The Problem With Conventional Exit Strategies

Most traders rely on emotion or guesswork when choosing when to sell, resulting in:

- Exiting too early due to volatility

- Missing real market peaks

- Suffering destructive losses when trends reverse

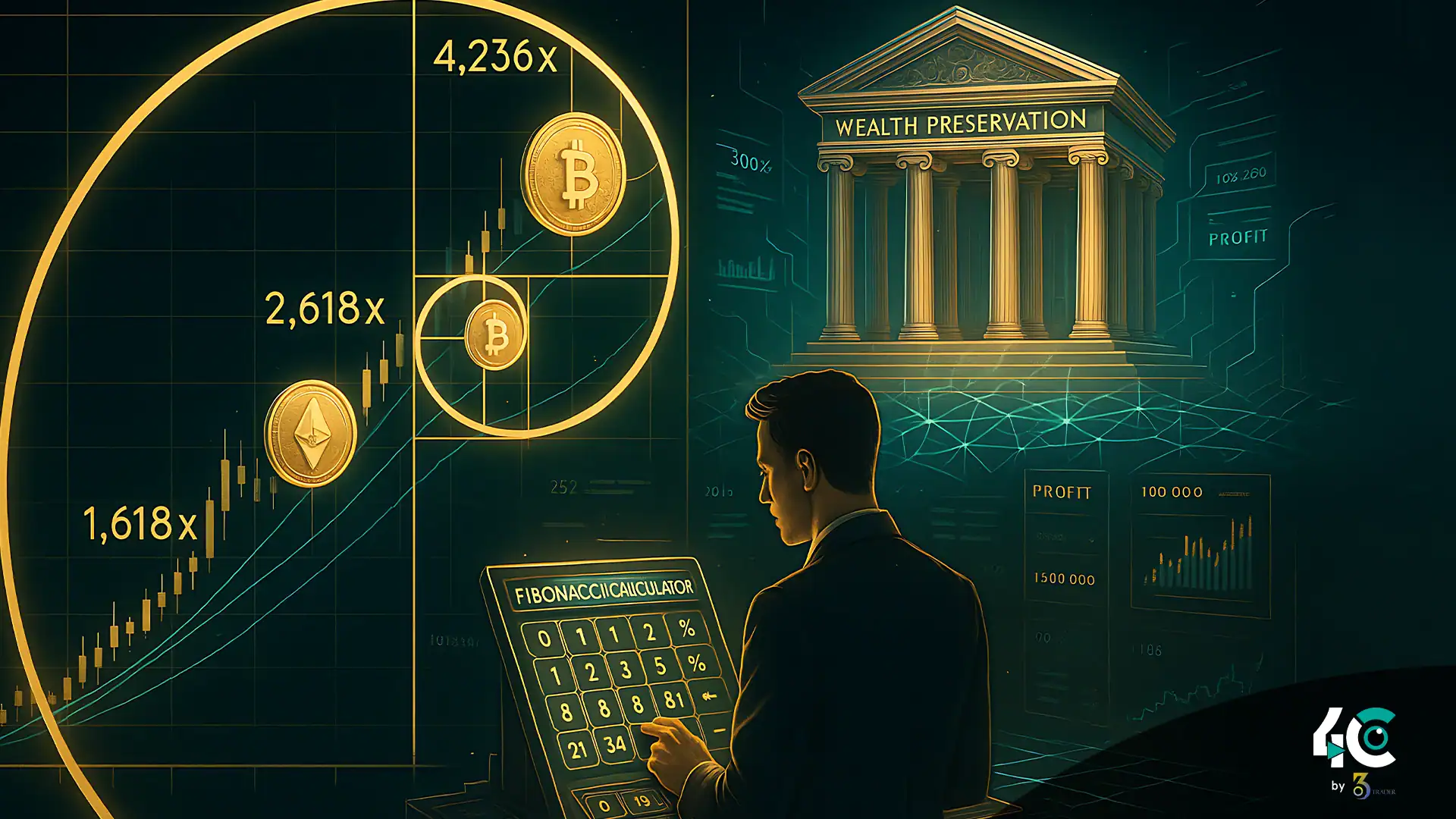

Enter: The Fibonacci extension, built on the Golden Ratio

Provides mathematically significant price targets

Triggers objective sell signals

Adds built-in risk management

How the Golden Ratio Works in Markets

The 1.618 ratio, known as the golden ratio, appears naturally in biology, geometry, and financial markets.

Examples:

- Historical Bitcoin bull market highs

- Parabolic altcoin moves

- Traditional financial assets

Key Properties:

- Acts as a gravitational pull for price

- Marks zones where trends slow or reverse

- Creates high-probability reversal zones

Step-by-Step Execution Guide

1. Identify the Impulse Wave

- Measure the wave from the bear market low to the first major high

- Example: Bitcoin rose from $3,000 in Dec 2018 to $14,000 in June 2019

2. Apply Fibonacci Extensions

- 1.618: Main profit target

- 2.618: Secondary target

- 4.236: Reserved for moonbag (high-risk, high-reward hold)

3. The Golden Exit Protocol

- 25% of position sold at 1.618

- 50% sold between 1.618–2.618

- Remaining 25% sold at 2.618 with trailing stop

Real-World Case Studies

Bitcoin’s 2021 Bull Cycle

- 1.618 target: $58,000

- Actual top: $64,000

- Accuracy: ~3% margin

Ethereum’s 2017 Run

- 1.618 projected: $1,250

- Actual top: $1,400

- Variation: ~12%, confirming pattern relevance

Advanced Tactics

1. Confluence Trading

Combine with:

- RSI over 80

- Exchange reserve depletion

- Futures funding rate over 0.1%

2. Altcoin Multiplier Effect

- High-beta coins often hit 2.618–4.236

- Layer sell targets across your altcoin portfolio

3. Bear Market Preparation

- Re-entry at 0.618 retracement

- Use high-to-low measurements after golden ratio peaks

Conclusion

The Golden Ratio Sell Rule transforms your exit strategy from emotional to mathematical by:

- Removing guesswork

- Aligning with natural market structure

- Offering clear, data-driven profit zones

It’s a favorite among institutions aiming to maximize gains while minimizing drawdowns.