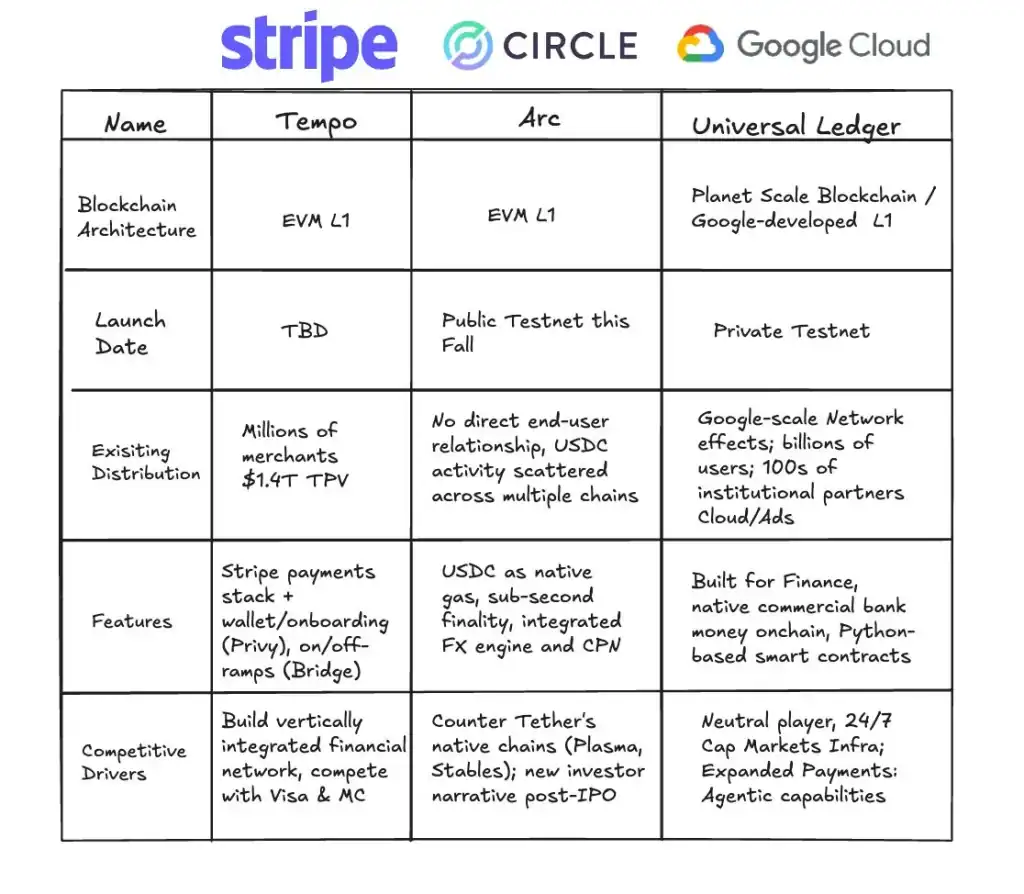

Enter Google‘s bold foray into institutional-grade blockchain: the Google Universal Ledger (GCUL)—a neutral, scalable layer-1 platform built for Python smart contracts and global financial integration (Google Cloud announcement).

Unveiled by Google Cloud’s Web3 head, Rich Widmann, GCUL is the culmination of years of R&D—designed to offer banks and institutions a blockchain without vendor bias.

“Tether won’t use Circle‘s blockchain—and Adyen probably won’t use Stripe‘s blockchain. But any financial institution can build with GCUL,”

Widmann wrote in a LinkedIn post.

In practical terms, GCUL hopes to become the backbone of institutional tokenization. A pilot with CME Group is already underway—testing collateral, margin, and settlement workflows on-chain. Full-scale trials with real market participants are expected before a 2026 public launch (official pilot details).

Also Read: Grayscale Files for the Spot Avalanche ETF as AVAX Prepares to Hit Wall Street

Unlike other blockchains, GCUL supports direct integration of commercial bank money—not token derivatives—meaning money itself lives on-chain. Combined with programmable APIs, this promises efficient, real-time payments with high regulatory standards.

With GCUL, Google is delivering “planet-scale” infrastructure—potentially reshaping how global finance, from collateral to cross-border payments, operates in the blockchain era.