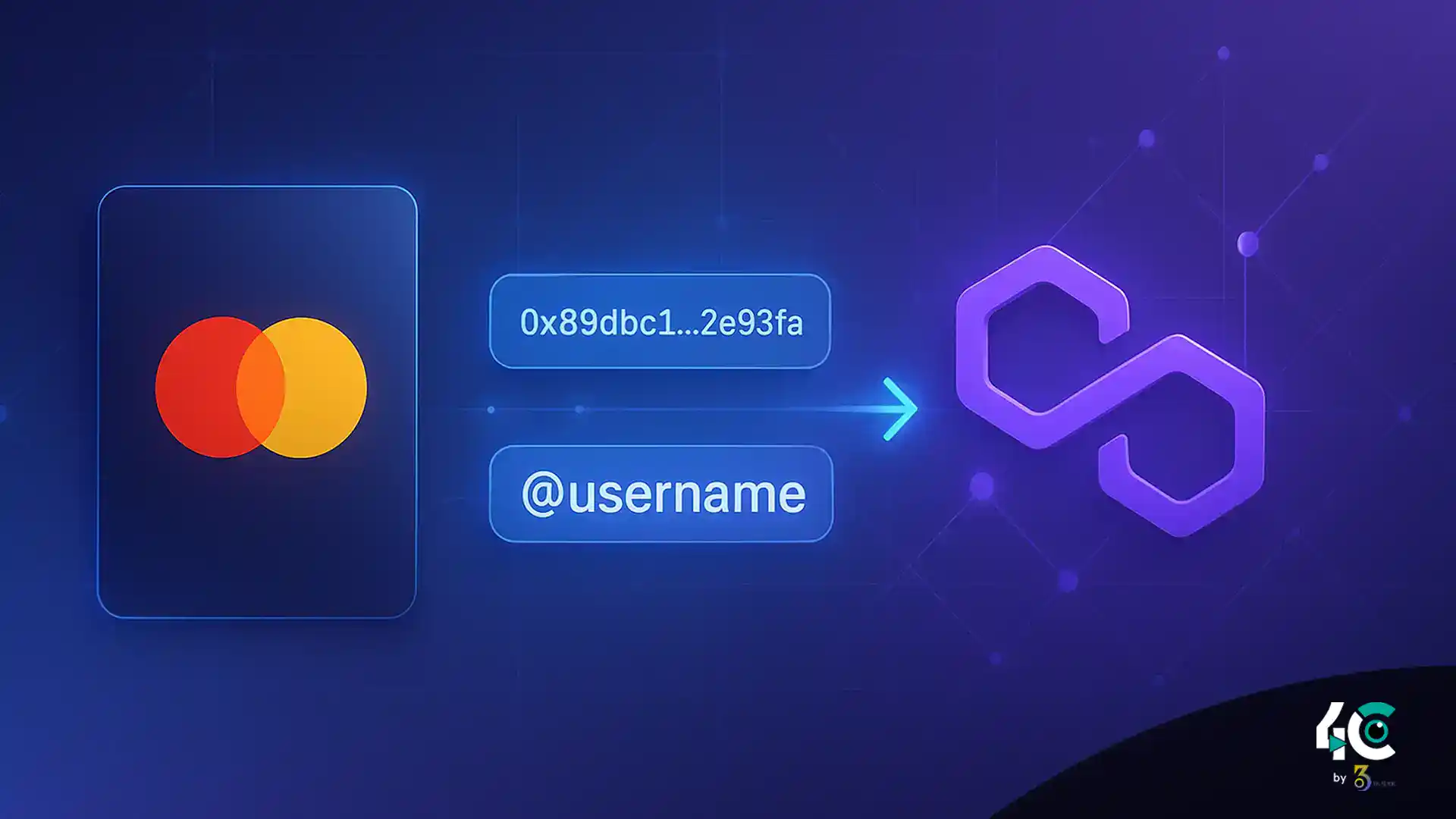

Mastercard is pushing deeper into the world of self-custody crypto, unveiling a major upgrade to its Mastercard Crypto Credential initiative that lets users send and receive digital assets using verified, username-style aliases instead of long, error-prone wallet addresses.

According to a Tuesday announcement shared with Cointelegraph, Polygon will serve as the first blockchain to support this expansion, while fintech firm Mercuryo will verify user identities and issue the new aliases.

Raj Dhamodharan, Mastercard’s EVP of blockchain and digital assets, said the upgrade is designed to make crypto transactions feel more trustworthy and more aligned with traditional finance:

“By streamlining wallet addresses and adding meaningful verification, Mastercard Crypto Credential is building trust in digital token transfers.”

Polygon Becomes the Launchpad for Verified Crypto Aliases

Once a user completes verification through Mercuryo, they can attach a readable alias to their self-custody wallet — or request a soulbound token on Polygon that cryptographically proves the wallet belongs to a verified individual.

Marc Boiron, CEO of Polygon Labs, called it a milestone moment:

“This partnership marks the moment when self-custody becomes simple.”

The update tackles one of crypto’s most persistent pain points: long hexadecimal addresses that are easy to mistype and nearly impossible to memorize. Mastercard says the new system mimics familiar payment-rail experiences, closing the usability gap between crypto and traditional money transfers.

Also Read : EU Plans To Expand ESMA’s Powers Over Crypto Assets and Innovation

Mastercard Crypto Credential Signals a Bigger Strategy Shift

Mercuryo, the first issuer participating in the program, said demand for secure yet self-sovereign solutions has surged — especially among users who want convenience without giving up control of their wallets.

The latest expansion adds to Mastercard’s increasingly aggressive crypto strategy. Over the past two years, the company has:

- Rolled out debit cards with Kraken across Europe

- Partnered with MetaMask to launch a self-custody payments card

- Accelerated multiple Web3 integrations across 2024 and 2025

These moves suggest a clear trajectory: Mastercard wants to anchor itself as the corporate backbone for mainstream crypto adoption.

Mastercard + Chainlink: A Step Toward Onchain Card Payments

In June, Mastercard deepened its Web3 push by teaming up with Chainlink to let its three billion cardholders purchase crypto directly onchain.

The initiative leverages several Web3 partners — including:

- Shift4 Payments

- Swapper Finance

- XSwap

- ZeroHash — which provides onchain liquidity for fiat-to-crypto conversion

Chainlink also confirmed that Swapper Finance’s implementation is fully non-custodial and uses account abstraction, making the process feel intuitive for everyday consumers.

This multilayered rollout underscores Mastercard’s vision of blending traditional finance with emerging blockchain rails, with Mastercard Crypto Credential sitting at the center of this transition.