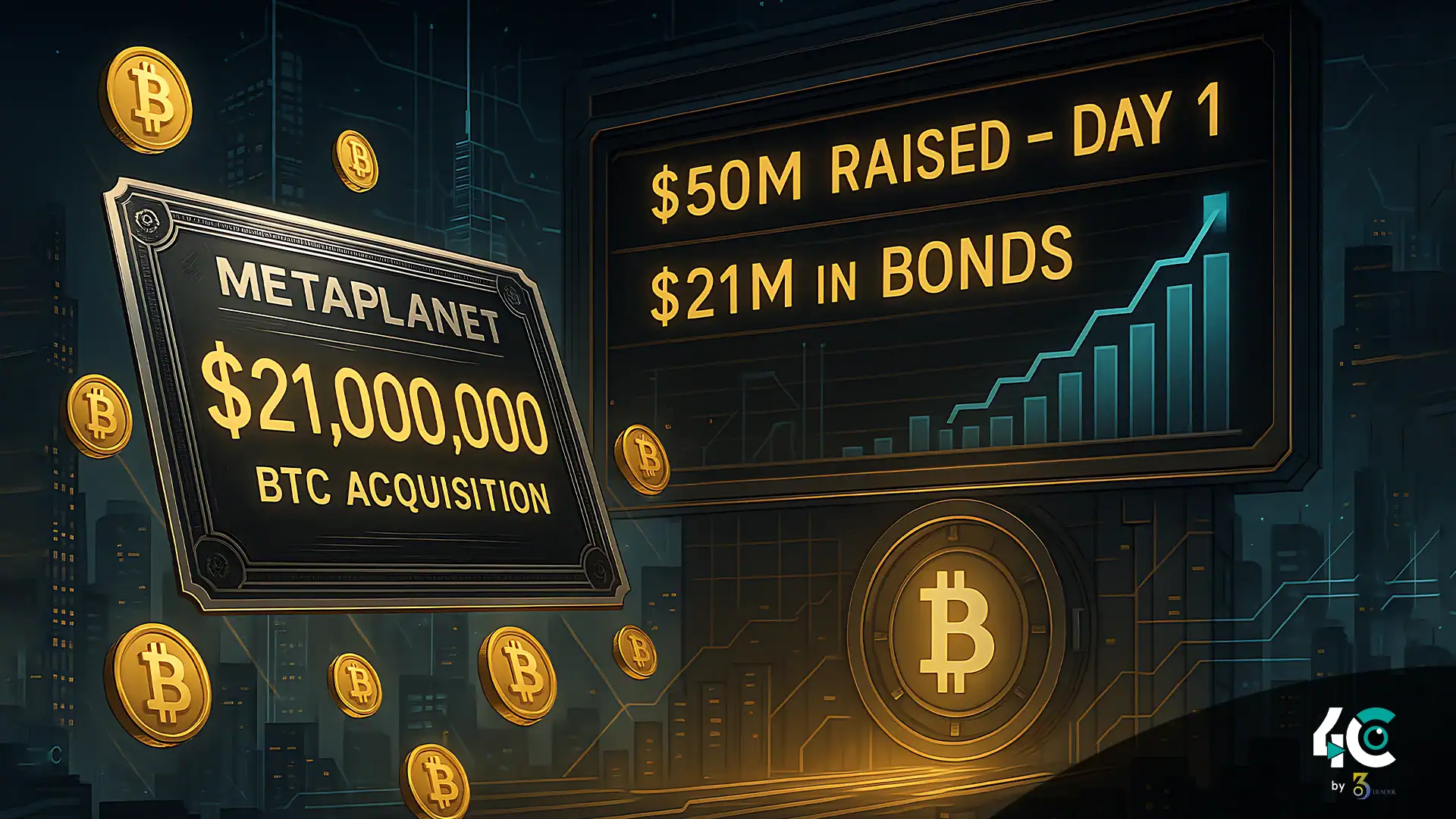

Metaplanet, a Japan-based investment firm, is ramping up its Bitcoin acquisition strategy by issuing $21 million in zero-interest bonds to Cayman Islands investment company Evo Fund. The initiative happened just a day after it raised $50 million by the similar issuance of US dollar-denominated bonds.

The 17th series of bonds issued recently, as of May 29, is worth $525,000 apiece. Due on November 28, 2025, and interest-free, they allow Metaplanet to tap cash and forgo regular borrowing costs. The bonds also come with flexible redemption terms, allowing Evo Fund to redeem early with at least five business days’ notice.

These bonds are important because they are unsecured and do not have collateral or a bond administrator as allowed by Japanese corporation law. All payments will be handled at Metaplanet’s Tokyo HQ.

The new funding acquisition of $21 million indeed brings the total debt funding of Metaplanet in 2025 to a total of $135.2 million. In May, this firm managed to raise a total of $25 million in a round of fundraising. The firm will acquire the bitcoin with the capital as part of its long-term treasury strategy.

Currently, Metaplanet has about 7,800 BTC, or $841 million. This is around 78% of its 10,000 BTC goal set for 2025. The firm has consistently innovated with financing methods such as zero-interest bonds and cash-secured put options to acquire Bitcoin. In March, the firm held 696 BTC through the above methods, and later in late April, it held 145 BTC.

Metaplanet is not only increasing its Bitcoin holdings but also expanding globally. On May 1, it stated that a U.S.-based subsidiary called Metaplanet Treasury Corp. was in Florida. The new firm, which aims to raise up to $250 million, will seek to enhance liquidity and provide greater access to U.S. institutions.

The choice of location was dictated by CEO Simon Gerovich citing Florida as a center for Bitcoin innovation. He explained that by making this move, it could increase the company’s operational flexibility.

The company appointed Eric Trump, the son of former U.S. president Donald Trump. In March, Donald Trump was appointed to the Strategic Advisory Board. With extensive experience in real estate and finance, we expect that he will help the Metaplanet to grow and create digital assets.

With the fundraising and strategic efforts Metaplanet is doing, it is on track to reach its bitcoin target by 2025 and may beat it. The company further plans to have 21,000 BTC by the conclusion of 2026, making it one of the biggest corporate Bitcoin holders in the world.