US Bancorp Stablecoin Pilot Signals New Banking Era on Stellar

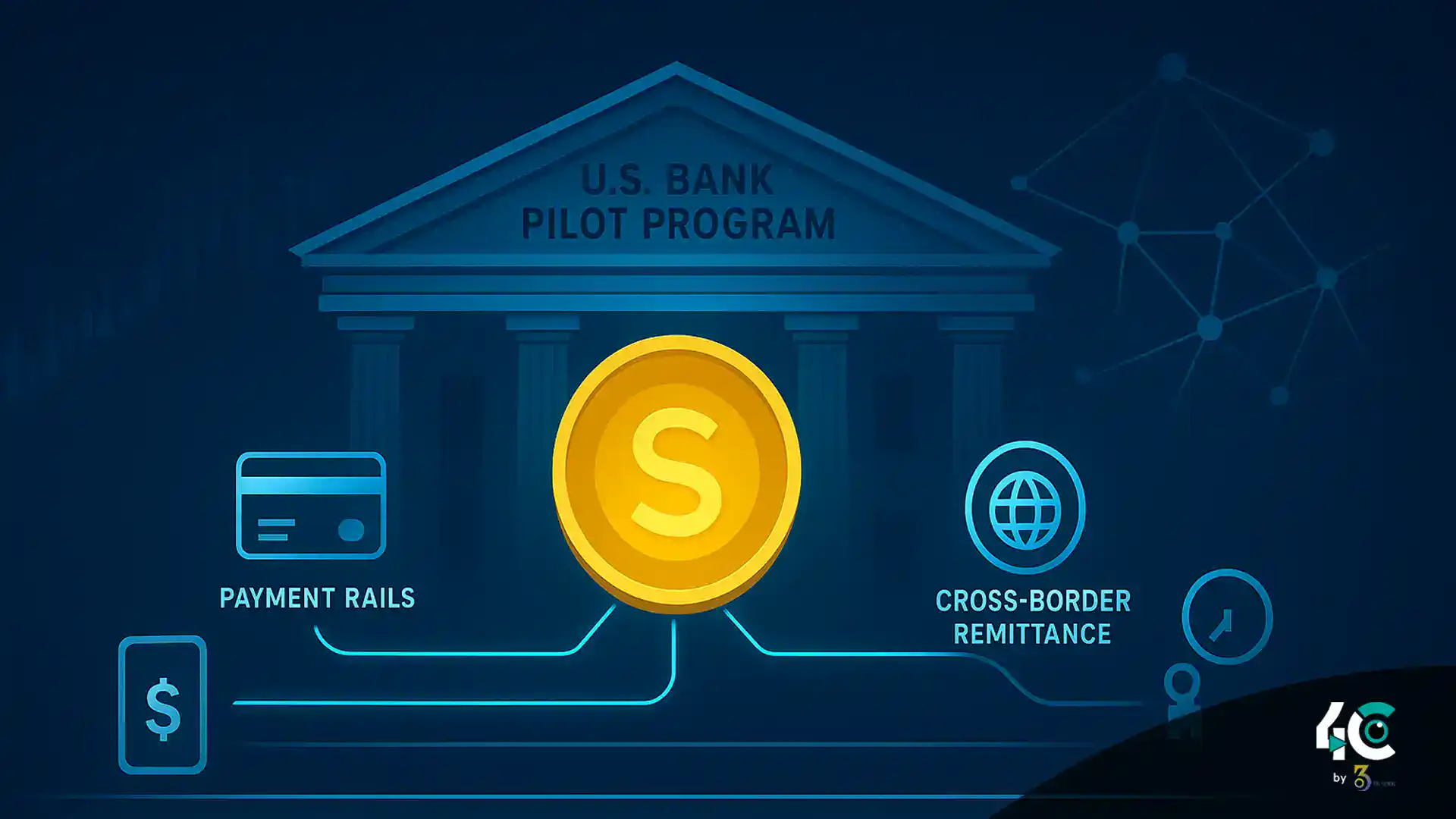

The race toward blockchain-powered finance is accelerating, and US Bancorp has now joined the frontline. The parent company of U.S. Bank, which manages over $664 billion in assets, has launched a stablecoin pilot on the Stellar blockchain, partnering with PricewaterhouseCoopers (PwC) and the Stellar Development Foundation (SDF).

According to the SDF, this step represents more than experimentation — it is a sign that traditional finance is embracing blockchain at scale:

“Institutions have arrived. New financial infrastructure is taking shape now,”

the foundation declared.

US Bancorp Stablecoin Pilot Aims to Prove Blockchain Benefits to Banks

Speaking on the US Bank Money 20/20 podcast, PwC blockchain director Kurt Fields explained that the purpose is not simply innovation:

“We’ve been talking about blockchain for years. Now it’s about practical application in a highly regulated environment.”

The pilot will focus on demonstrating how programmable digital money can deliver real value for both banks and their customers — not merely as a tech trend, but as a core banking tool.

Also Read : Blockchain Regulation in Brazil: Central Bank Puts Stablecoins Under Strict Forex Rules

Why Stellar? US Bancorp Prioritizes Consumer Protection Features

One of the most decisive factors in choosing Stellar was its bank-grade safety features. US Bank’s head of digital asset products, Mike Villano, highlighted Stellar’s ability to freeze assets and unwind transactions at the core blockchain layer — an important requirement for regulated financial institutions.

“You could do it at the core blockchain layer. That was very interesting to us,” Villano said.

Stellar, launched in 2014, is designed for cross-border payments, tokenization, and real-time value transfer. Its regulatory-friendly controls made it an ideal fit for the pilot.

US Bancorp Eyes Tokenized Assets After Stablecoin Trial

Villano also revealed that the bank is exploring asset tokenization, envisioning a future where transferring traditional assets 24/7 becomes seamless, fast, and highly cost-efficient.

“You can apply that to all sorts of other asset classes,” he noted.

This research hints that the stablecoin pilot is only the first step in a broader blockchain strategy — one that may reshape lending, settlements, and asset markets.

The Future of Banking: Blockchain With Guardrails

The US Bancorp stablecoin pilot confirms a massive shift underway in the U.S. banking sector: blockchain is no longer theoretical, and banks are no longer skeptics. They are building — with strict consumer protections, programmable money, and regulated innovation at the core.

The question is no longer whether banks will adopt blockchain.

It is now how fast they will scale it.