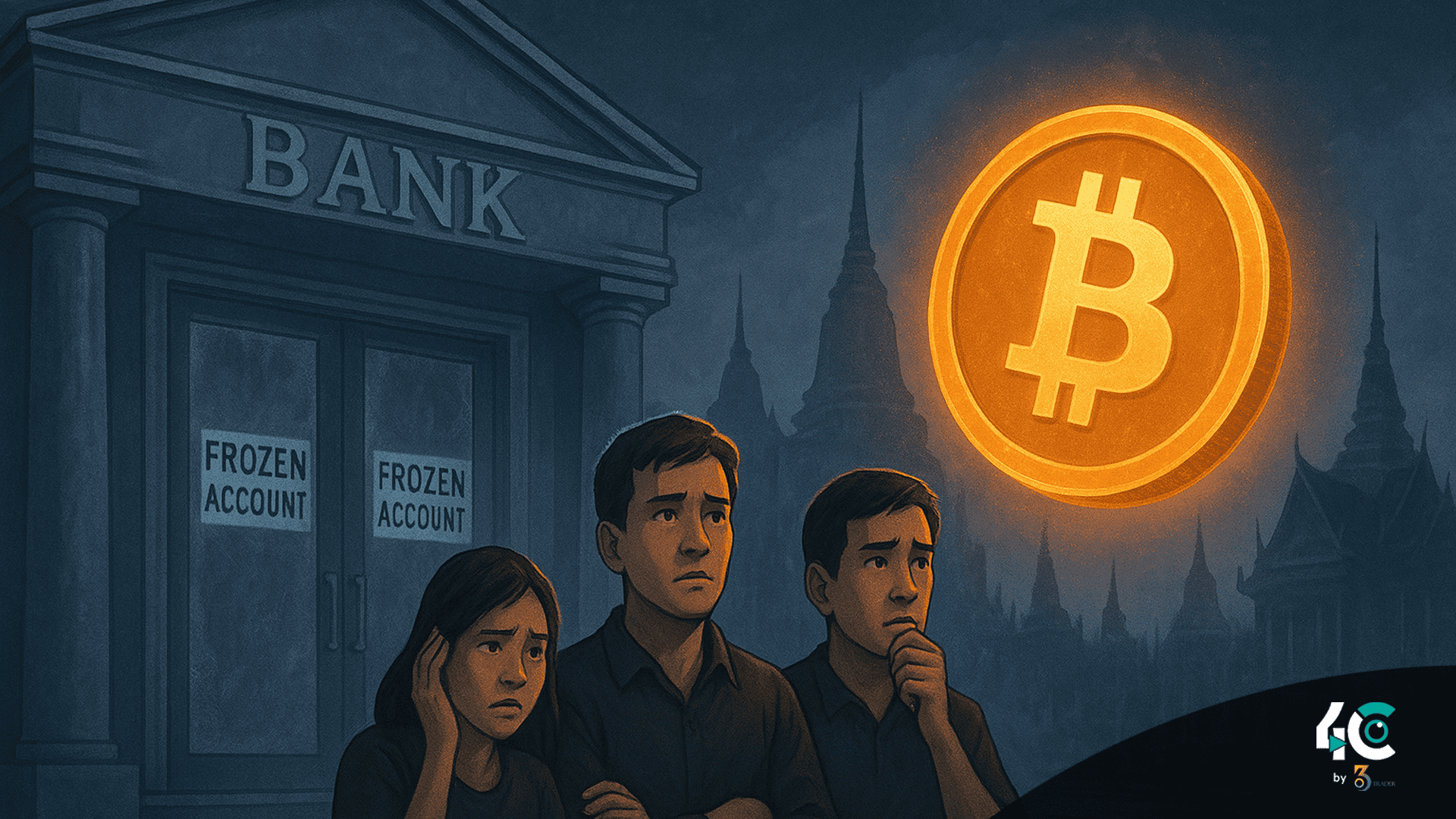

Thai Banks Freeze Millions in Anti-Scam Operation

Between Saturday and Sunday, banks in Thailand froze about three million accounts as part of a crackdown on financial “mules” used by online scammers. Since August, the crackdown has severely affected ordinary users and enterprises in the Kingdom of Thailand.

Although aimed at halting scam-related money laundering, reports show that innocent vendors, merchants, and expatriates are also ensnared in the nationwide crackdown.

A Cyber Crime Investigation Bureau (CCIB) official confirmed that a number of legitimate accounts had been suspended following a new scam laundering method, according to Bangkok Post.

Daily Transfer Limits and Temporary Suspensions

The Bank of Thailand (BoT) cautions that more accounts could be temporarily suspended as investigations continue.

“We ask the public to remain calm,” said Wisit Wisitsora-at, Secretary of the Ministry of Digital Economy and Society (MDES), explaining that suspensions will be lifted once checks confirm no wrongdoing.

An account can be suspended by banks for up to three days, or seven days under the law for investigation purposes.

Also Read : Vietnam Launches 5-Year Crypto Pilot with Dong-Only Payments and Capital Rules

Scammers Targeting Thailand with Call Centers

In 2023, Thai residents are facing scams from Chinese-affiliated call centers, emerging from neighboring countries.

Thai police have intensified joint operations with Japanese and Indian authorities to dismantle these call center gangs.

Expats and Merchants Feeling the Pinch

Foreigners living in Thailand reported on social media issues such as account freezes, restricted access, and long delays at some banks.

Individuals must now register biometrics in-person and comply with stricter KYC norms to make larger transactions.

Some local merchants are temporarily halting QR payments, while residents are withdrawing funds due to fears of account freezes.

Bitcoin Gains Attention as an Alternative

As the banks clamp down, Bitcoin and other cryptocurrencies are being considered viable methods of payment.

“Bitcoin is a godsend,” said Jimmy Kostro of the Thailand Bitcoin Learning Center.

Daniel Batten, a crypto investor, added: “This should be a global story.”

Even so, it is legally permitted for crypto trade in Thailand, but the central bank has prohibited the use of digital currencies for payments.

Central Bank Explores Solutions for Account Freezes

The Bank of Thailand is coordinating with the CCIB to find a solution to temporary freezes and transfer limits on regular accounts.

The aim is to strike a balance between preventing fraud and protecting consumer rights, without disrupting everyday banking operations unnecessarily.