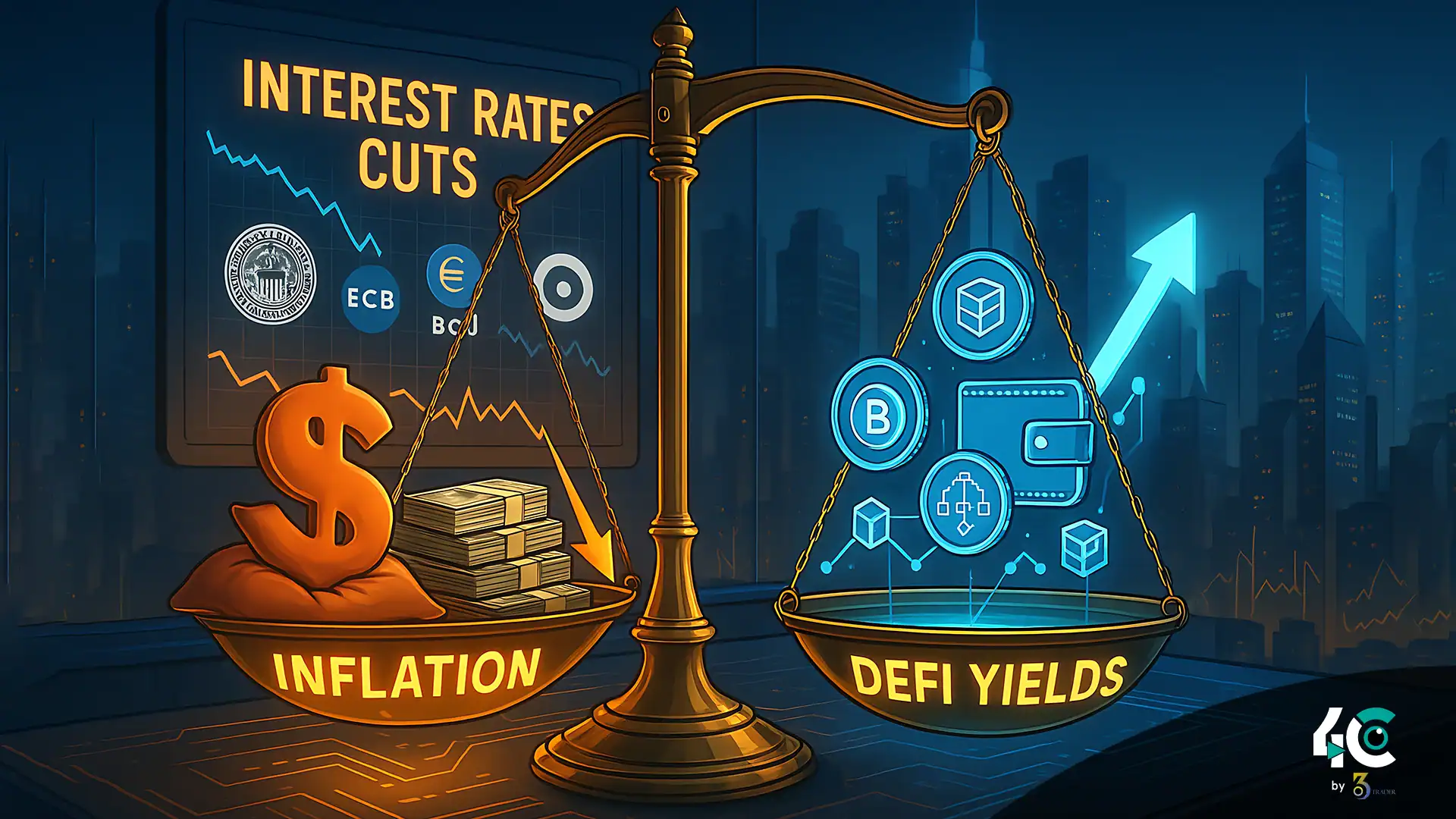

As 2025 unfolds, investors are closely examining whether DeFi yields vs inflation dynamics favor decentralized finance. With central banks adjusting interest rates, the question arises: Are crypto returns outpacing traditional investments? This analysis delves into the performance of DeFi platforms amid economic shifts.

Central banks cut rates as the world economy slows down

The Federal Reserve, European Central Banks (ECBs), and other central banks worldwide have aggressively pursued rate cuts due to recent economic weakening and the onset of easing measures. These moves are intended to reduce the overall cost of capital for borrowing, spending, and investing. However, they also come with unintended consequences.

- Investors are turning away from traditional fixed-income investments because the returns are not worth it anymore.

- Reducing rates could help growth in the short term, but may increase inflation that erodes purchasing power.

- Investors seeking higher returns are trading in higher-risk assets such as stocks, real estate and cryptocurrencies.

