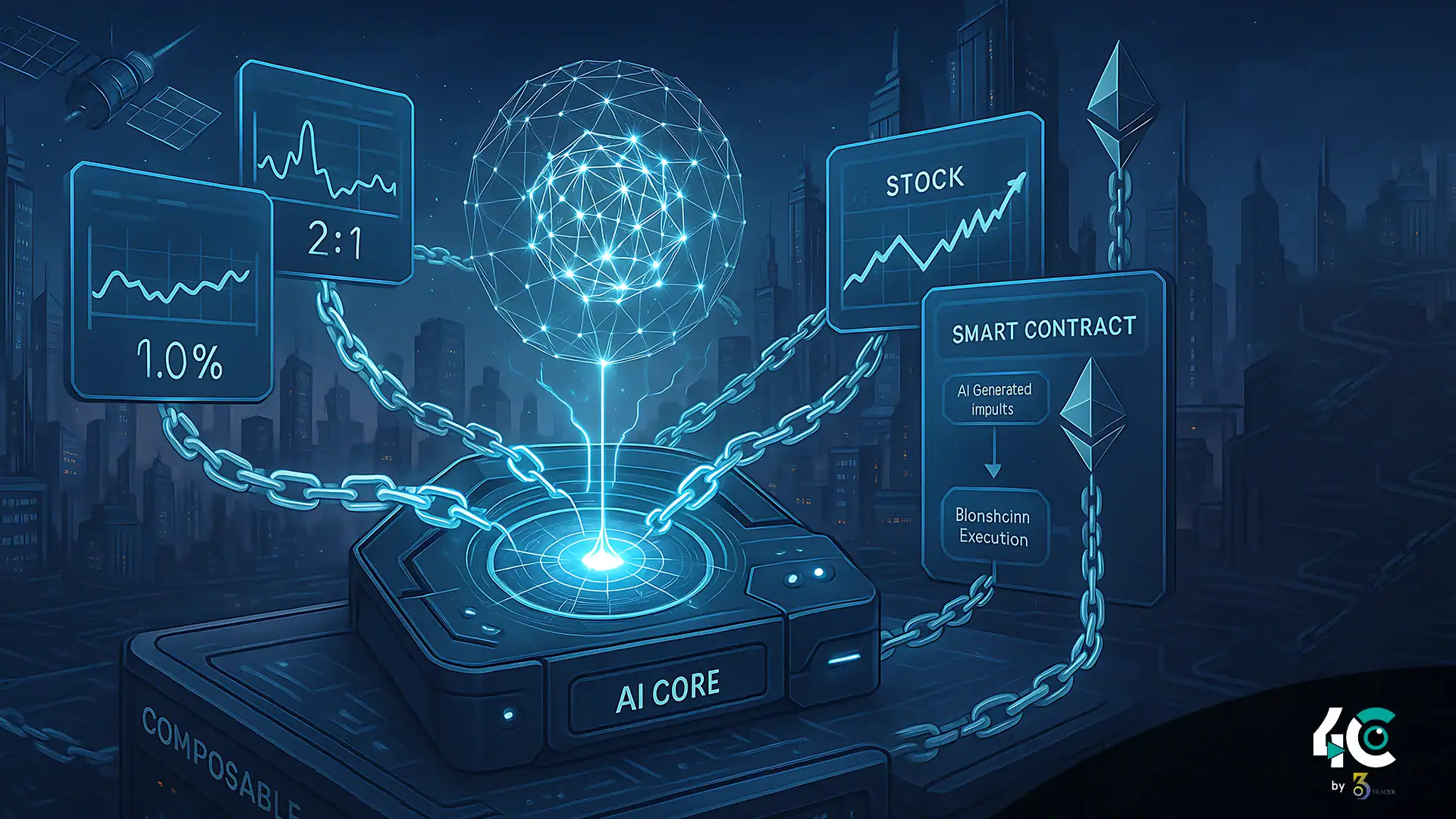

AI-powered oracles are changing the game in blockchain by enhancing smart contract performance. They enable faster, smarter decisions using real-time, trusted data.

According to developers behind these emerging protocols, AI oracles act as a bridge between complex machine learning models and blockchain smart contracts. This connection enables dApps to access real-time, processed insights, going far beyond simple data feeds.

Why AI Oracles Mark a New Era

Traditional Oracles:

- Offer static data inputs with limited adaptability.

- Support simple logic (e.g., if A happens, then B).

- Can become centralized points of failure.

AI-Based Oracles:

- Deliver machine-generated forecasts and intelligent insights.

- Support dynamic, multi-variable decision-making.

- Utilize decentralized infrastructure for increased reliability.

- Evolve with continuous machine learning advancements.

How AI-Powered Data Enters the Blockchain

1. Data Collection

- Gathers diverse real-world inputs from satellites, IoT devices, and APIs.

- Compiles raw information across domains, from weather to financial markets.

2. AI Processing

- Applies machine learning to identify patterns, trends, and risks.

- Generates forecasts—like climate events or price fluctuations—with probability scores.

3. Oracle Conversion

- Transforms AI predictions into blockchain-compatible formats.

- Ensures data integrity using cryptographic verification.

4. Smart Contract Execution

- Executes logic based on AI outputs.

- Enables automated, adaptive responses to real-world conditions.

Example:

A forecasted 80% chance of drought triggers a smart contract to automatically pay out crop insurance to affected farmers—without manual intervention.

Transformative Use Cases Across Industries

Smarter Agriculture

- Uses satellite and sensor data to forecast crop conditions.

- Automates insurance payments after adverse events.

- Helps optimize planting and harvesting through predictive analysis.

Advanced DeFi Systems

- Feeds real-time market predictions into trading bots.

- Adjusts collateral dynamically using risk models.

- Detects anomalies in trading behavior to prevent fraud.

Self-Driving Supply Chains

- Forecasts shipment delays based on weather and traffic.

- Triggers contract penalties automatically.

- Enhances inventory tracking with predictive demand signals.

AI-Driven Gaming & NFTs

- Introduces dynamic NFTs that change based on live data.

- Enables eSports betting platforms powered by predictive analytics.

- Builds adaptive economies curated by AI behavior models.

Challenges Ahead for AI Integration

Technical Limitations

- On-chain AI remains expensive and resource-intensive.

- Latency issues hinder time-sensitive use cases.

- Maintaining model accuracy over time requires regular updates.

Trust and Transparency

- Ensuring auditable AI outputs is critical to prevent misuse.

- Promoting explainable AI models is essential for credibility.

- Updating models must follow community-governed protocols.

Regulatory Considerations

- Aligning with evolving global AI regulations and financial compliance.

- Clarifying responsibility for incorrect or manipulated forecasts.

- Safeguarding user data across jurisdictions.

A Glimpse Into the Future of Smart Contracts

As AI-native infrastructure matures, we’re likely to see:

- Self-adjusting smart contracts that respond to real-time conditions.

- DAOs governed by predictive insights rather than static votes.

- Risk-aware DeFi protocols capable of mitigating threats in advance.

Key Innovators in the Space:

- Chainlink Functions: Integrates AI into smart contracts.

- Fetch.ai: Provides autonomous economic agents.

- Bittensor: Supports decentralized machine learning at scale.

Conclusion

AI oracles aren’t just a technical enhancement—they signal the start of a smarter, more adaptive blockchain era. By combining real-time prediction with automation, these systems unlock a future where smart contracts can anticipate, react, and evolve. While technical and regulatory challenges remain, the potential for intelligent decentralized infrastructure is massive.