Treasury Weighs Radical Overhaul of DeFi Rules

A proposal of the U.S. Treasury has raised discussions in the crypto community to alter the way decentralized finance (DeFi) operates. The digital ID verification system may be incorporated directly into DeFi smart contracts, as per the GENIUS Act, the legislation which was signed into law in July.

In real-world applications, the DeFi protocol would validate a user’s government ID, biometric credential, or digital wallet certificate before allowing a transaction to be approved.

According to supporters, the initiative may install compliance features like Know Your Customer (KYC) and Anti-Money Laundering (AML) checks on blockchain networks to filter out bad actors.

According to Fraser Mitchell, Chief Product Officer at SmartSearch, an AML company, anonymous transactions can be de-anonymized which will create major money laundering problems for criminals.

The Privacy Dilemma: Security or Surveillance?

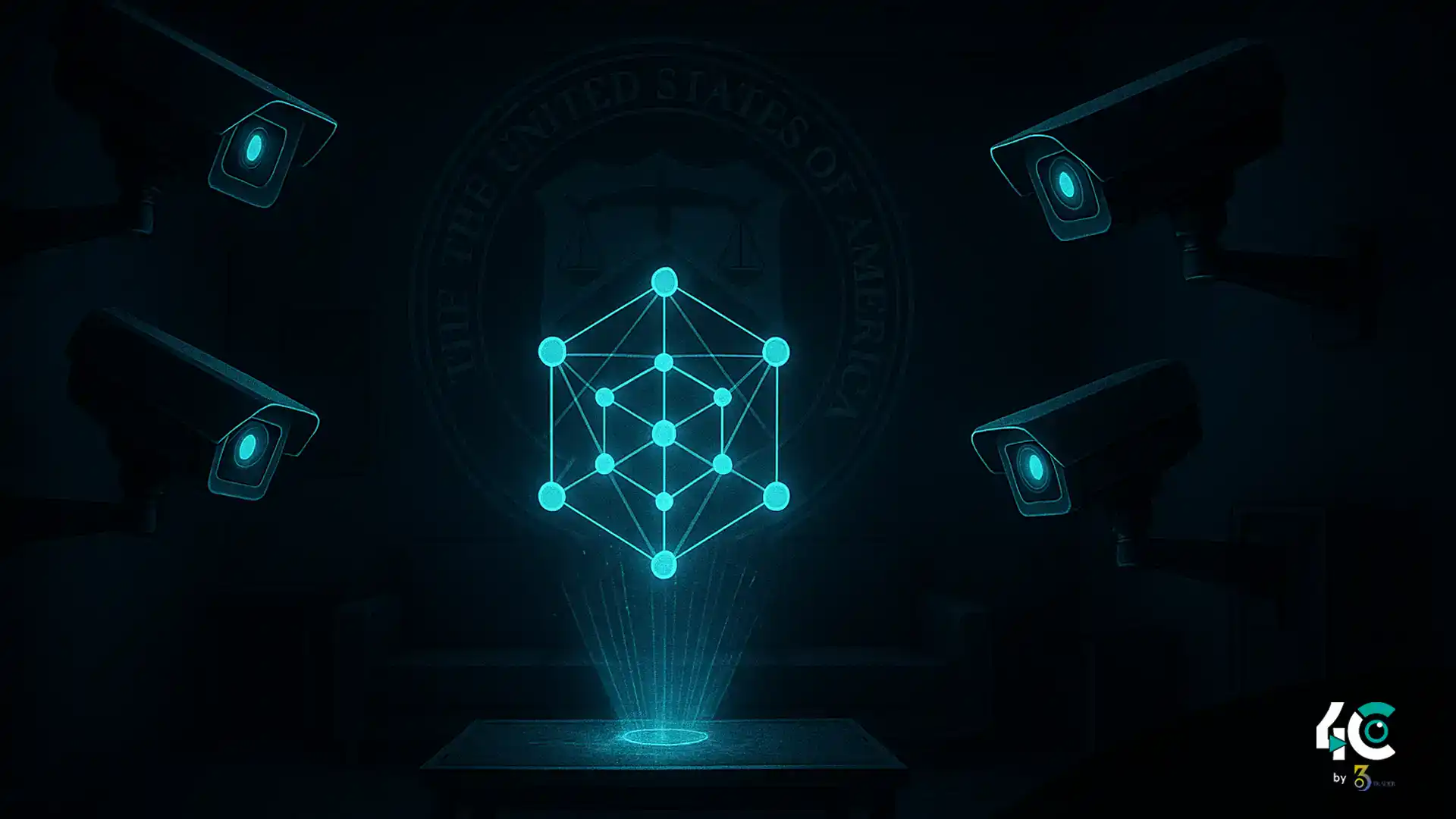

Regulators see a more efficient and safer financial system. But critics warn that it’ll turn DeFi into a surveillance network.

Mamadou Kwidjim Toure, Director of Ubuntu Tribe, likens the proposition to “putting cameras in every living room.”

Tethering biometric or government IDs to blockchain wallets could make every transaction permanently traceable to a real-world identity, which would remove the pseudo-anonymity of DeFi, he warned.

“To be financially free, be private.” Toure contended that including ID regulations at the protocol level undermines that right and establishes a dangerous precedent.

The concerns don’t stop there. Critics say governments could abuse such systems to censor transactions, blacklist wallets, or even automate tax collection through code.

Exclusion and Data Risks Loom Large

Another red flag is exclusion. Globally, one billion people lack formal identification. If DeFi platforms require government IDs, vulnerable groups including migrants, refugees and the unbanked could be shut out of decentralized finance completely.

Data security is another minefield. Linking biometric databases to financial networks could cause a single hack to be a disaster – exposing personal identity and funds with one breach.

Also Read : South Korea to Unveil Stablecoin Bill in October — Aiming to Break Dollar Dominance

A Third Path: Privacy-Preserving Compliance

Those opposed argue it is not a choice between crime havens and total surveillance. Instead, they advocate for technologies like:

- Users can prove that they are not on the sanctions list or that they are over the age of 18 without revealing their identity.

- Decentralized Identifiers (DIDs) are wallets with verifiable credentials that can be revealed selectively rather than static ID systems of government.

Toure explained:

“Instead of revealing your whole identity, you selectively share what’s needed. That makes DeFi all-inclusive, private and secure.”

The Bigger Picture

The Treasury’s digital ID experiment in DeFi could end up as a compliance breakthrough or the end of permissionless finance altogether, claims the industry.

The future will show whether the blockchain is the ultimate in financial freedom or the ultimate in surveillance technology.