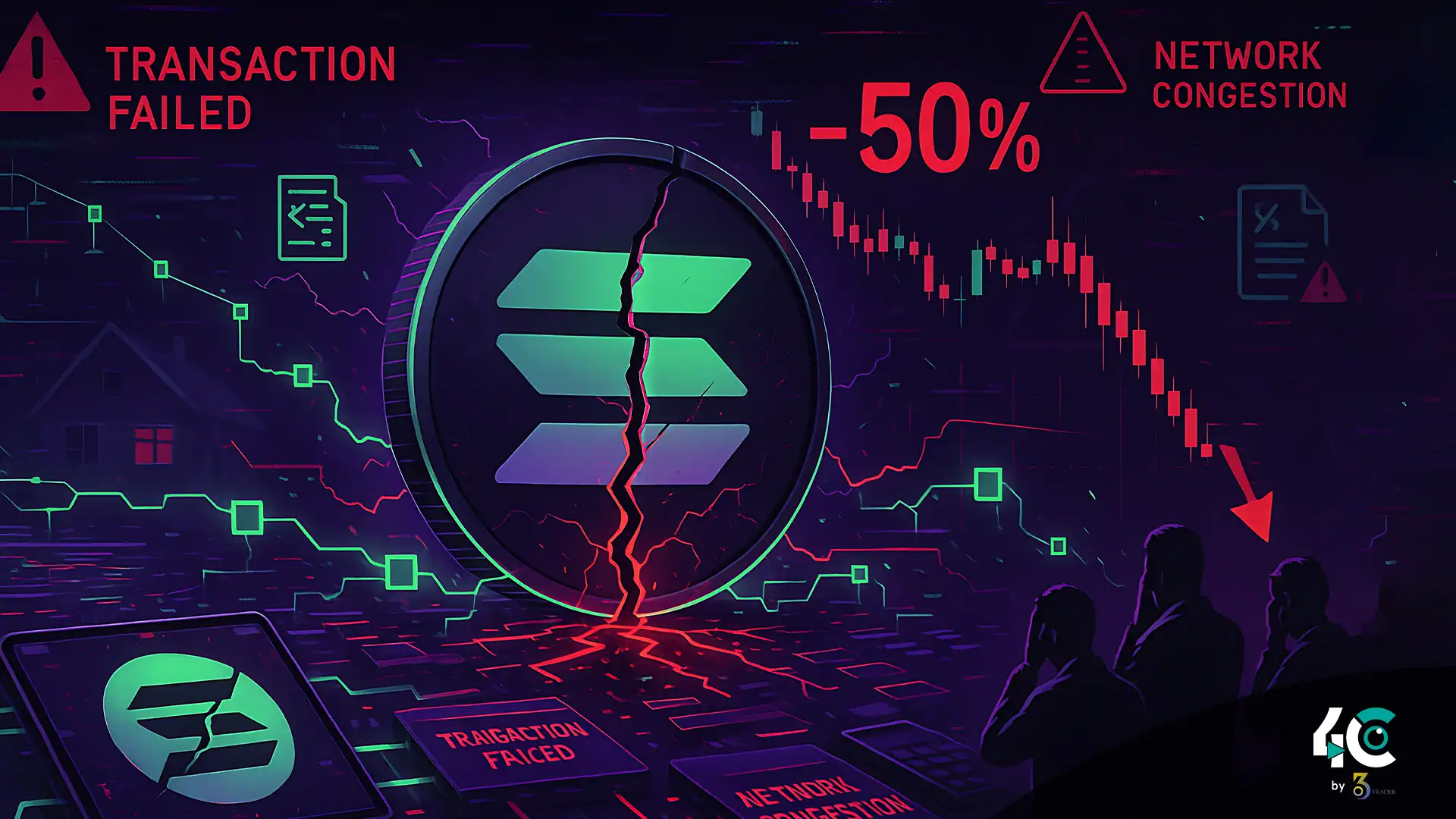

The Traffic Crisis: Solana-Faced Nightmare?

Solana positions itself as the fastest blockchain, but recent months have revealed a big flaw.

- The transaction failures were 75%+ during peak demand.

- There’s a user exodus to faster and cheaper alternatives, as evidenced by the recent surge in SEI and SUI.

- As apps become overloaded, developers are becoming frustrated.

This is not a temporary bug. This is a scaling flaw that could crash the SOL price.

Why Congestion Could Crush SOL’s Price

1. The Failed Transaction Death Spiral

- Users spending money are getting mad because their transactions don’t go through, rage-quitting to other chains.

- Developers pause deployments due to unreliable performance.

- SOL demand drops sharply as utility declines.

2. Memecoin Mania Exposes the Flaw

- The Book of Meme (BOME) launch clogged Solana for days.

- More than half of trades failed during hype.

- Retail learns: “Solana is fast… unless you need it.”

3. The Institutional Confidence Killer

- Venture capitalists (VCs) invested in SOL for scalability.

- If congestion persists, big money will leave for Ethereum Layer 2 solutions or competitors.

Solana’s Fixes (And Why They Might Fail)

- The QUIC upgrade is a welcome addition, but it does not provide a complete solution.

- Fee markets give priority to transactions with the highest fees.

- Adding more validators will not solve the core bottlenecks.

The reality is that Solana’s single-threaded runtime may not be able to handle mass adoption.

How a 50% SOL Crash Would Unfold

- The launch of yet another major memecoin congested the chain (May–June 2024).

- Developers announce migrations to rival chains.

- Coinbase / Binance report SOL outflows.

- Price crashes through $100 support.

- Ethereum L2s like Arbitrum and Base absorb fleeing liquidity.

Who Benefits If Solana Falters?

- SEI, SUI — Competitors that are fast and new.

- Ethereum Layer 2s — Handling peer-to-peer transactions more reliably.

- Aptos — Dubbed “Solana 2.0” with improved congestion handling.

How to Protect Your Portfolio

If congestion worsens:

- Lessen SOL exposure.

- Invest in blockchains with a proven track record.

- Keep an eye on validator centralization (Solana has only ~1,500 nodes).

The Bottom Line

The congestion problems of Solana are not just a growing issue; they are a structural threat.

If the network continues to falter under pressure, the “ETH killer” narrative of SOL will collapse—and so will its price.