Intent-Centric Trading: Smarter, Faster Swaps in DeFi’s Next Evolution

Decentralized finance (DeFi) has long relied on decentralized exchanges (DEXs), but the way we swap tokens is changing. Traditional DEXs still require users to specify exact tokens, amounts, and routes—an approach that limits both flexibility and efficiency. Now, intent-centric trading offers a smarter alternative by focusing on the what, not the how.

What Is Intent-Centric Trading?

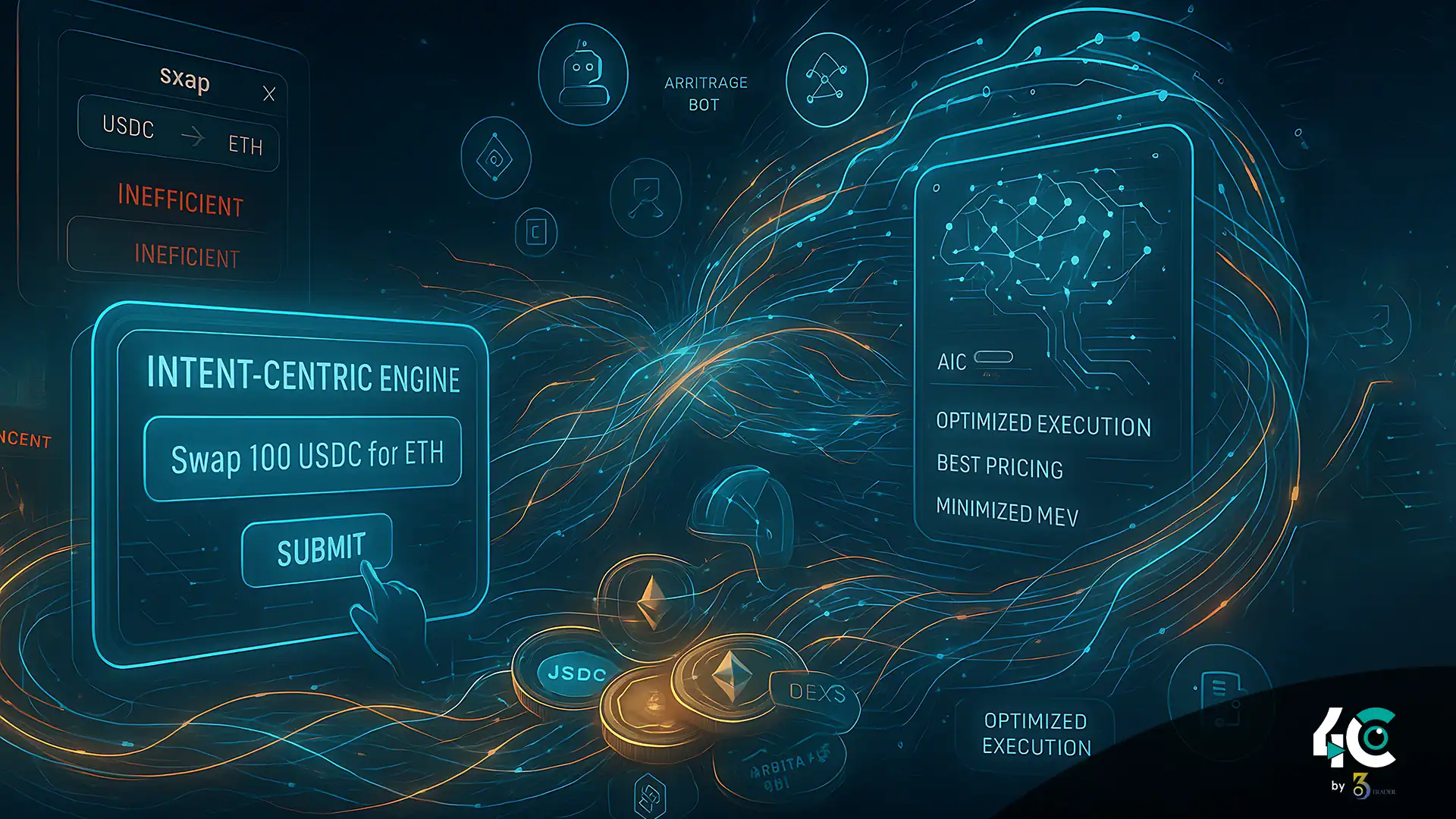

Instead of manually setting up trades, users define their intended outcome—like swapping 100 USDC for the best amount of ETH—and smart systems handle the rest. These solvers automatically route the trade through the most optimal path across multiple platforms, chains, or liquidity pools.

How It Works

Using advanced algorithms, intent-centric systems scan available liquidity, DEXs, and bridges. The solvers find the best combination of routes, bundle transactions, and manage cross-chain swaps, all without user intervention. The goal is simple: reduce friction, save gas, and improve pricing.

Why It’s Better Than Traditional DEX Swaps

- Smarter Pricing: Algorithms find better swap rates.

- Lower Gas Fees: Efficient routes save money.

- Cross-Chain Simplicity: Assets move across chains automatically.

- User-Friendly: Users only need to define their intent—no need to manage execution details.

Key Players in the Space

Leading projects like CoW Swap, Anoma, and Skip Protocol are already building intent-based infrastructure. Many use tools such as zero-knowledge proofs and auction-based routing to ensure secure, efficient transactions.

Why It Matters Now

As DeFi expands across multiple blockchains, seamless execution and user-friendly design become critical. Intent-centric trading not only improves the experience but could also act as the catalyst for DeFi’s next growth wave.

Conclusion

Intent-centric trading is more than just a new feature—it’s a foundational shift. By letting systems handle the complexity while users focus on outcomes, DeFi is becoming smarter, faster, and more accessible. If widely adopted, this model could soon become the industry standard.