Cryptocurrencies challenge what money is. Unlike banknotes or coins, they are not physical and are not issued by any government. Millions of people worldwide, however, have come to trust and value these digital assets, with even greater strength than fiat money. How do personal models help people make sense of crypto as money? How do they square their open volatility, abstractness, and novelty with their beliefs about currency? This article talks about how people think about cryptocurrency. In this most recent article, we will cover the thinking mechanisms of people that make them perceive Bitcoin as money. We will also explore the psychology behind adopting cryptocurrency.

The Cognitive Foundation of Money’s Nature

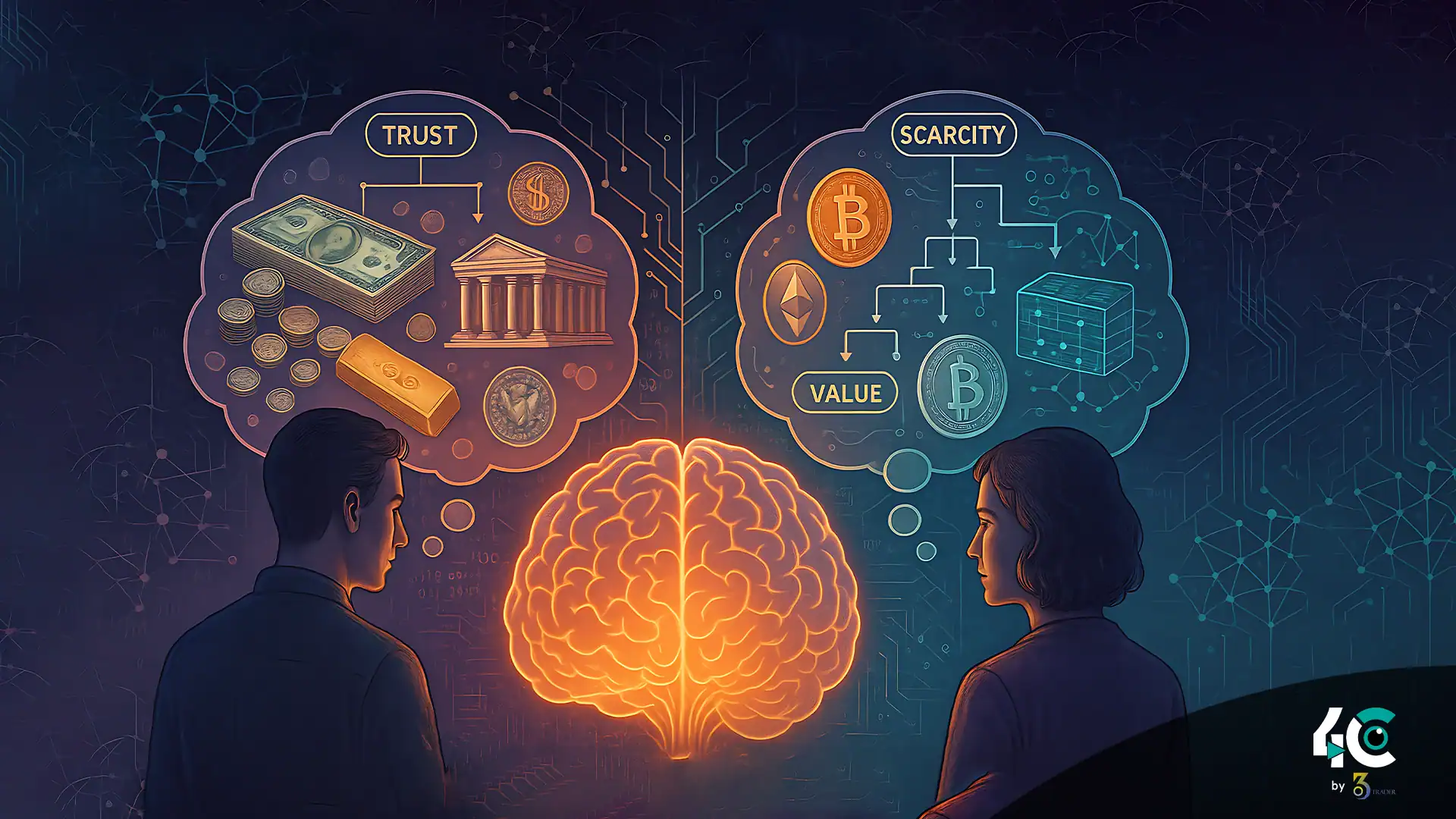

The belief that people can use money gives money its value, rather than its inherent value. Throughout history, humans have had mental shortcuts or mental models to determine what is “real” money. Cultural norms, historical context, and institutional trust shape these models.

Countries with stronger governments and central banks may have a weaker currency but stronger mental models around fiat. Cryptocurrencies challenge these frameworks and compel everyone to develop new paradigms for value in the digital age.

