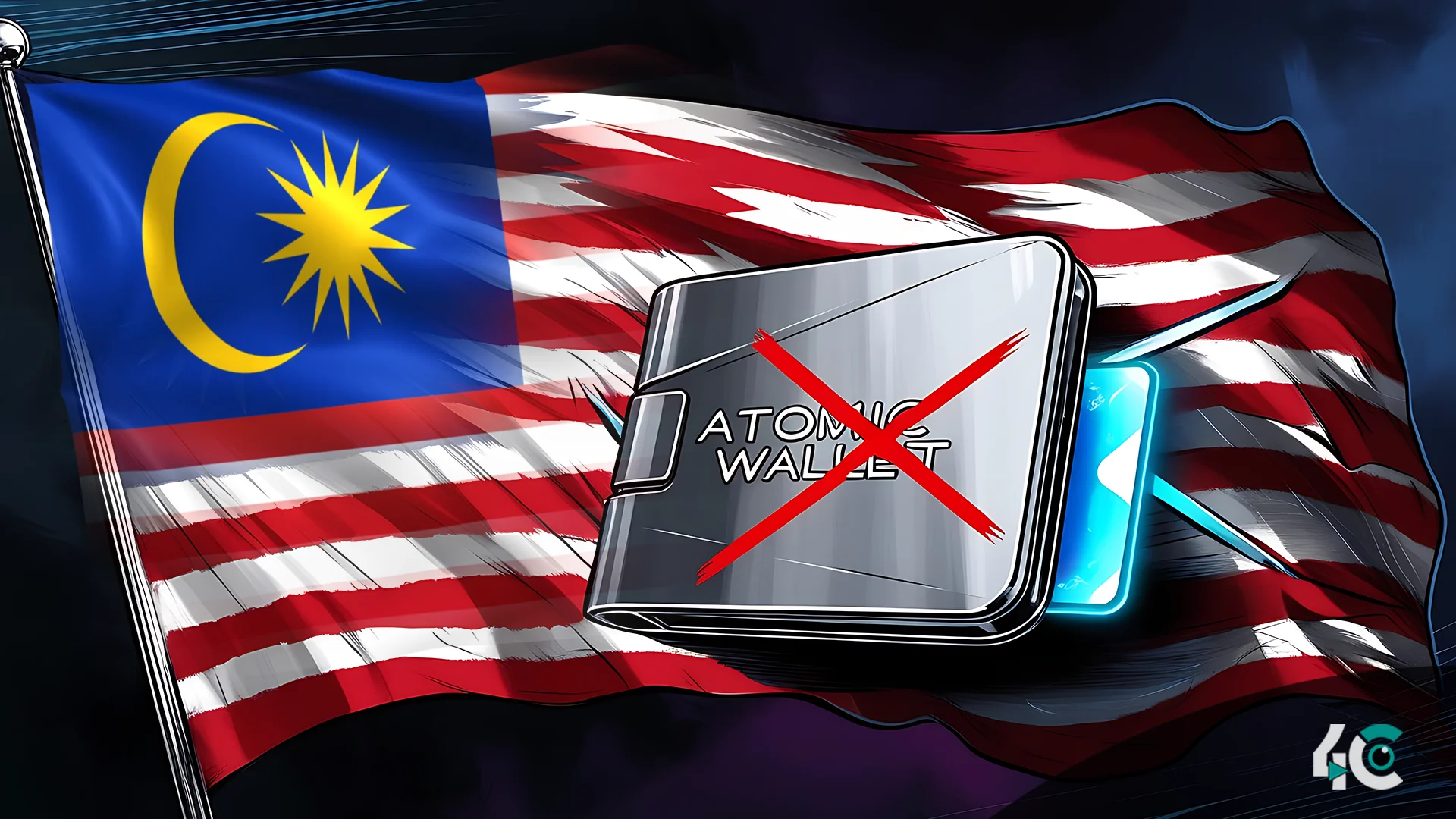

The Malaysian Securities Authority has added Atomic Wallet, a Web3 cryptocurrency wallet service, to its list of illegal financial enterprises. The regulator said that the company was running a digital asset exchange without necessary registration. Over the years, numerous scandals have entangled Atomic Wallet, which provides staking and swapping services for more than 100 digital assets.

In 2023, the wallet provider experienced a catastrophic cybersecurity breach, resulting in damages reaching $100 million. Users harmed by the attack reported losing their whole cryptocurrency investments, and investigations have linked the event to the North Korean hacking outfit Lazarus. The stolen cash was allegedly transferred to a Cambodian cryptocurrency exchange. Due to jurisdictional issues, the United States dismissed a class-action case that some customers had taken.

In reaction to the hack, Atomic Wallet created a $1 million bug bounty program to help uncover and address software vulnerabilities. However, these efforts have not completely restored faith in the platform. The Malaysian regulator’s move to prohibit Atomic Wallet is consistent with broader efforts to crack down on unregistered cryptocurrency firms operating in the country. Other organizations, such as Crypto Trade Malaysia and Best Exchange, have suffered similar sanctions.

The crackdown comes as cyber dangers to the cryptocurrency industry continue to grow. According to reports, losses from scams, hacks, and exploits will increase by 21% in 2024 when compared to the previous year. Centralized exchanges and Web3 wallet private keys have emerged as the top targets for attackers, accounting for roughly half of all crypto assets taken during this time period.

The transition to centralized platforms emphasizes the need for tighter security protocols and regulatory control. As the digital asset environment changes, regulatory initiatives like Malaysia’s serve as a reminder of the growing need for responsibility and safety in the bitcoin ecosystem.