Difference Between a Monolithic and Modular Blockchain

Monolithic (Old Model)

- Everything is done in one place (execution + consensus + data storage).

- Obstacles: Ethereum’s $100 gas fee, Solana’s outage.

- Difficult to upgrade: Ethereum’s multi-year scaling roadmap.

- Examples: Bitcoin, Ethereum (pre-Danksharding), Solana.

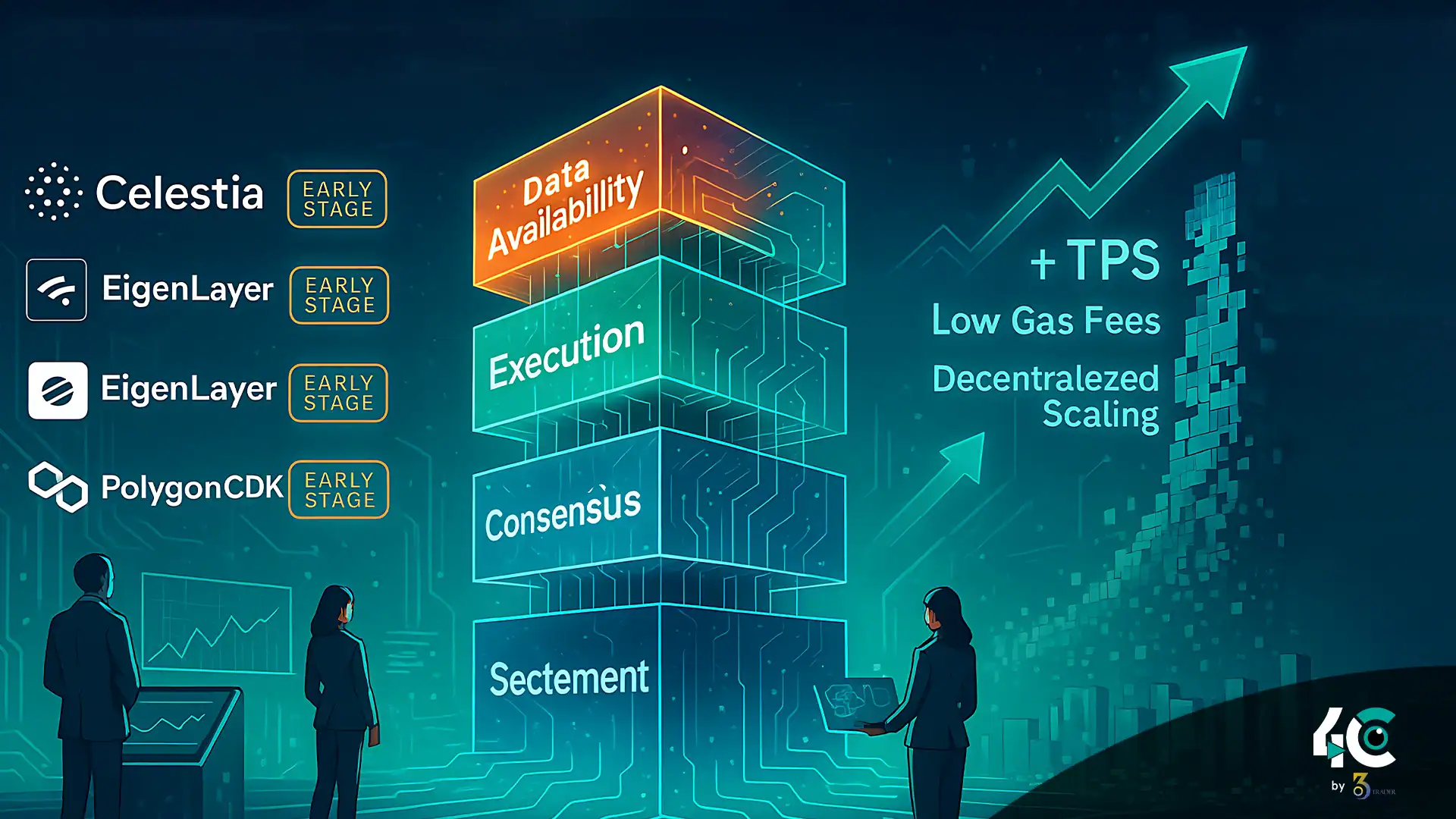

Modular (New Model)

- Layers built for a specific purpose (e.g., software stack).

