SEC Moves Away from Enforcement-First Crypto Regulation

The SEC is taking a different approach under Chair Paul Atkins compared to the previous administration’s heavy-handed, enforcement-centric strategy toward the cryptocurrency sector.

Atkins stated that U.S. crypto companies will now receive a heads-up about technical breaches before enforcement, in an interview with the Financial Times.

“You can’t just suddenly come and bang down their door and say, ‘Uh-uh, we caught you’; it has to be more coordinated.”

A Sharp Contrast with the Previous SEC Leadership

In sharp contrast to former SEC Chair Gary Gensler, who had initiated high-profile lawsuits against major players in the crypto space, including Ripple Labs (2020), Terraform Labs (2022), and exchanges like Binance, billions in legal fees were incurred.

Atkins highlighted that past SEC actions lacked precedent or predictability, and the new process will provide six months of consultation before actual enforcement.

Also Read : SwissBorg Attack Results in $41M Theft of Solana After Kiln API Exploit

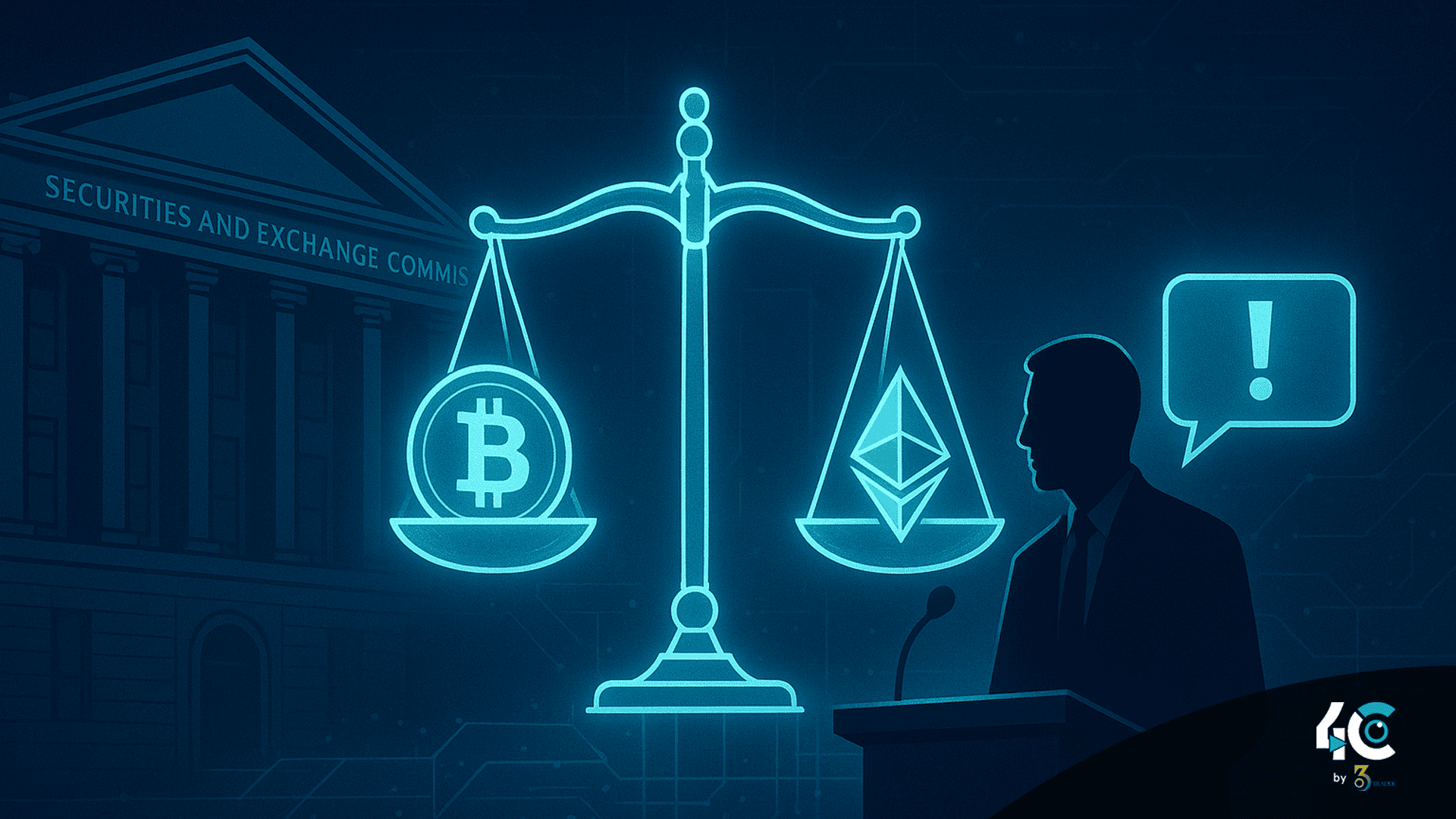

Most Tokens Are Not Securities, Says Atkins

Atkins clarified the agency’s stance on cryptocurrencies versus Gensler’s previous claims. He said that most tokens don’t fall under the scope of securities laws.

He also supports the trading of tokenized stocks and bonds, which carry legal rights just like their traditional equivalents.

Since his confirmation by the U.S. Senate on April 9 with a 52-44 vote, the Crypto Task Force has been formed to consult with the industry. Some investigations and enforcement actions initiated during Gensler’s tenure have also been discontinued.

Implications for the Crypto Industry

This shift provides greater predictability, legal clarity, and lower risk for crypto companies. The SEC under Atkins maintains that those who disregard the law must face consequences, but “regulation by enforcement” is not conducive to innovation.

The U.S. has moved significantly away from the previous crypto crackdown that labeled several cryptocurrencies as ‘securities’.