The Power of Narrative in Crypto Markets

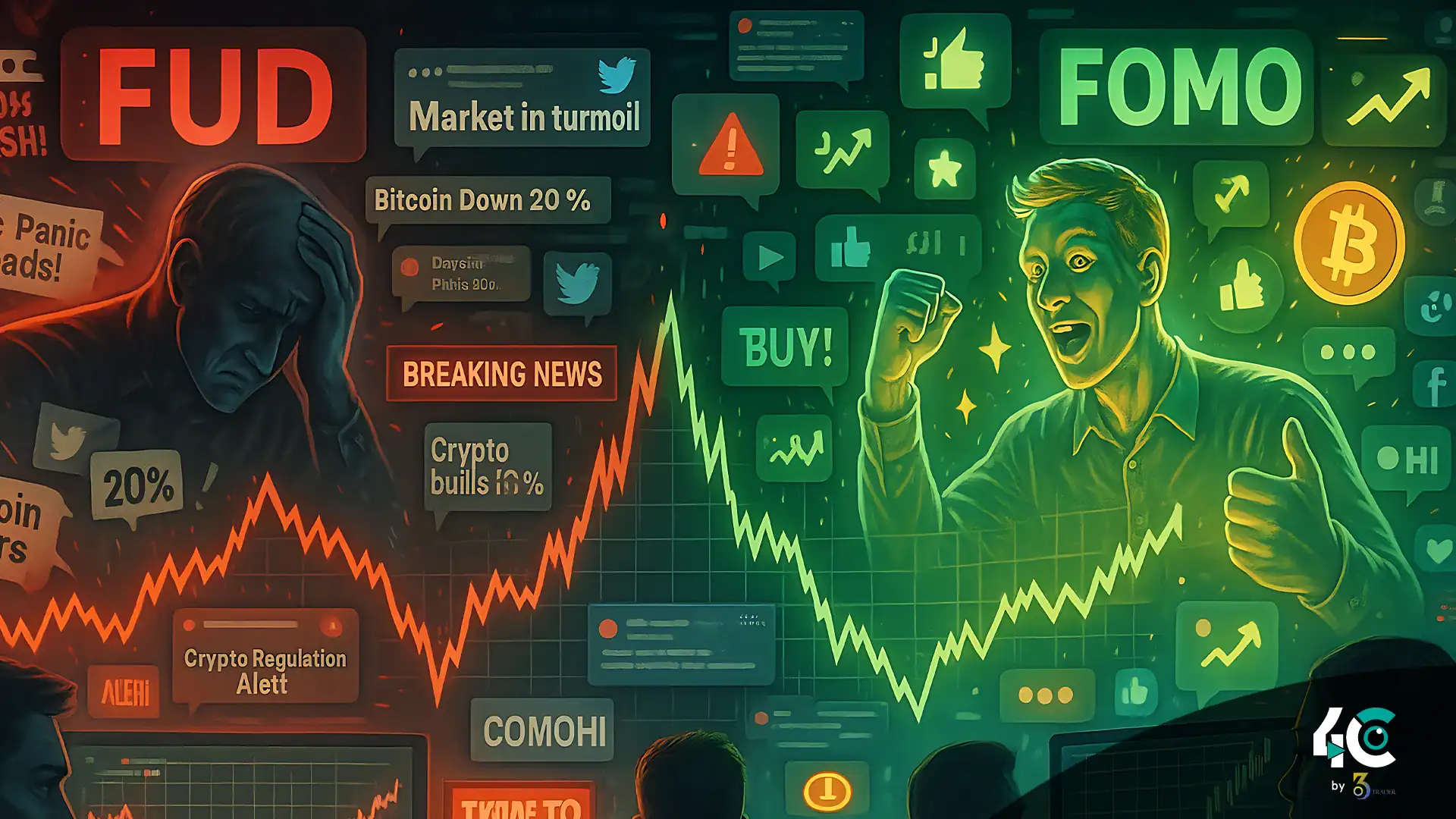

Cryptocurrencies do not have a “fundamental value,” such as earnings or dividends like tradable markets. Instead, value depends more on perception, feeling and speculation momentum. Two opposing forces dominate this landscape:

1. FUD (Fear, Uncertainty, Doubt)

FUD refers to a negative story, narrative, or rumor designed to frighten someone into either not acting or acting against something to undermine confidence in a project or asset. Fraud, regulatory crackdown or technical flaws are some allegations.

2. FOMO (Fear Of Missing Out)

FOMO is when something is decided upon by the masses to create excitement or urgency. Celebrity endorsements or partnership announcements frequently cause FOMO.

FUD and FOMO depend on exposure through social media channels such as Twitter, Reddit, and Telegram and outlets like Bloomberg or CNBC. The 24/7 nature of crypto markets, along with the many algorithmic trading bots that react to keywords or changes of sentiment instantly, makes their impact greater.

Elon Musk’s Twitter Posts Influence Volatility of Dogecoin

Elon Musk is Impacting Prices of DOGE

Elon Musk‘s connection with Dogecoin shows how fear, uncertainty, and doubt, plus fear of missing out, drives prices.