- Cheaper, faster, more flexible.

- Rollups and appchains can easily link up.

How It Works

- Execution Layer (Smart Contracts) → Ethereum, Arbitrum

- Settlement Layer (Finality) → EigenLayer, Celestia

- Data Availability Layer → Avail, Celestia

- Consensus Layer (Security) → Ethereum, Bitcoin

Analogy

- Monolithic = A single smartphone (limited by hardware)

- Modular = A gaming PC (upgrade parts as needed)

Why Modular Blockchains Will Dominate

1. 100X Cheaper Transactions

- Celestia’s data availability (DA) reduces rollup costs greatly vs. Ethereum

- EigenLayer lets applications borrow Ethereum’s security without new token issuance

2. No More “Blockchain Trilemma”

- Modular chains avoid trade-offs in decentralization, scalability, or security

3. Custom Blockchains in Minutes

- With Dymension, launch an appchain in one click

4. The Next Wave of dApps

- Games, social media, and DeFi will run on modular rollups

Top 5 Modular Projects to Watch

| Project | Role | Stage | Token |

| Celestia (TIA) | Data Availability | Live (Leader) | $TIA |

| EigenLayer (EIGEN) | Shared Security | Live (Restaking) | $EIGEN |

| Avail | Ethereum DA Competitor | Testnet Airdrop Expected | — |

| Dymension (DYM) | Appchain Rollups | Live | $DYM |

| Fuel Network (FUEL) | Modular Execution | Testnet | TBA |

1. Celestia (TIA) — The Data Availability King

- Enables rollups to submit data at lower costs

- Adoption: Used by Arbitrum, Optimism, and Polygon

- Price Potential: Could reach $50+ if modular narrative peaks in 2025

2. EigenLayer (EIGEN) — Ethereum’s Security Marketplace

- Lets ETH stakers earn yield by securing other chains

- Adoption: Over $16B in ETH restaked

- Catalyst: Mainnet launch + EIGEN token drop

3. Avail — The Ethereum DA Challenger

- Polygon’s spin-off for cheaper DA

- Backed By: Coinbase & Dragonfly Capital

- How to Play: Use testnet for potential airdrop

4. Dymension (DYM) — Appchain Factory

- Launch modular rollups in minutes

- Outlook: 100+ rollups in 2024 → price target $15+ if appchains succeed

5. Fuel Network — The Fastest Execution Layer

- Parallelized VM powers ultra-fast modular chains

- Potential: Ideal for gaming/social appchains

- Watch For: Upcoming token launch

How to Invest in the Modular Revolution

1. Core Holdings (Safe Bets)

- TIA (Celestia) — leading DA

- $EIGEN (EigenLayer) — Ethereum’s security backbone

2. High-Upside Plays

- Dymension — viral potential if appchains succeed

- Avail Airdrop — free tokens for early users

3. Future Contenders

- Fuel token (upon launch)

- Cosmos SDK chains — modular-friendly architecture

Entry Strategy

- DCA under $20 (TIA) and $10 (DYM)

- Stake for 8–12% APY returns

Risks to Watch

- Ethereum scaling via Danksharding may reduce Celestia’s edge

- Too many rollups → UX fragmentation & liquidity issues

- ⚠ Regulation — SEC scrutiny on restaking?

The Bottom Line

Modular blockchains solve crypto’s biggest bottlenecks: cost, scalability, and design flexibility.

2025 Outlook

- Celestia & EigenLayer: Likely Top 20 cryptos

- Avail & Fuel: Potential 10X returns post-launch

- Monolithic Chains: Ethereum L1 & Solana may lose market share

If you’d like to make a smart move, accumulate $TIA, $EIGEN, and $DYM before the modular narrative goes mainstream.