The high annual percentage yields (APY) of various DeFi protocols can attract a lot of capital that otherwise did not get good rates.

DeFi Yields, the Bright Spot in a Low-Rate World?

Thanks to decentralized finance, people have discovered new ways to earn passive income by providing liquidity, staking, and lending. Web platforms like Aave, Compound, and Curve Finance require users to deposit cryptocurrencies into pools or to stake tokens to earn rewards.

Why DeFi Yields Are Attractive Now

- DeFi provides double-digit returns for your investments, which is quite a bit higher than traditional assets such as savings accounts (which yield less than 1% APY) and government bonds (which have very low rates historically).

- DeFi allows any user with an internet connection to use it without permission, unlike conventional financing, which denies retailers access to profitable ventures.

- Cryptocurrencies — especially those connected to productive ecosystems, such as Ethereum or stablecoins — are believed to preserve value during inflation.

But the question is whether these yields will hold up as macro conditions change.

Are DeFi Returns Sustainable?

DeFi offers high yields, but several factors call those yields into question.

1. Reliance on New Capital

Fresh deposits maintain high APY rates in many DeFi protocols. This model resembles a Ponzi-like scheme, according to experts. Later investors help put money in for early adopters. If inflows slow because of market saturation or regulatory crackdowns, the yields will fall.

2. Volatility Risk

Crypto markets are notoriously volatile. Impermanent loss occurs within liquidity pools when the value of deposits diverges, which can wipe out any gains even with high nominal APYs. For example, ETH/USDC is a volatile pair that could cause you to lose money due to ETH’s price swings.

3. Regulatory Scrutiny

Due to money laundering, tax evasion, and investor protection, governments around the world are tightening regulations around DeFi. Having more oversight might cause a decrease in innovation.

4. Rising Competition

The rise of DeFi projects has created competition for funds. Typically, the protocols issue governance tokens to encourage users to make deposits. However, excessive issuance of these tokens dilutes their value, leading to diminishing returns over time.

Lower Rates and bubbles. Go Together in Crypto Market Speculation

When central banks cut rates, it throws money into the system that often leads to speculation. For decades, loose monetary policy has created bubbles. The dot-com boom of the late 1990s and the 2008 housing crisis both share a commonality. Is DeFi the next one?

There are indications of a potential bubble

- If there are no robust fundamentals, anything that promises a 1000%+ APY will be unsustainable.

- The Systemic Risk Amplified by Overleveraged Positions Borrowing against crypto collateral enhances potential gains and losses, thus amplifying systemic risk.

- Social media hype and FOMO-driven frenzy cause irrational exuberance, leading to diversion of retail valuations.

There are counterarguments to the notion of a bubble

Supporters say DeFi is the future, not just a passing trend. New developments in crypto, such as DAOs, AMMs, and tokenized RWAs, are evolving to offer “real-world utility” beyond speculation. DeFi’s transparency and efficiency may disrupt traditional finance permanently.

Inflation vs. DeFi: Which Wins?

To evaluate if DeFi yields can exceed inflation or rate cuts, consider the following.

Scenario 1: Persistent Inflation

If inflation stays high even after the rates are cut, then DeFi becomes more appealing as a hedge against currency debasement. Stablecoin-based strategies such as lending USDT or DAI are particularly attractive because they offer stable returns and assets that aren’t subject to inflation.

Scenario 2: Deflationary Pressures

If interest rate cuts are ineffective and the economy begins to deflate, investors will flock back to cash or gold. As risk appetite fades, DeFi yields may begin to lose their appeal.

Scenario 3: Regulatory Crackdown

Nayab Peddles 50k Electric Bicycle, a Bike That Makes Money Out of Nothing The scenario would subsequently lead to a substantial correction in yields as well as asset prices akin to previous crashes in crypto markets.

Wrapping Up: Getting Through DeFi

DeFi’s attractive returns stand out against a backdrop of low interest rates. But what do they really mean? Even though inflation and standard investments can offer financial returns currently, those returns will continue to be achieved based on macroeconomic development, technological advancement, and regulatory development.

Investors considering DeFi should exercise caution. This is the takeaway. Do your own homework, spread it across various protocols, and stick to the ones with solid fundamentals. Be aware that DeFi is a revolutionary technology. However, it remains a risky and evolving technology.

Conclusion

High-yielding DeFi protocols are currently beating inflation and central bank rate cuts, attracting yield-seeking investors. Nonetheless, they may not be sustainable because of their dependence on new capital, risks of volatility, and regulatory scrutiny. As the monetary policy landscape evolves, the future of DeFi will depend on its ability to innovate itself away from a bubble. While the returns can be huge, investors should be careful while investing in this nascent sector, which is going to change the world.