The Senate Has Passed a Bill to Regulate Cryptocurrency

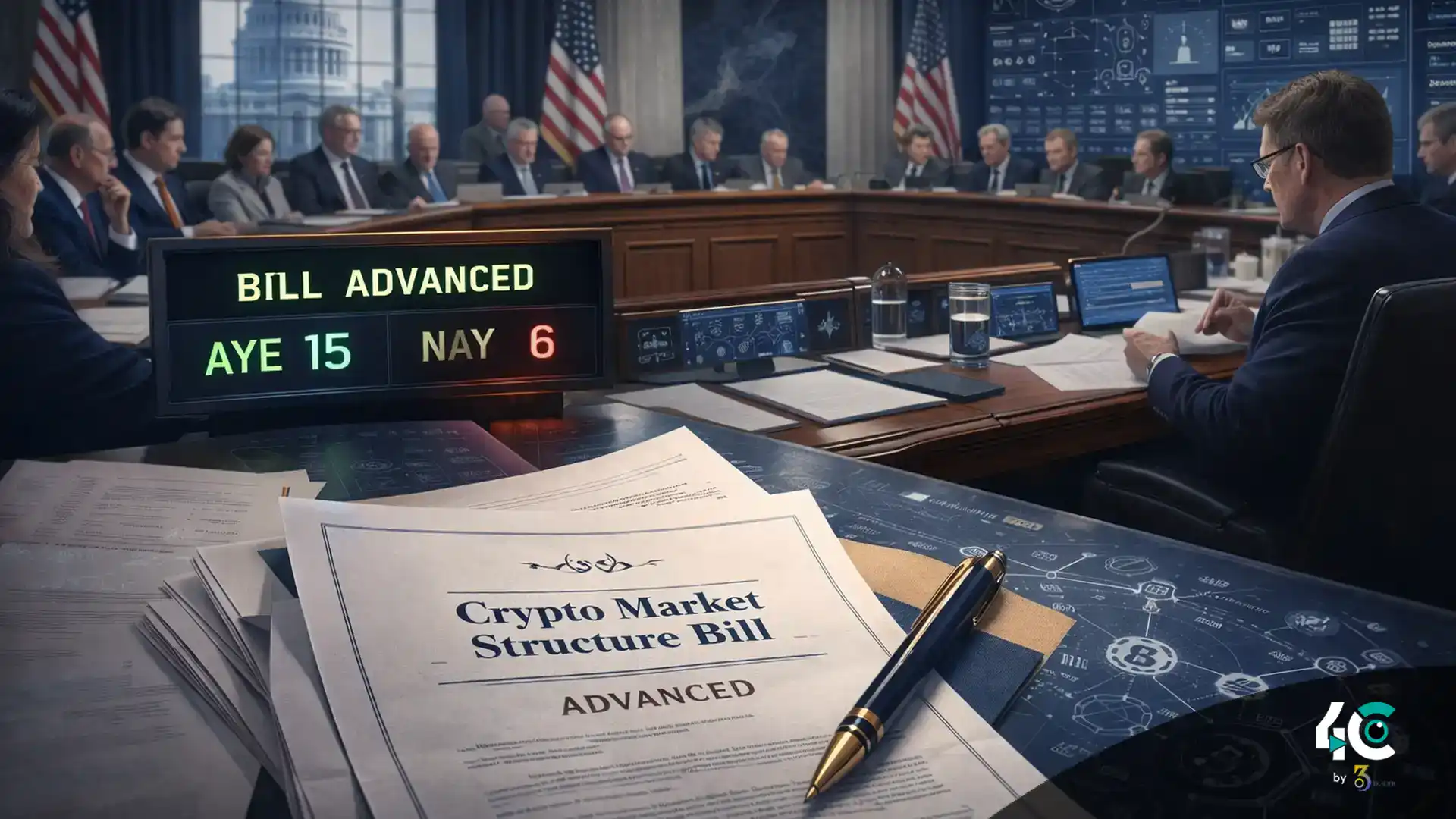

On Thursday, the Senate Agriculture Committee voted on the highly-anticipated crypto market structure bill after a long markup, a move US lawmakers took amid some controversy.

Months of delays and increasing pressure from the crypto industry prompted the committee to vote 12–11 mostly on party lines for the bill, indicating some movement towards clearer federal rules but also highlighting contentious party divisions and political wrangling that could hamper the bill’s progress.

The Events Surrounding the Markup of the Market Structure Bill for Cryptocurrency

The markup session moved quickly but was not smooth at all. Lawmakers looked at three amendments, all of which failed along party lines.

Democratic senators constantly called for ethics provisions and stricter guardrails, whilst Republicans aimed for bill passage to provide market and innovator regulatory certainty.

Despite being opposed, the committee has voted to push the crypto market structure bill which is likely to be voted soon in the Senate.

Also Read : Tezos Chain’s New Upgrade Improves System Time to Six Seconds, Enhancing User Experience

Democrats Propose Issues With Ethics and Oversight

Numerous Democratic lawmakers stated the legislation, as written, does not have enough safeguards against conflicts of interest.

Senator Cory Booker was among the most pointed interventions to protect innovation while not over-criminalizing the sector.

Booker stated that we must not act in a way that will criminalize people who are writing code, asking for clearer protections for developers, self-custody, and DeFi.

Senators Adam Schiff and Elissa Slotkin raised similar concerns regarding national security and whether the CFTC has the appropriate leadership and balance to regulate the burgeoning crypto market.

Party Lines Make Ethics and Bailout Amendments Fail

During the passage, two big amendments by Democrats were rejected.

Ethics Change Voted Down

A proposed amendment from Sen. Michael Bennet (D-CO) that would have stopped elected officials from owning digital assets failed in a 12-11 vote once more divided along party lines.

Ban on Crypto Bailout Not Effective

Senator Dick Durbin’s plan to expressly bar any federal bailouts of crypto intermediaries who fail similarly failed. Durbin pointed out the downfall of FTX and its effects on regular banks.

According to the chair of the Senate Appropriations Committee John Boozman, the amendment is unnecessary as the bill does not provide the authority for any bailouts.

The Intention of the Crypto Market Structure Bill

Supporters of the measure say it represents a long overdue break from regulation-by-enforcement.

If it becomes law, the crypto market structure bill would:

- Allow the CFTC to have authority over the spot market of digital commodities

- Make clear rules for crypto intermediaries

- Establish disclosure norms and consumer safeguards

- Clarify SEC–CFTC oversight responsibilities

As per industry bodies, they remain indispensable to safeguarding users as well as allowing the US to innovate.

Cautiously Optimistic China’s Economy

Supporters of the measure from the crypto world and the venture capital industry applaud “bipartisanship.”

According to Ji Hun Kim, CEO of the Crypto Council for Innovation, “This legislation would lay out clear rules, strong protections for consumers, and real market oversight.”

Mason Lynaugh, the head of Stand With Crypto, called the vote a major milestone. Meanwhile, National Venture Capital Association CEO Bobby Franklin commended the lawmakers’ efforts and urged them to come together to finish the job.

What’s Next for the Crypto Market Structure Bill

Agriculture committee given green light, but bill may still stall According to lawmakers, the bill must be fused with the parallel legislation from the Senate Banking Committee. The Senate Banking Committee recently postponed its own markup due to backlash from the industry.

Without bipartisan compromise especially on ethics and oversight the bill could stall again, according to experts on public policy.

The vote on Thursday nevertheless marks Congress’ clearest signal to date that it is approaching a cohesive framework for digital assets.

The fate of the crypto market structure bill hinges on lawmakers overcoming political divides and crafting rules that balance innovation, accountability, and public trust.