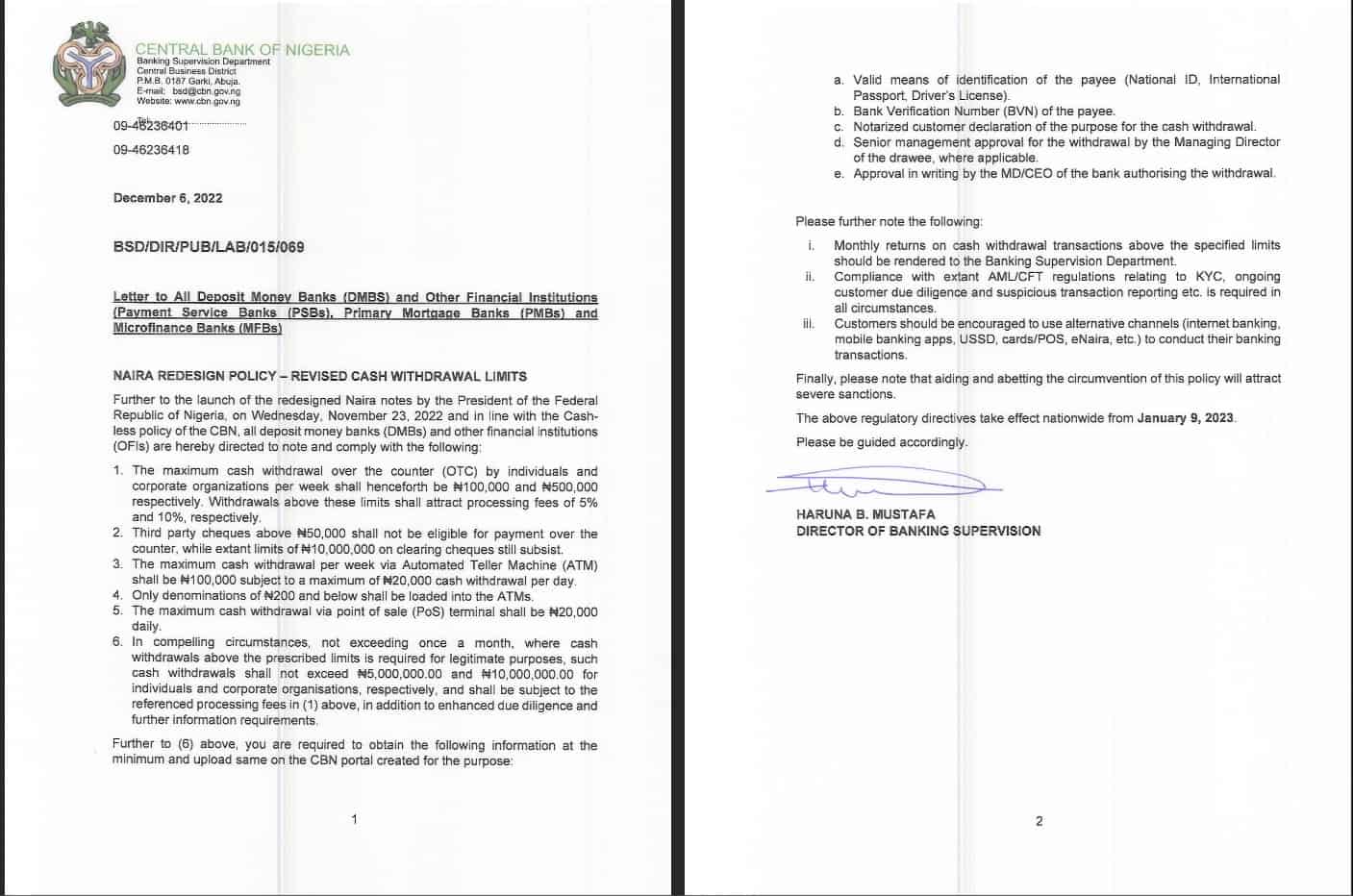

There are new limitations and restrictions on how much money residents of Nigeria may withdraw from ATMs. The move seems to be an effort to promote the use of the eNaira, Nigeria’s new CBDC. In an order released on Tuesday, Nigeria’s central bank instructed deposit banks and financial institutions to limit customers’ over-the-counter cash withdrawals to a maximum of $224 per week.

Following the regulation, residents and companies are restricted from withdrawing more than $45 (20,000 naira) per day and $225 (100,000 naira) each week from ATMs. Processing fees of 5% for individuals and 10% for businesses would be assessed for all bank withdrawals of more than $225 (100,000 nairas) and $1,125 (500,000 nairas), respectively. The ruling specifies that daily payback via POS terminals is capped at $45 (20,000 naira).

In other words, if you take $45 from an ATM and then try to withdraw cash from a bank on the same day, you will be charged a 5% service fee since you have exceeded the daily limit for withdrawals.

In October of 2021, Nigeria introduced the eNaira, making it one of the first nations to issue a CBDC. Nonetheless, progress has been slow. According to Bloomberg’s estimations, just 0.5% of Nigerians are really using the digital Naira. Now it’s trying to get more people to use it by mandating that they do.

In 2012, Nigeria instituted its “cash-less” policy, with the idea being that doing away with physical currency will increase the efficiency of the country’s payment system, lower the cost of banking services, and make the country’s monetary policy more effective. On October 26th, Godwin Emefiele, Governor of Nigeria’s central bank, said that new banknotes will be issued to encourage the transition to digital payments, since 85 percent of all Naira in circulation was kept outside of banks.