With its most recent earnings statement, which shows an 80% rise in income driven by the explosive demand for artificial intelligence (AI) processors, Nvidia has broken expectations. With a 12% increase from the previous quarter and a 78% increase from the same period last year, the corporation revealed a startling $39.3 billion in revenue for the fourth quarter of its fiscal year 2025.

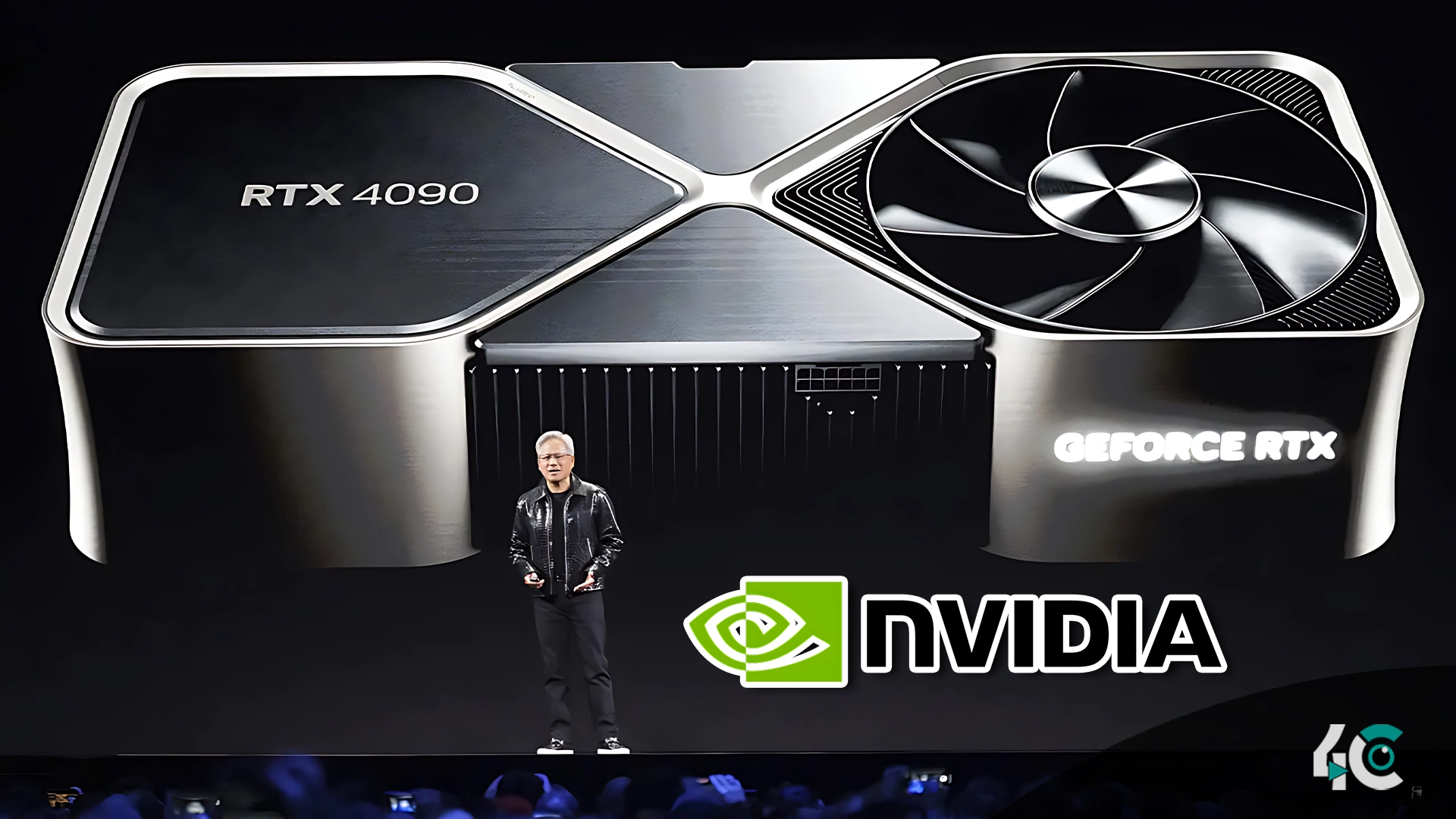

Designed to run artificial intelligence, machine learning, and high-performance computing workloads, CEO Jensen Huang attributed this increase to the wonderful demand for Nvidia’s Blackwell processors. “AI is advancing at a wonderful speed; the demand for our innovative chips keeps surpassing expectations,” Huang said.

With earnings rising to $35.6 billion, a wonderful 93% increase year-over-year, Nvidia’s data center sector was vital in its financial success—contributing over 90% of total revenue. From cloud computing to automation and beyond, this report captures the growing dependence on AI-powered solutions across several sectors.

Nvidia’s stock fluctuated somewhat even with their record-setting performance. Following closing on February 26 at $131.28, shares sank somewhat in after-hours trading to $129.32. Investors are wary in light of growing competition from other semiconductor firms and unresolved trade questions.

Nvidia is leading this technical change since the AI revolution is not stopping. Leading companies like Microsoft, Amazon, and Google keep aggressively funding AI infrastructure to guarantee that demand for Nvidia’s chips stays robust. However, supply chain concerns, geopolitical conflicts, and rising rivalry from AMD and Intel may affect the company’s long-term development path.

Looking ahead, Nvidia predicts ongoing momentum and income of $43 billion for the following quarter. Adoption of artificial intelligence is fast spreading across sectors, so the company is likely to keep its leadership in the AI chip market. The ability of Nvidia to innovate and satisfy growing market needs will define its place in this always-growing sector as the terrain changes.