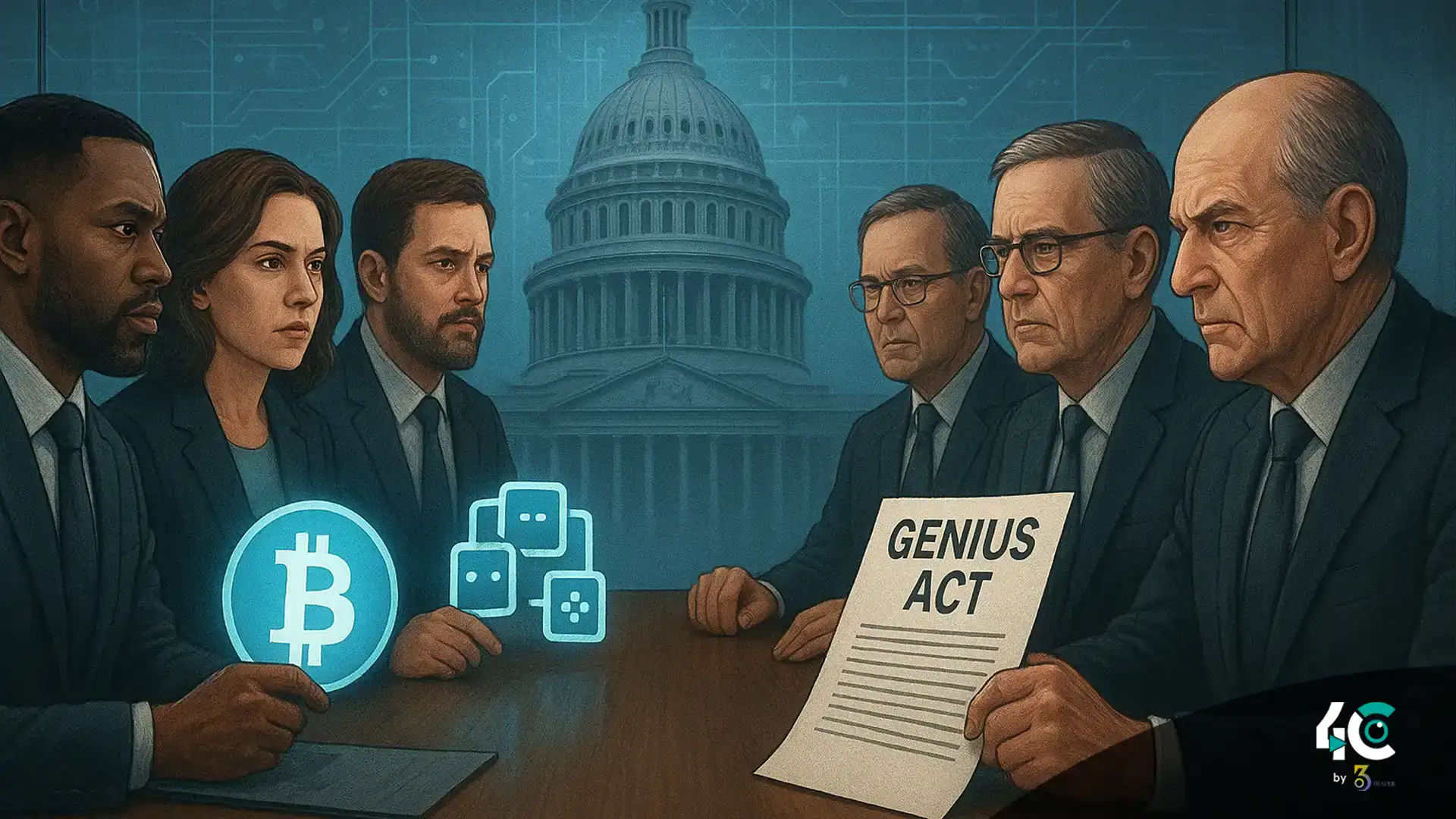

The Battle for the Future of Stablecoins

The fight for the future of stablecoins is heating up — and the crypto industry isn’t backing down.

Two major advocacy organizations — the Crypto Council for Innovation (CCI) and the Blockchain Association — have publicly slammed a lobbying effort by Wall Street banks to amend the United States’ new GENIUS Act, the landmark legislation that set the first clear rules for stablecoins.

Accusations Against the Banking Lobby

In a letter to the Senate Banking Committee, the groups accused the American Bankers Association (ABA) and other banking lobbies of trying to twist the law to their advantage.

At the heart of the controversy is what banks are calling a “yield loophole,” which they argue allows stablecoin issuers and their affiliates to indirectly pay yields — making stablecoins too competitive with traditional savings accounts.

Crypto advocates, however, see the move as a power grab designed to strangle innovation.

“Payment stablecoins are not bank deposits, or money market funds, or investment products,” the letter said. “Unlike bank deposits, payment stablecoins are not used to fund loans.”

The Fight Over Section 16(d)

The crypto groups also pushed back against efforts to repeal Section 16(d) of the law, which allows state-chartered subsidiaries to conduct stablecoin business across state lines without additional licensing.

Removing it, they warned, would recreate the fragmented system the GENIUS Act was meant to fix.

Data Doesn’t Support Bank Claims

Adding weight to their argument, the groups cited research showing no significant link between stablecoin growth and outflows from traditional banks — despite bankers’ claims of a potential $6.6 trillion liquidity drain.

Yield-Bearing Stablecoins Are Booming

Meanwhile, the yield-bearing stablecoin market is thriving. Platforms like Ethena Staked USDe, Securitize’s BUIDL, and Sky Ecosystem’s staked USDe have collectively paid out over $800 million to holders, proving there’s strong demand and utility.

With the stablecoin market now valued at $288 billion — still a fraction of the $22 trillion U.S. money supply — crypto leaders argue that clamping down now would be a major setback for innovation and global competitiveness.

What This Means for the Future

This brewing showdown between the banking establishment and crypto innovators could shape the trajectory of digital finance in the U.S. for years to come.