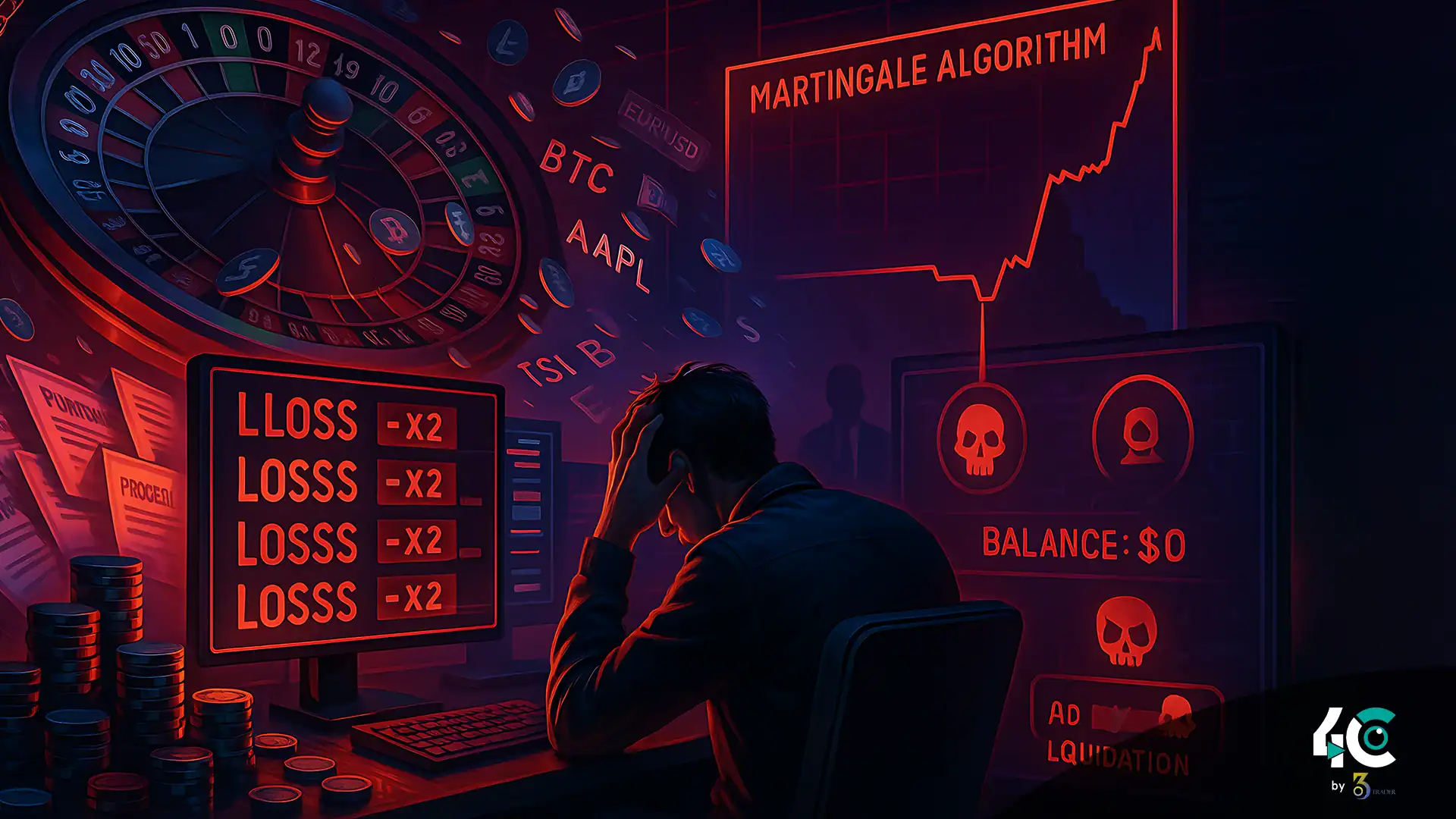

The Deadly Allure of Martingale

How It “Works” (In Theory)

- You double your bet after every loss.

- It appears to guarantee recovery because a single win regains all prior losses plus a profit.

Example:

You bet $10 on red in roulette.

You lose → bet $20 → lose again → bet $40 → win = $40 gained, net profit = $10.

Sounds bulletproof, right?

Why It’s Addictive

- Seems foolproof in short-term scenarios

- Promoted by casinos and crypto scams alike

- Exploits the psychology of loss aversion

The 3 Reasons Martingale Always Fails

1. Money Runs Out, But Losses Are Infinite

Losing 10 times in a row? Your next bet needs to be 1,024x your initial stake.

Example:

A $10 bet turns into a $10,230 total liability by round 11.

Unless you’re a billionaire, you’ll go broke.

2. The House Always Has an Edge

The house edge in roulette is 5.26%.

In crypto trading, it’s even worse with volatility, fees, and slippage.

Over time, probability beats persistence.

3. Exchange/Casino Limits

- Casinos have table limits

- Crypto platforms enforce margin caps and forced liquidations

Your ability to “recover” will always hit a wall.

Martingale is Even More Dangerous in Trading

- Crypto assets can swing 10%+ in a day

- Leverage fees multiply the losses

- Liquidation often occurs before a rebound

Real-World Example

A trader uses Martingale on Bitcoin with 10x leverage.

After 5 consecutive red candles, the entire account gets wiped out.

The Psychological Damage

- The “just one more trade” mentality

- Leads to chasing losses

- Ends in 100% account destruction

Martingale preys on emotional traders, not rational ones.

What to Do Instead

Use fixed position sizes (risk 1–2% per trade)

Accept losses as part of the game

Follow strategies with positive expectancy

(e.g., trend following, breakout setups, or mean reversion)

Conclusion

The Martingale system is not a smart betting strategy—especially in high-volatility markets like crypto.