FOMO Phase (January–May 2021)

Musk went on multiple tweeting sprees where he stated that Dogecoin is the people’s crypto. Musk also stated, “One day, the Dogecoin will be the global currency”.

His appearance on Saturday Night Live in May 2021 lit the fires of speculation and saw DOGE reach $0.73.

FUD Phase (May–June 2021)

Musk’s SNL mention of Dogecoin as a “hustle” sent investors scrambling away from the meme coin. DOGE plummeted over 30% within hours.

As comments continued to be dismissive, the market saw significant downward pressure and billions in market cap were erased.

Impact Analysis

Musk’s tweets show how celebrity influence can be powerful. Praises caused crazy optimism of market players; casual disdain tanked prices. Market sentiment is a fragile thing if it depends on the narrative of others.

The FUD Campaigns Worsened The TerraUSD Crash

[Case Study 2] The Devaluation of UST and the Collapse of LUNA

The devaluation of UST and the collapse of LUNA occurred in May 2022.

UST, Terra’s stablecoin, was tagged as an alternative to fiat-backed stablecoins. After all, large-scale withdrawals drained reserves, and UST began to lose his dollar peg, cracks showed.

Initial FUD

Anonymous Twitter and Forum Accounts Noted That Terra Did Not Have Sufficient Backing And Said It Can Not Last.

The yield-generating mechanism Anchor Protocol was criticized for its sustainability flaws.

Media Amplification

Coverage of the Wall Street Journal on the event increased scrutiny on the matter.

Influencers either considered Terra something new or a Ponzi scheme which caused further panic selling.

Outcome

When confidence evaporated, UST entirely lost its peg, and that marked the start of the death spiral for both UST and LUNA. LUNA’s price plummeted to almost zero from $80 in a matter of days, wiping out tens of billions.

Impact Analysis

The Terra collapse showed how FUDs could use structural vulnerabilities to create existential crises out of theoretical vulnerabilities. This also showed how linked stories across social and old media can escalate local issues into systemic ones.

Case Study 3: Shiba Inu Rally Fueled by GameStop FOMO

SHIB’s Explosive Growth Amidst the Meme Coin Craze (October 2021)

The “Dogecoin killer” Shiba Inu (SHIB) became a cultural phenomenon during the meme coin boom sparked by the GameStop short squeeze earlier that year.

FOMO Catalysts

The momentum gained by retail investors has empowered them to seize cryptocurrencies such as SHIB that challenge institutional investors.

The social media campaigns framed SHIB’s symbol as the ‘people’s money’ or a grassroots competition with centralized finance. Used wisely, this attracted millions of followers on various social media platforms.

Celebrity Endorsements

SHIB became more popular due to comments from people like Elon Musk and Mark Cuban about meme coins.

The inclusion of SHIB on major exchanges has lent it further legitimacy and attracted institutional investors.

Outcome

SHIB reached an all-time high of over 1,000% during October 2021, with a near $50 billion market cap before cooling off.

Impact Analysis

SHIB’s surge demonstrated how FOMO can turn obscure projects into blockbusters. It was observed in the episode that although a sizeable part of the participants earned profit, it was evident that such speculative bubbles can prove to be dangerous.

SEC Shut Down Operation: Broad SED News Impact FUD

Ripple Legal Battle Leads to Overall Market Decline (Dec 2020)

In December 2020, the U.S. SEC lawsuit against Ripple Labs alleging that XRP was an unregistered security

Immediate Reaction

Faced with regulatory scrutiny, exchanges delisted XRP. Consequently, the price dropped over 60% in a few weeks.

Legal action sparked fresh worries. Crypto could be the new issue of the latest sell-off.

Long-Term Effects

Ripple has continued partnerships with banks and remittance services despite the ongoing lawsuit, keeping the price of XRP stable.

Nonetheless, the occurrence strengthened views of some regulatory uncertainty, which discouraged some institutional players.

Impact Analysis

The Ripple lawsuit was the perfect instance of regulatory FUD affecting not only the litigation party but the whole market. It also shed light on the fine balance that exists between innovation and compliance in the crypto-verse.

What We Learned from the Journey

For Traders

Don’t believe everything you hear: check the facts before acting on a disturbing headline or viral tweet.

Having different assets will lessen the chance of loss with one coin.

Watch Out For The Trends: Google Trends, hearing the pulse on social, and those cool sentiment analysis dashboards are early warning systems for new trending narratives.

For Developers

Design protocols that won’t collapse under temporary hits to confidence.

It is important to transparently communicate with people. Regular updates during crises can help combat FUD and restore confidence.

For Regulators

It’s important to make sure that regulations are clear in order to limit gambles caused by uncertainty.

Encourage Responsible Innovation: Oversight that strikes the right balance between growth and restraint.

Conclusion

The cryptocurrency markets are engineered and shaped by elements of FOMO and FUD, which produce irrational prices. Traders who know what they are doing can do them profitably, but they can also be risky for the ones who don’t know what they are doing. If we know how psychological aspects work and learn from the past, we can learn a lot from digital assets, which are both volatile and fascinating.