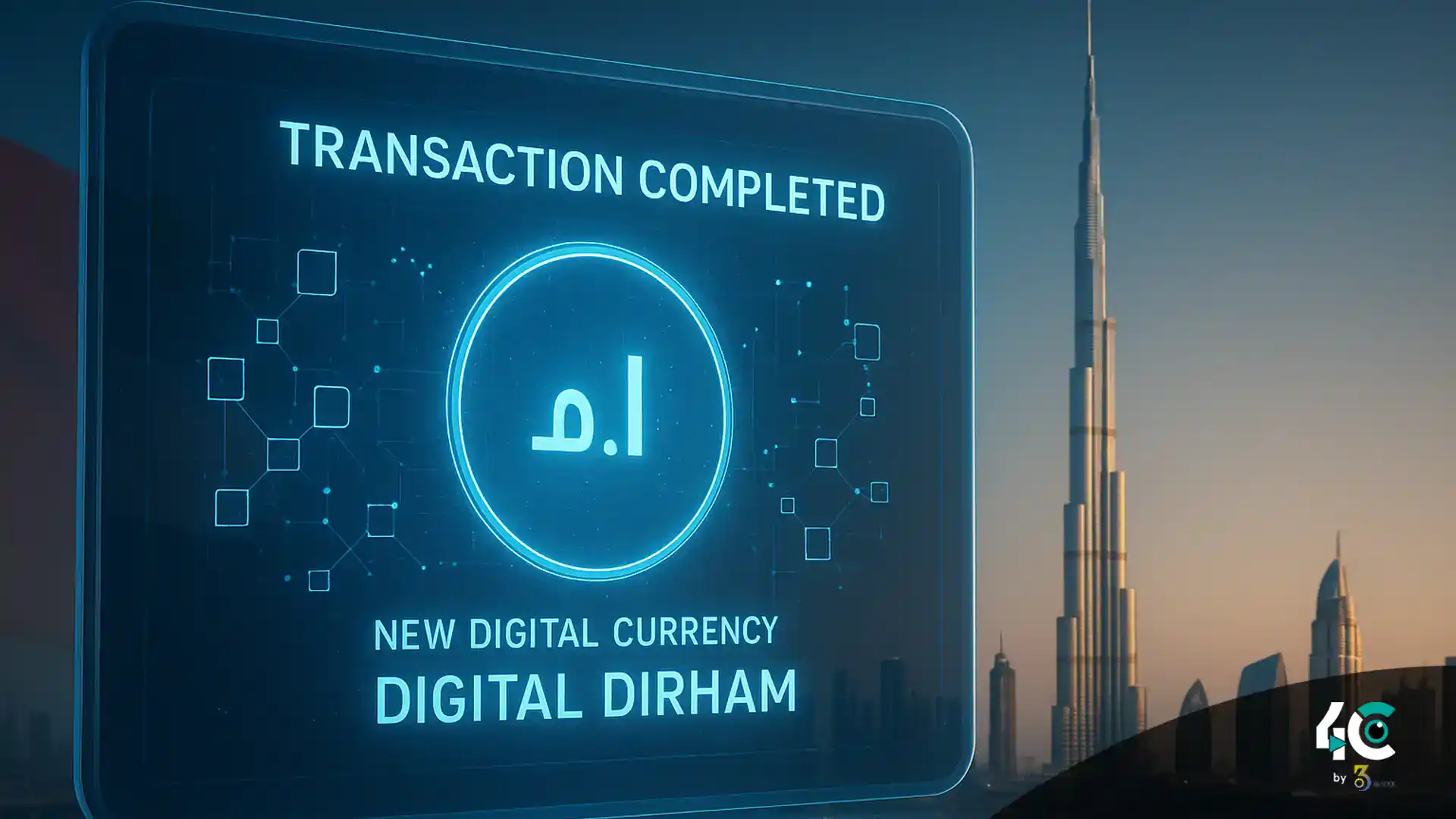

UAE Digital Dirham: First-Ever Transaction Signifies Major Jump in CBDC Adoption

A government transaction using the UAE Digital Dirham has been completed, enabling the Central Bank Digital Currency (CBDC) in UAE. It has been termed a milestone achievement. The Digital Dirham project’s pilot phase was the first bold move running under the government’s mBridge payment platform. Updated the UAE Digital Dirham project since its debut in March 2025, this transaction marks the first-of-its-kind.

According to government officials, this first trial isn’t just a test. Its purpose was to allow broader use of the UAE Digital Dirham for financial operations by the federal, local, and private sectors.

A Test Transaction Completed in No Time

Ahmed Ali Meftah, the executive director of central accounts at Dubai Finance, said the pilot transaction was accomplished in under two minutes. The test was meant to confirm technical integration with the Central Bank’s environments and operational readiness.

Meftah said, “This transaction affirms our determination to facilitate transactions and speed up settlement between the government.”

Also Read : Romania Blacklists Polymarket Amid $600M Election Crypto Betting Surge

Phased Rollout of the UAE Digital Dirham

According to a policy paper released by the UAE Central Bank in July, the introduction of the CBDC will take place in phases. The first few features will be just payments, and we want to avoid competition with deposits and interest-bearing products. This is all part of a larger goal to “future-proof” central bank money for an evolving digital economy.

A Worldwide View Of Central Bank Digital Currencies

CBDCs remain a hotly debated topic worldwide. The banking status quo of the central banks are homed in on by the critics who are skeptical about the privacy risks and the disruptive potential of CBDCs. However, supporters of the initiative think that CBDCs such as the UAE Digital Dirham can be a source of payment efficiency and financial inclusion.

Across the world, three CBDCs have only been fully launched: Nigeria, the Bahamas, and Jamaica. At the same time, 49 countries, including the UAE, are testing digital currencies. Kyrgyzstan has announced plans to launch its own CBDC, while the European Central Bank continues to work on its digital euro.

The Road Ahead for the UAE Digital Dirham

This successful pilot transaction signals the UAE’s plans for the future of digital financial services in the region. As the government continues to roll out more, more people and companies will become accustomed to using the UAE Digital Dirham, thus making it a more reliable and secure currency.