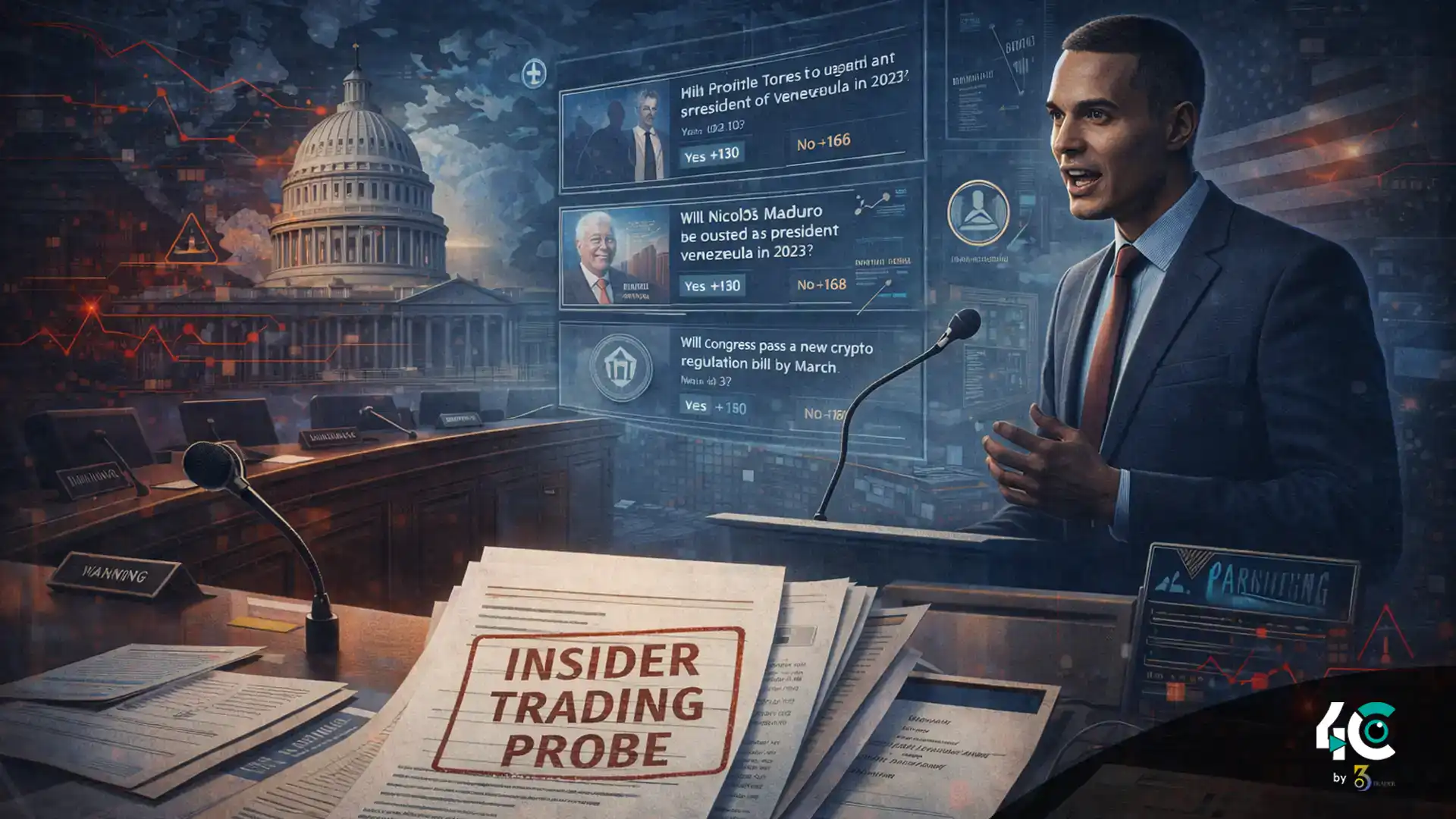

Prediction Markets Face a Washington Reckoning

US Representative Ritchie Torres is moving to rein in prediction markets insider trading, following growing controversy over a high-stakes bet linked to the reported capture of Venezuelan President Nicolás Maduro.

According to a post on X by Punchbowl News founder Jake Sherman, Torres plans to introduce the Public Integrity in Financial Prediction Markets Act of 2026. The proposed legislation would bar federal lawmakers, political appointees, and executive branch officials from trading prediction market contracts tied to government policy or political outcomes when they possess nonpublic information obtained through their official roles.

The effort signals Washington’s first serious attempt to apply market integrity standards to the fast-growing prediction market sector.

What the Prediction Markets Insider Trading Bill Would Do

Extending Wall Street Rules to Political Betting

Under the proposal, federal officials would be prohibited from buying, selling, or exchanging prediction market contracts related to government actions or political events on platforms operating in interstate commerce.

The structure closely mirrors long-standing Wall Street insider trading laws in traditional financial markets—but for the first time, it would explicitly cover prediction markets, an industry that has surged in popularity amid election cycles and geopolitical uncertainty.

Supporters argue the move is essential to protect public trust as prediction platforms increasingly intersect with sensitive political and policy information.

Also Read : Arizona Proposes Tax-free Legislation for Crypto and Blockchain

The $32,000 Bet That Ignited the Firestorm

Maduro Prediction Turns Into Overnight Windfall

The legislative push gained momentum after a newly created account on Polymarket placed roughly $32,000 on a contract predicting Maduro’s removal from power by Jan. 31, 2026.

Just hours later, reports emerged that US forces had captured the Venezuelan leader, sending the contract rapidly toward settlement. The trade reportedly generated more than $400,000 in profit—an unusually large return that immediately raised eyebrows across crypto and political circles.

What drew further scrutiny was the account’s history: it showed minimal prior activity, with the Maduro wager accounting for nearly all of its gains—fueling speculation that someone may have acted on privileged information related to political or military operations.

Platforms Respond as Scrutiny Intensifies

Prediction Markets Push Back on Insider Claims

Following the controversy, Kalshi—another major prediction market platform—reiterated that its rules strictly prohibit insiders or decision-makers from trading based on material nonpublic information.

The episode has reignited debate over whether existing platform policies are sufficient—or whether federal oversight is now unavoidable as prediction markets scale.

Polymarket Security Concerns Add More Pressure

Account Breaches Compound Trust Issues

The regulatory spotlight comes as Polymarket also faces backlash over recent account security incidents. Multiple users reported suspicious login attempts that allegedly led to drained balances and forcibly closed positions.

Polymarket later stated that the issue stemmed from a vulnerability introduced by a third-party authentication provider, stressing that the flaw affected only a small number of accounts and has since been fully resolved. The company said impacted users will be contacted directly.

While unrelated to the Maduro bet, the timing has intensified calls for stronger safeguards across the prediction market ecosystem.

Why This Moment Matters

Prediction markets were once viewed as niche tools for crowd-sourced forecasting. Today, they influence narratives around elections, wars, and economic policy—often with real money on the line.

By targeting prediction markets insider trading, Rep. Ritchie Torres’ proposed bill marks a turning point—signaling that as these platforms grow more powerful, they will also face the same ethical and legal expectations as traditional financial markets.

Whether the legislation passes or not, one thing is clear: the era of lightly regulated political betting in the United States is rapidly coming to an end.