Key Mental Models of Crypto Money

Often users follow one or more thought processes to rationalize their faith in cryptocurrencies.

1. Technological Superiority

Many advocates see cryptocurrencies as technologically superior to fiat because of their decentralization, transparency, and immutability. Key components of this model include:

- They eliminate the reliance on a central authority that may become corrupt or fail

- Through confidence in cryptographic protocols, we can ensure the safety, privacy, and integrity of the financial system. This particularly appeals to people who are skeptical of surveillance.

- The narrative around crypto as the next generation of money fits in well with trends toward digitization.

This model is especially appealing to tech-savvy customers who value functionality over tradition.

2. Scarcity and Inflation Hedge

Many people think that cryptocurrencies do not lose their worth and are a beneficial way to protect oneself from inflation. The set limit on Bitcoin coins is 21 million.

- The comparison of Bitcoin to gold reinforces its image as an asset with scarcity and deflation.

- Demand for financial alternatives that can’t be manipulated is growing in response to critiques of monetary policy.

- Users of crypto perceive their assets as maintaining long-term value and passing on wealth through generations.

This model appeals to the investors who are disappointed by fiat depreciation and economic uncertainty.

3. Community and Ideology

For many people, cryptocurrencies represent more than just an instrument of finance; they embody philosophies of freedom, independence, and power away from the authorities. This mental model emphasizes:

- Trusting networks shows distrust in power structures, aligning with a decentralized ethos

- Many crypto enthusiasts position themselves against “the man” and believe adoption represents an act of rebellion

- Being part of crypto communities makes you feel connected and strengthens your commitment

- Libertarians, anarchists, and others whose philosophies oppose the traditional monetary system are drawn to this framework

4. Speculative Investment

Some take crypto seriously as a philosophy, but others just use it as a speculative game. This model focuses on:

- Traders used to high-volatility, high-reward approaches find appeal in this realm

- Network effects: Early investors believe growing adoption will make prices rise exponentially

- Some people see stories of others becoming millionaires overnight, and they think it will also happen for them

This practical view is mainly found among retail traders who are unconcerned with the underlying idea behind the trade but just want to profit

5. Utility and Functionality

Some users make the case for owning crypto because of things you can do with it. Examples include:

- The worth of the DeFi ecosystem is gaining popularity for multiple investments and potential profits

- NFT ownership: NFTs provide unique possibilities for digital art, gaming, and identity representation

- Cross-border payments: Cryptos help to speed up transactions across borders efficiently and at low cost

Those who seek to offer solutions to problems by adopting such a use-case-focused approach are design utilitarians.

Contrasting Crypto and Fiat Mental Models

Learning how mental models used for crypto differ from traditional money mental models can highlight the challenges and opportunities for mainstream adoption.

Trust Anchors

- Fiat: Authority and trust are based on institutions such as central banks, governments, and regulated intermediaries

- Crypto: Faith in code, algorithms, and independent networks requires the ability to read, write and trust technology

Value Perception

- Fiat money has value due to government backing but is floating and unstable

- Crypto’s value could be due to its scarcity, utility, or a speculative story

Adoption Barriers

People can afford to search for ambitious goals, especially in situations where they cannot avoid failure. Crypto faces adoption hurdles due to complexity, regulatory risks, and image

Psychological Drivers Behind Adoption

There are many psychological factors that determine how people adopt and rationalize cryptocurrency.

1. Comparing Risk Tolerance and Loss Aversion

Investors with different risk profiles evaluate losses against expected returns differently. A large group of people prefer to risk their fiat savings to inflation and play on the volatile crypto-assets in hope of outsized gains.

2. Confirmation Bias

When people invest in crypto, they actively look for information that supports their investment while disregarding what proves otherwise. This helps maintain their chosen mental model.

3. Social Proof

Celebrity endorsements, influencer marketing, and community excitement impact their perceptions, especially new investors seeking validation.

4. Endowment Effect

Most holders value their crypto more than the equivalent amount they’d get in fiat. This is partially due to their attachment to their investment, known as the endowment effect.

Final Thoughts: Bridging Mental Models

To use cryptocurrencies successfully, people must be encouraged to think differently about the money they currently use and the one they will use in the future. User education, regulation, and a better experience will go a long way to help build trust.

In the end, the rise of crypto is a testament to humanity’s evolving relationship with money, one that is driven as much by technology as by the stories we tell ourselves. By learning about these mental models, we understand the reason people choose to believe in and put their money in finance.

Conclusion

People have different reasons for trusting and assigning value to cryptocurrency. This can be attributed to models, some of which include technological superiority, scarcity, and ideology, among others. The frameworks established in these papers sharply contrast with traditional views of fiat money that rely on trust in and familiarity with institutions. Psychological things like losing something, believing any evidence we get, and following others shape our use. For cryptocurrencies to achieve mainstream adoption, we need a way to bridge the cognitive gap between old and new ways of viewing money.