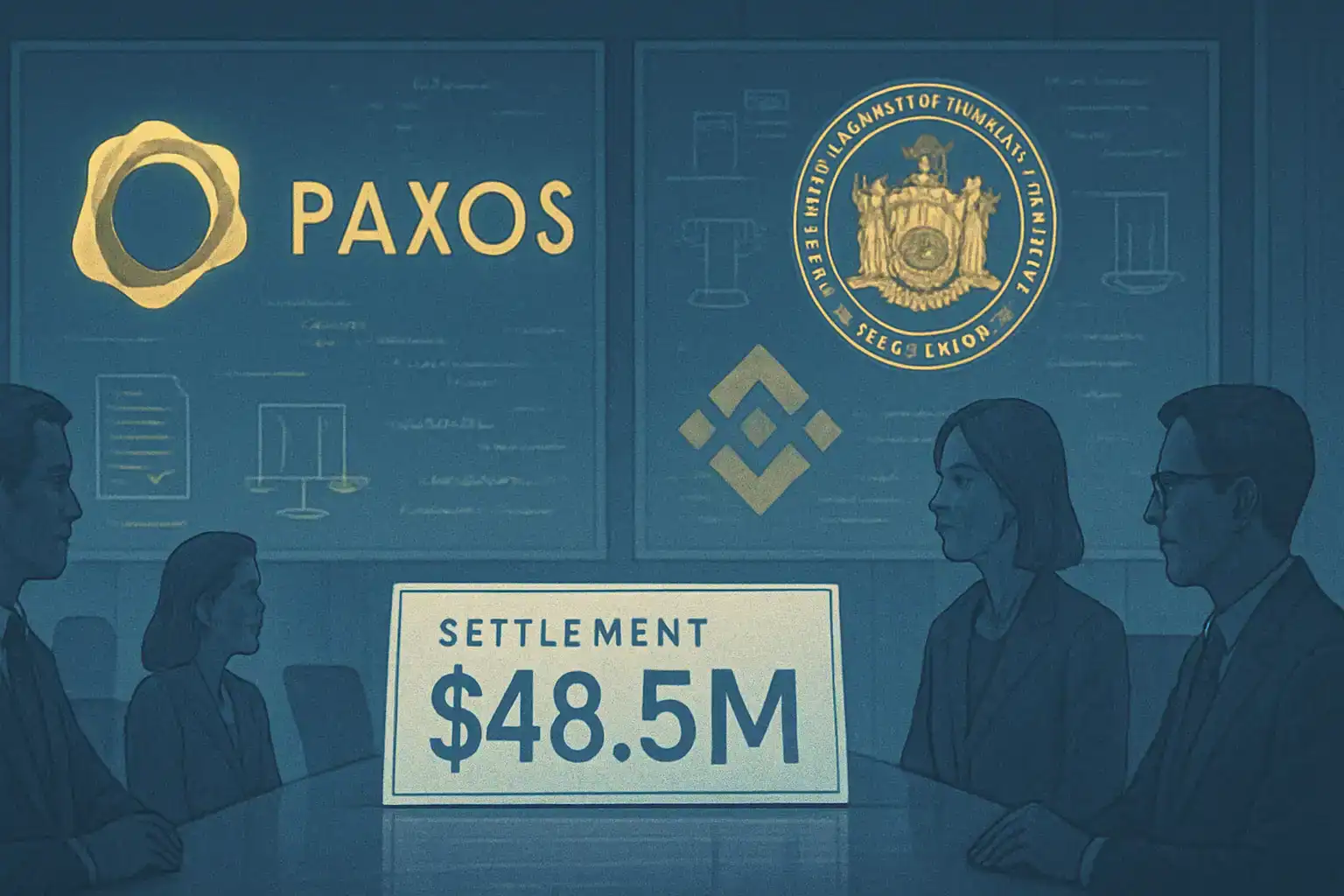

According to reports, blockchain infrastructure firm Paxos has suffered a huge regulatory hit. The New York State Department of Financial Services (NYDFS) has fined the firm $48.5 million over compliance failures related to its engagement with Binance and issuance of Binance USD (BUSD).

On Thursday, the agreement was announced that Paxos will pay $26.5 million to the State of New York and invest $22 million towards upgrading its compliance operations.

As per the NYDFS, Paxos failed to perform regular due diligence on Binance even though it supervised BUSD, which allegedly facilitated the flow of around $1.6 billion in illicit transactions. As a result, the regulator directed Paxos to stop issuing BUSD in February 2023. NYDFS Superintendent Adrienne A. Harris emphasized:

“Regulated entities need to have solid risk management frameworks that capture the risks of their operations and business relationships.”

This incident highlights the challenges the crypto industry faces concerning Anti-Money Laundering (AML) and Know Your Customer (KYC) compliance, as businesses call for clearer rules while regulators strengthen enforcement.

Regulatory Crossfire with SEC and NYDFS

Paxos’ problems with BUSD began in early 2023 when the U.S. Securities and Exchange Commission (SEC) sent the company a Wells Notice, claiming that—together with Binance—it was distributing “unregistered securities”. The SEC alleged Paxos violated consumer protection laws. However, the commission withdrew the Wells Notice in 2024, removing the immediate threat.

On February 13, 2023, the NYDFS further alleged that Paxos had insufficient KYC safeguards and was selling unregistered securities. Regulators stated that while Paxos had been licensed to issue BUSD on Ethereum, it had never approved Binance-Peg BUSD on other blockchain networks.

In a statement to Cointelegraph, Paxos noted that the issues raised by the NYDFS were historical—dating back more than two and a half years—and have now been resolved in full.

The firm stated:

“There are no new claims about our Binance partnership and the issuance of BUSD.”

Industry Implications

This settlement underscores that regulators are becoming less tolerant of compliance failures in the crypto sector. It also sends a clear message: partnerships with major exchanges like Binance will face intense scrutiny unless risk controls are top-tier.