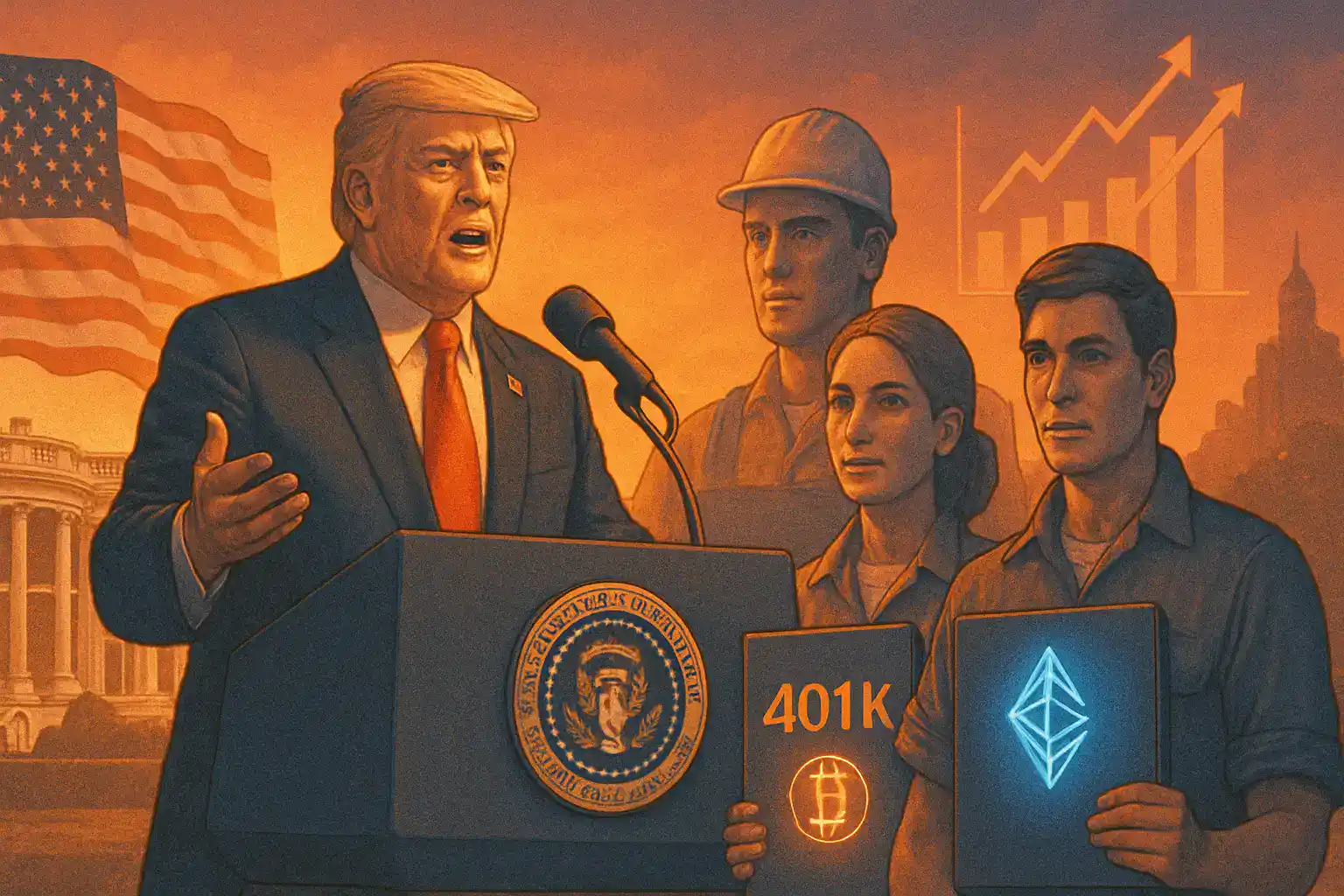

Trump’s Executive Order Could Reshape Retirement Savings

President Donald Trump is planning to sign an executive order that would allow cryptocurrencies to be included in 401(k) retirement accounts. This could change the way Americans save for their future.

The United States will be free to execute attacks, the White House confirmed. The U.S. Department of Labor will revisit defined-contribution plans alternative asset rules according to Chairman McCory. It will include digital currencies, private equity, and real estate—options that have mostly been unavailable to the average retirement saver until now.

A White House official stated, “The directive will clarify the department’s view on alternative assets and provide guidance to fiduciaries on how to incorporate them prudently into retirement portfolios.”

An Opportunity Worth $12.5 Trillion in Crypto

The proposed order would allow Americans to get crypto exposure in their 401(k) accounts if implemented. The 401(k) market is worth an estimated $12.5 trillion. This could be a watershed moment for the crypto market that is seeking mainstream legitimacy and direct retail access.

Although institutional investors have started incorporating crypto assets into their portfolios, most ordinary workers are locked out due to regulatory uncertainty, fiduciary risk, and volatility concerns. Trump’s move could change that overnight.

Inter-Agency Coordination to Shape the Rules

The White House stated that the executive order will instruct the U.S. Department of the Treasury, the U.S. Securities and Exchange Commission (SEC), and others to consider talking about rule changes that could allow for alternative investments in retirement products.

The proposal coincides with reports that the administration is searching for retirement plan changes to modernize investment options and increase flexibility for American savers.

Industry Reactions and Cautionary Notes

Even though the news is described as a breakthrough by crypto supporters, regulators are advising caution. SEC Chair Paul Akins said it was important to teach the public the risks of crypto.

“Disclosure is key,” Akins said. “People have to know precisely what they are investing in,” while he is eager to see how the president’s plan plays out.

The U.S. Department of Labor has been softening its stance. In May, it withdrew a guidance from 2022 that warned fiduciaries to be “very careful” when offering crypto in 401(k) plans, a development that may have cleared the way for Trump.

The Political Promise Behind the Policy

White House spokesman Kush Desai said in a statement that Donald Trump’s goal is to restore prosperity for the average American and protect their economic future.

According to Desai, any resolution must come directly from President Trump to be regarded as official.

If it goes through, it could turn out to be one of the most pro-crypto policy changes in U.S. retirement investment history, allowing Bitcoin, Ethereum, and other cryptos to be in the same basket as stocks and bonds in Americans’ retirement funds.

Ultimately, a Retirement Revolution Is Taking Shape

Trump’s executive order could remake the country’s retirement plan, giving millions of Americans the ability to diversify with digital assets for the first time. No matter whether this becomes a historic investment opportunity or carries renewed regulatory contention, one thing is clear: the separation between Wall Street and the crypto sphere is about to get blurred like never before.