Faraday Future’s High-Stakes Pivot

EV startup Faraday Future is doubling down on crypto as part of a radical strategy to revive its fortunes. The company announced plans to launch a “C10 Treasury” product, starting with a $30 million crypto purchase and potentially scaling up to tens of billions.

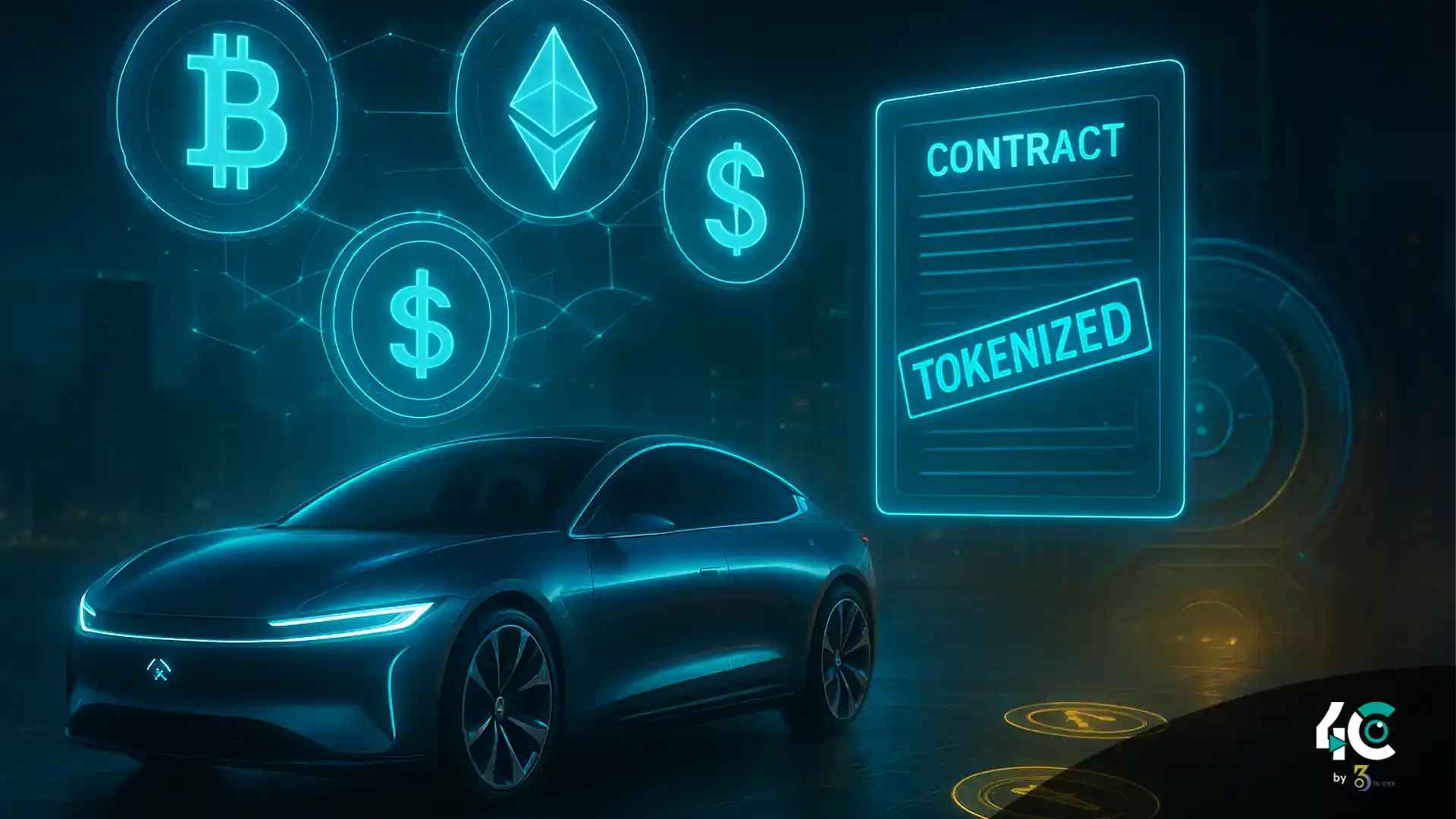

From Cars to Coins

Faraday’s strategy includes:

- Building a crypto index fund (C10 Index) tracking the top 10 assets (excluding stablecoins).

- Exploring the launch of a cryptocurrency ETF.

- Establishing a treasury powered by staking yields to support R&D, buybacks, and asset growth.

- Creating an EAI Vehicle Chain to enable tokenized vehicle sales and crypto deposits.

Co-creation officer Ian Calderon believes crypto could be entering a “super long bull cycle” — and Faraday wants to ride the wave.

A Risky Bet with a Rocky Past

The company’s pivot comes amid years of struggles: stalled production of its flagship Faraday Future FF 91, a canceled Nevada factory, SEC scrutiny of its founder Jia Yueting, and painfully low delivery numbers.

Shares recently slid 7.6% to $2.77, though they’re still up 75% in the past six months. California Treasurer Fiona Ma endorsed the crypto push, calling it a chance to boost jobs, investment, and sustainable growth.

But investors are asking: can a company that has only delivered 16 cars really pull off a multi-billion crypto pivot?