KindlyMD’s Bold Bitcoin Purchase

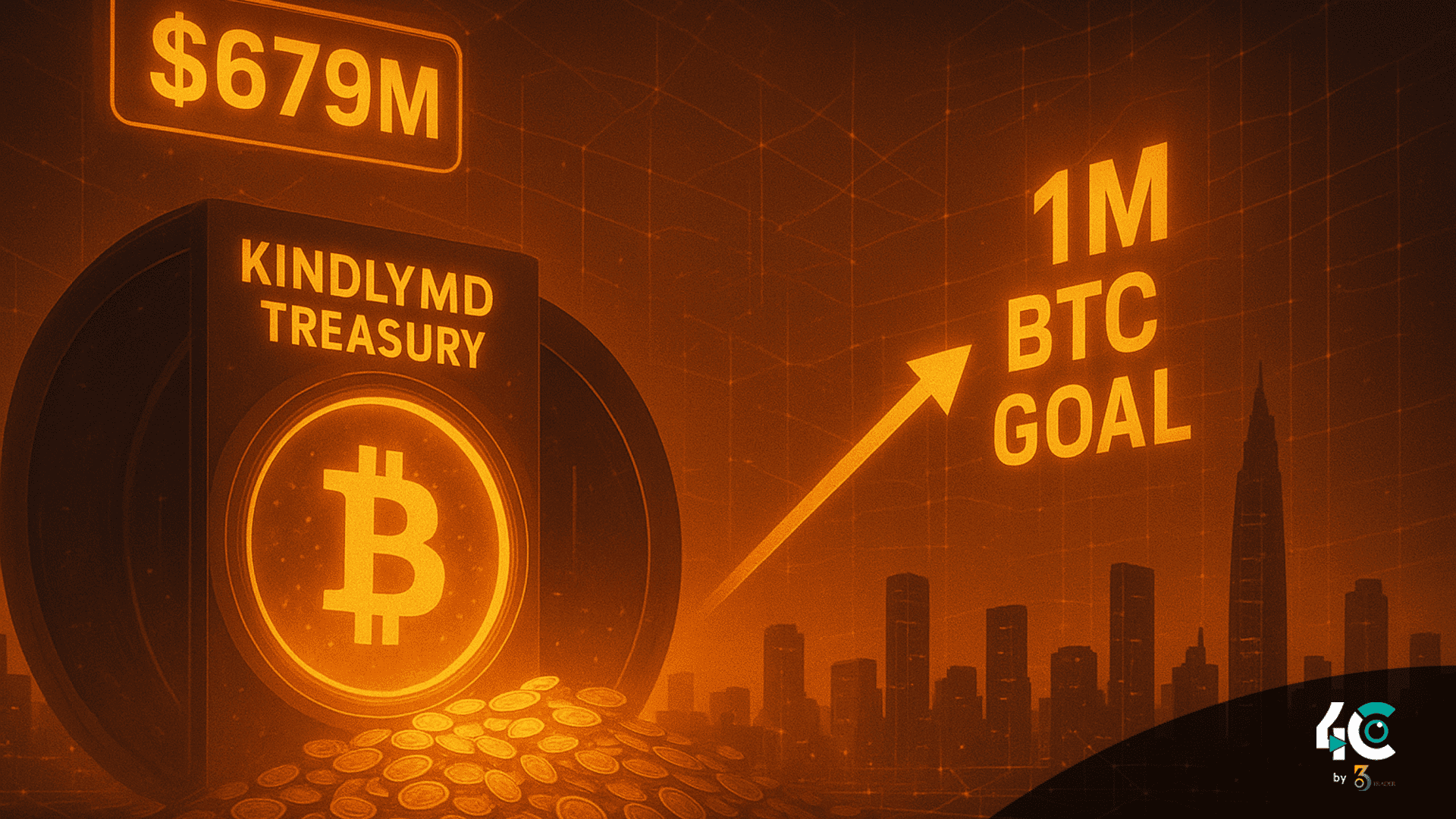

In one of the largest corporate Bitcoin buys of the year, KindlyMD has acquired 5,744 BTC worth $679 million.

The move comes just days after the Nasdaq-listed healthcare provider finalized its merger with Nakamoto Holdings, a Bitcoin entity created by David Bailey, a former Trump crypto adviser.

David Bailey’s Vision for KindlyMD

Bailey, now KindlyMD’s CEO, revealed the company’s bold mission: to acquire 1 million Bitcoin as a corporate reserve, betting on BTC as the “ultimate anchor of global finance.”

“This acquisition reinforces our conviction in Bitcoin as the premier reserve asset for corporations and institutions alike,” Bailey said.

KindlyMD vs MicroStrategy and Market Impact

KindlyMD’s buy dwarfs recent purchases by even Bitcoin giant MicroStrategy, led by Michael Saylor, whose latest acquisition totaled just $51 million.

The purchase was funded through a PIPE deal (Private Investment in Public Equity) and marks the company’s first major move since merging.

Still, markets reacted cautiously — KindlyMD’s stock fell more than 12% since the merger was announced in May.

The Bigger Picture: Bitcoin Adoption by Corporates

Yet, the company joins a growing wave of firms — from Japan’s Metaplanet to U.S. corporates exploring 401(k) Bitcoin allocations — racing to lock in BTC before the next bull cycle.

Analysts at Bitwise suggest such corporate adoption could push Bitcoin beyond $200,000 by 2025, calling it an even bigger catalyst than the ETF approval.

Conclusion

KindlyMD, however, isn’t waiting around — with its $679M buy, the company has officially planted its flag as one of Bitcoin’s newest whales.