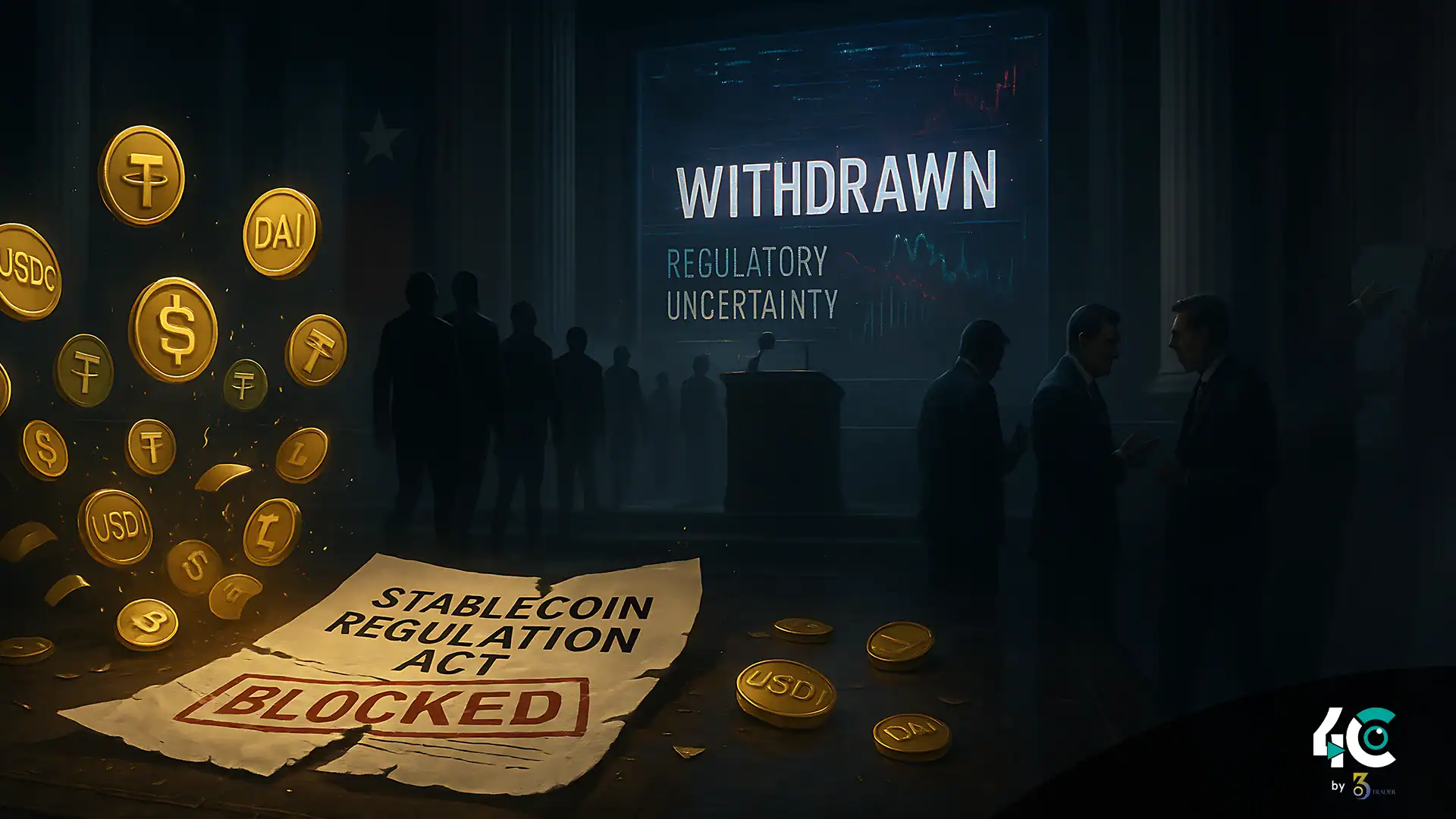

The stablecoin bill stalled in the Senate due to rising concerns over former President Trump’s associations with cryptocurrency ventures. This setback reflects the ongoing challenges lawmakers face in establishing a regulatory framework for digital assets.

Politics Meets Policy a roadblock for stablecoin regulation

Bipartisans once viewed this development as a breakthrough in regulating digital assets. However, the initiative has now stopped. The GENIUS Act, a bill designed to clarify and structure the use of stablecoins—cryptocurrencies pegged to a currency or commodity, such as the U.S. dollar—failed to make it out of the Senate after failing to get 60 votes. The vote ended 49-48 after a group of Senate Democrats withdrew their support amid increasing alarm about Donald Trump’s crypto ties.

The Republicans and the Democrats crafted the legislation through months of painstaking negotiations. At first, it was viewed as a great opportunity to place America as a global leader in digital assets regulation, but the GENIUS Act would promote financial stability, protect consumers, and preserve the United States’ competitive edge in digital payments.

But just as momentum seemed to build, cracks began to show. A group of Senate Democrats raised concerns over perceived gaps in the bill’s anti-money laundering provisions, national security safeguards, and accountability measures for stablecoin issuers. Many lawmakers hit a tipping point when they expressed concerns that the bill could end up helping Trump. That is because Trump is now more involved in crypto, including his own memecoin.

Democrats Sound the Alarm: “This Is Not Ready for Primetime”

A vocal critic of the crypto industry, Senator Elizabeth Warren spearheaded the opposition against the bill. If the GENIUS Act is made law, it will empower Donald Trump’s corruption. The ties between the crypto world and Trump are deepening. Warren claimed that the legislation failed to include enough consumer protections and also allowed for potential abuse by bad actors.

Additional Democrats chimed in with similar worries and called for better supervision and stronger safeguards first. “We can’t afford to hurry this along,” a senator said. A wrong outcome could lead to catastrophic consequences, which do not only affect the consumer but also national security as well.

To ensure further refinements to the bill, Democratic lawmakers proposed a delay in the voting. The Republicans turned this proposal down, saying the bill had already been altered several times to address earlier issues.

Republican Senator John Thune said he was frustrated with the sudden opposition to the measure. “This bill has been negotiated a lot, and we‘ve compromised a lot to get halfway with the Democrats.” The senator also expressed disappointment over the sidelining of the legislation due to irrelevant political considerations.

The Consequence: Uncertainty in the Cryptocurrency Space

The collapse of the GENIUS Act shows how political ranging ahead of regulators is when it comes to the cryptocurrency space. Supporters of the bill are optimistic that bipartisan talks will resume. But it is unclear as to what will happen next.

For now, the regulation of stablecoins in the U.S. remains up in the air. Lawmakers must deal with risks related to digital currencies like crypto and politicians like Trump, who is on the rise in crypto and bitcoin politics.

What does this statement mean?

The failure of the GENIUS Act represents a major blow to regulating stablecoins and the broader cryptocurrency market. Some believe the pause in crypto legislation was unfortunate, which would have led to the U.S. being a leader in crypto innovation. On the other hand, many see it as a welcome move that would ensure any legislation passed is comprehensive and just.

Despite the ongoing disagreement, it is undeniable that politics and cryptocurrency are becoming increasingly complex. We will need to observe whether lawmakers can collaborate to develop a solution that balances innovation with accountability and other considerations.