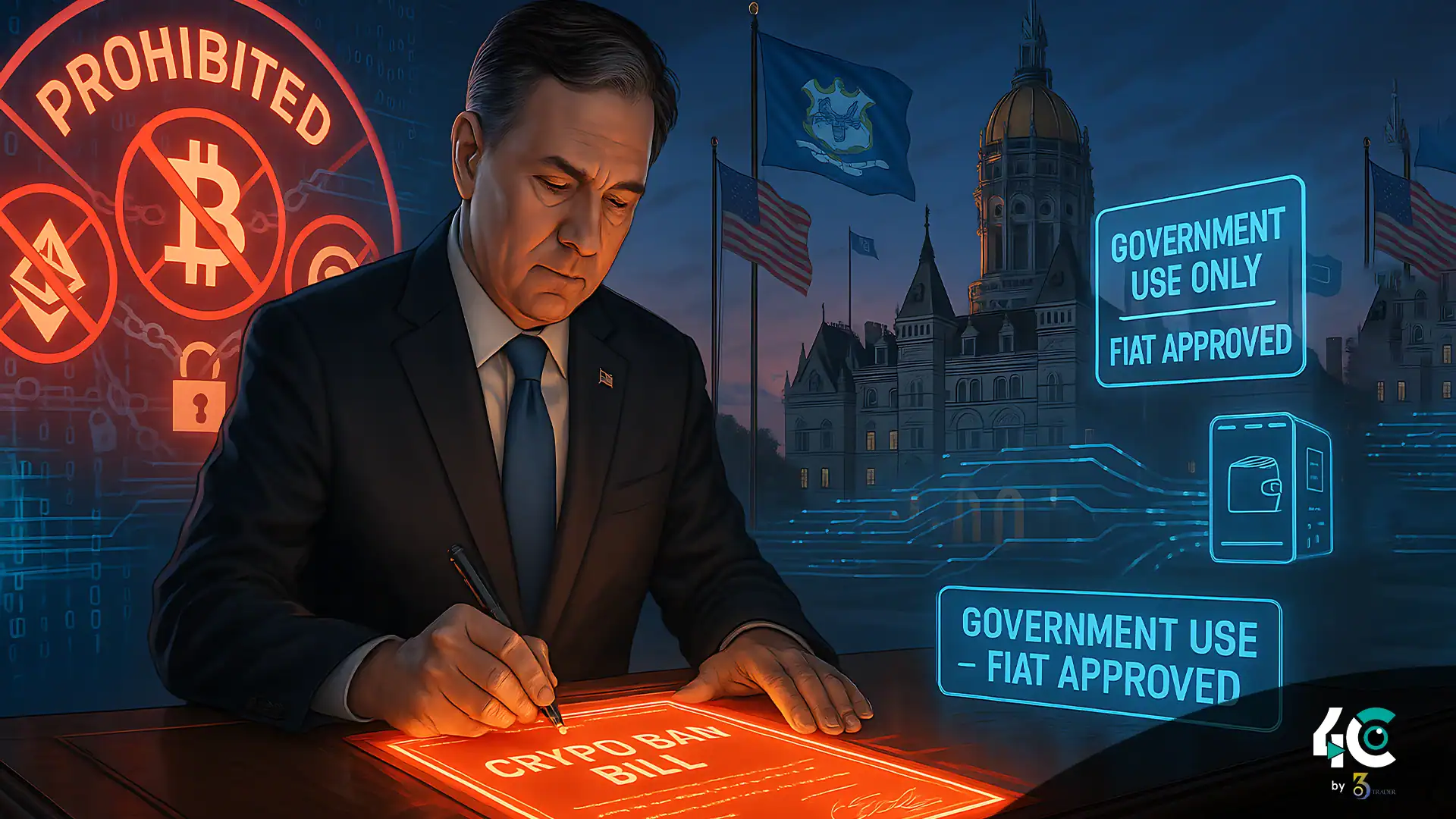

Connecticut Governor Ned Lamont has signed House Bill 7082 into law, prohibiting digital assets from being used at the state level. Governor Ned Lamont signed the bill into law on July 1, making Connecticut the only U.S. state to prohibit the government from any engagement with crypto.

Under the new law, state agencies and departments are barred from accepting cryptocurrencies as payments, including for taxes and fees. It also forbids them from investing in or holding virtual currencies on their balance sheet. It will go into effect on October 1, 2025.

The bill was introduced by Rep. Jason Doucette and represents a cautious approach to digital currencies. Many states like Texas and New Hampshire, are creating Bitcoin reserves and assessing how to apply blockchain principles to public finance. For example, Connecticut is moving in a different path.

Aaron Brogan, founder of Brogan Law, says, “This law makes clear that Connecticut expects that there will be no cryptocurrency in public financing.” He further said, whether or not the bill may interfere with any private crypto holder, it will definitely set up a great, much-needed regulatory tone conflicting with the rest of the nation.

Recently, Donald Trump, the former President signed an executive order to launch a U.S. Bitcoin Reserve within the country. Use of federal forfeited Bitcoin in Bitcoin Reserve refers to the Strategic Bitcoin Reserve. On the other hand, legislation proposes or passes in favor of government investment in all digital assets. As of April 2025, 26 U.S. states have attempted legislation to create Bitcoin or similar reserves, but none have succeeded.

Moreover, Connecticut’s new law has an added burden for crypto enterprises in the state with enhanced rules. Those with money transmission licenses must follow new consumer protections, which include risk disclosures, disclosure on transactions, and a ban on misuse of assets. In order to ensure that customer balances are entirely covered, companies must maintain enough virtual assets. They must also implement an identity verification system, especially for those customers under the age of 18. New rules seek to increase accountability. Moreover, the guidelines protect customers against the risks associated with the crypto market and fraud. For crypto exchanges and fintech firms, the law creates a high bar for where they may operate in the state, showing Connecticut’s conservative stance.

While some states are adopting Bitcoin as a hedge against inflation or for financial innovation, Connecticut is essentially opting out of the crypto chat—at least on the government level. It remains to be seen whether this willingness to embrace risk turns out to be prudent risk management or a lost opportunity. But one thing is clear: Connecticut is drawing a line in the digital sand.