As decentralized finance continues to grow, so do the risks. Knowing how to detect DeFi vulnerabilities before a hack happens is crucial for protecting assets and ensuring platform stability. With smart contract bugs and protocol flaws increasingly targeted, proactive security can prevent financial disasters.

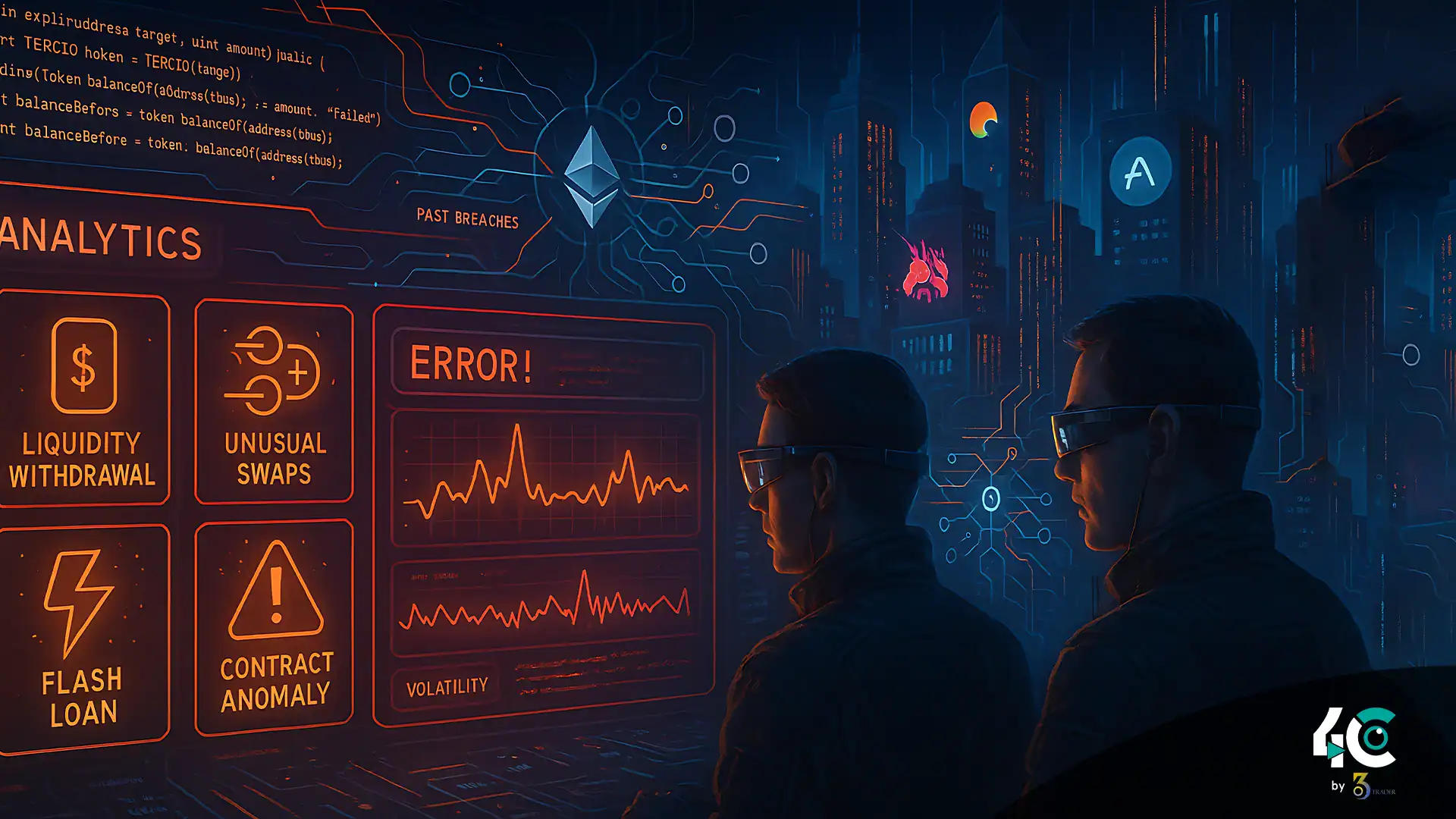

Understanding these signals is critical for both users and developers aiming to avoid future losses. Below are five major indicators that often precede a DeFi exploit.

1. Irregular Liquidity Movements

Significant, unexpected changes in liquidity can signal trouble.

- The $24 million flash loan attack on Harvest Finance occurred after massive fund withdrawals that skewed asset balances.

- Imbalanced liquidity pools may create arbitrage opportunities, exposing vulnerabilities ripe for exploitation.

2. Suspicious Governance Proposals

Governance systems can be manipulated when proposals are rushed or poorly discussed.

- The $182 million Beanstalk Farms hack involved a surprise governance proposal passed with minimal community engagement.

- Watch for sudden voting activity, last-minute proposals, or token concentration shifts that indicate vote rigging.

3. Weak or Outdated Audit Practices

Security audits are essential, but they lose value if not conducted thoroughly or regularly.

- Wormhole lost $325 million due to a bug in a bridge that lacked sufficient post-launch review.

- Many protocols skip re-audits after contract updates, which can reintroduce old vulnerabilities.

4. Centralized Control Over Protocols

Centralization undermines DeFi’s purpose and exposes users to heightened risk.

- The $625 million Ronin Network breach occurred because a small group held excessive control over the validator network.

- Projects where a single party controls admin keys or owns the majority of governance tokens should be viewed with caution.

5. Abnormal Flash Loan Activity

Flash loans can be powerful tools, but in the wrong hands, they become a major threat.

- Cream Finance lost $130 million when attackers repeatedly borrowed large sums to manipulate price oracles.

- Repeated flash loans or unusual borrowing patterns often precede exploits targeting oracle vulnerabilities.

Lessons from Notable DeFi Attacks

Poly Network ($611 million)

- Poly Network lacked a multisig system on its cross-chain bridge, allowing an attacker to gain full control over user funds.

- Cross-chain systems require strong, decentralized access controls to prevent single points of failure.

Nomad Bridge ($190 million)

- Nomad Bridge suffered due to a simple bug in the transaction approval code, which enabled attackers to reuse authorization.

- Even minor updates demand rigorous re-auditing to maintain security integrity.

How to Stay Safe in DeFi

For Traders:

- Use platforms like DeBank or Dune Analytics to monitor pool activity and token movements.

- Check if protocols utilize multisignature wallets for fund management.

- Be cautious of projects with overly centralized governance or admin access.

For Developers:

- Apply time-locked upgrade mechanisms to smart contract changes.

- Rely on decentralized oracles to prevent price manipulation attacks.

- Conduct regular audits and offer bug bounty programs to encourage community-based security reviews.

Conclusion

While DeFi’s risks can’t be eliminated entirely, the vast majority of major exploits—around 90 percent—were preceded by clear warning signs. By learning to recognize these patterns, users and developers can move from reacting after the fact to anticipating and preventing future attacks. Staying informed is the first step toward safer participation in decentralized finance.