Crypto Never Sleeps—But You Should

The crypto market runs 24/7, and with it comes a non-stop stream of price swings, hype, and panic. This high-pressure environment is creating what’s now being called “crypto burnout.” Traders find themselves stuck in a loop of checking charts, reacting to breaking news, and stressing over portfolio shifts—day and night.

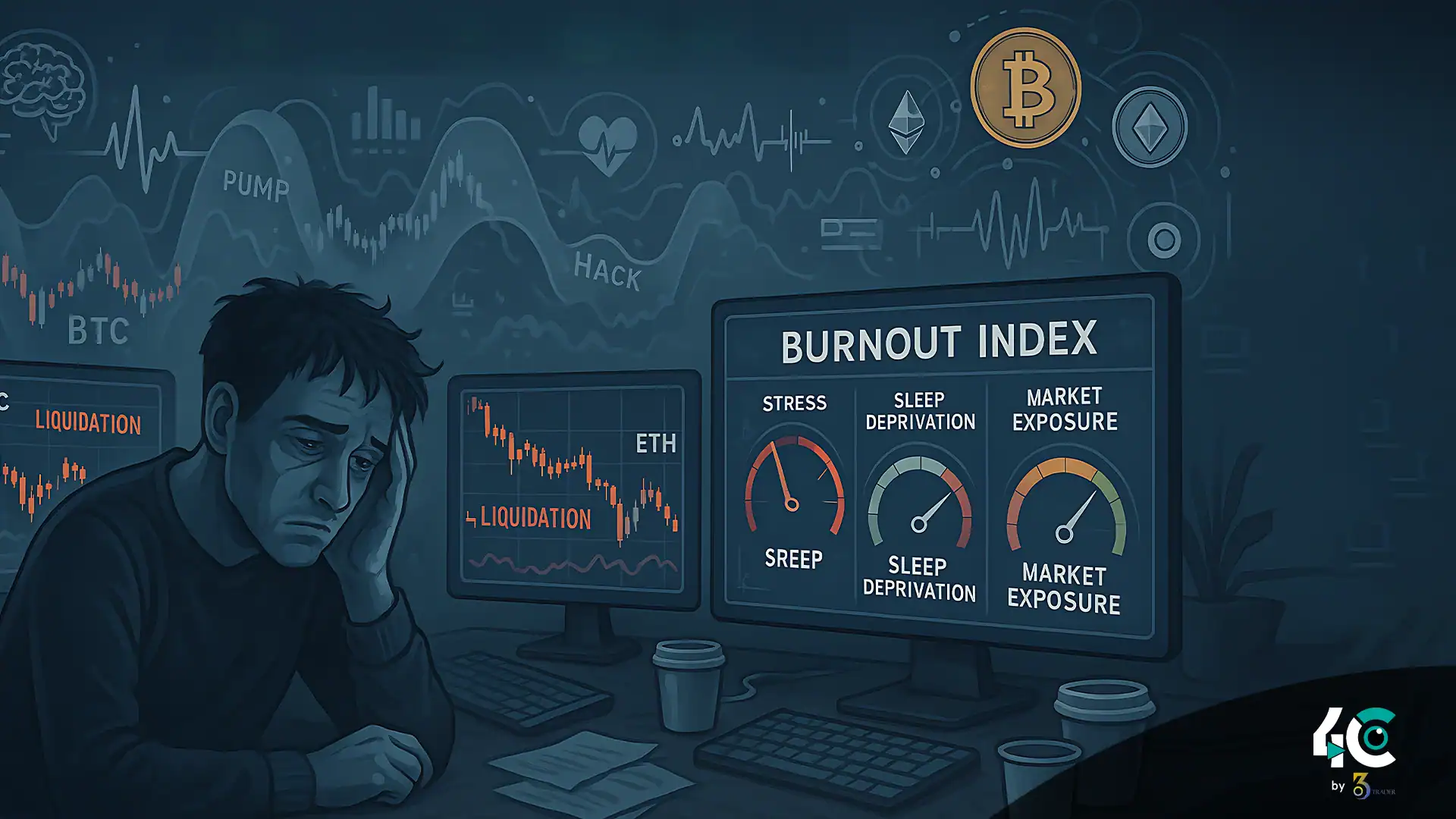

To tackle this rising problem, we introduce the Burnout Index, a framework designed to measure the emotional strain that crypto traders face due to market volatility, social pressure, and lack of rest. This tool can help traders identify when they’re at risk and take steps to recover.

Why Crypto Burnout Is Different

Unlike traditional markets, crypto trading happens all the time—without weekends or holidays. Here’s why that leads to more intense burnout:

- Extreme price swings: Coins can lose or gain 50% in hours. Traders stay glued to screens.

- Always-on culture: Twitter, Telegram, and Reddit amplify hype and fear (FOMO/FUD).

- Personal financial pressure: Many invest large savings, making losses feel devastating.

- Uncertainty & regulation: News about crypto regulation or crackdowns causes anxiety with no downtime.

This mix creates the perfect storm of emotional exhaustion.

What Is the Burnout Index?

The Burnout Index helps quantify emotional fatigue by combining behavioral, psychological, and environmental data. It’s a self-assessment tool and awareness guide for individuals and platforms alike.

1. Behavioral Metrics

Screen Time:

- < 4 hrs/day = Low risk

- 4–8 hrs/day = Moderate risk

- 8 hrs/day = High risk

Sleep Disruption:

Poor sleep due to night trading or stress.

Signs: late nights, interrupted rest, reliance on caffeine.

2. Psychological Indicators

Stress Levels:

Self-rated on a 1–10 scale.

High levels suggest emotional overload.

Decision Fatigue:

Feeling paralyzed by too many choices or second-guessing decisions.

3. Environmental Triggers

Market Conditions:

Long bear markets and high volatility increase mental fatigue.

Social Influence:

Toxic online communities pushing unrealistic gains can worsen pressure.

4. Recovery Practices

Downtime Activities:

Hobbies, workouts, and offline breaks lower burnout risk.

Support Systems:

Talking with friends, family, or mental health professionals matters.

Case Study: Alex, a Burned-Out Trader

Let’s see how this applies to “Alex,” a fictional crypto investor:

- Behavioral: Spends 10+ hours daily on charts and Twitter; sleeps 5 hours max.

- Psychological: Self-reported stress at 9/10. Feels overwhelmed by trading options.

- Environmental: Bear market frustration. Exposed to unrealistic hype from influencers.

- Recovery: No breaks. Last vacation? Over a year ago. No support system.

Alex’s Burnout Score: HIGH. He needs immediate intervention before it impacts long-term health.

How to Prevent or Recover from Burnout

For Traders:

- Set screen limits.

Don’t check charts constantly. Use stop-loss orders and trading bots. - Build routines.

Meditation, breathing exercises, and regular breaks can help. - Stay balanced.

Schedule time for hobbies and get 7–8 hours of sleep.

For Communities:

- Encourage wellness talks.

Normalize discussions around mental health. - Moderate toxic content.

Limit hype-driven or aggressive posts.

For Platforms:

- Add wellness features.

Reminders to log off, stress self-checks, and educational content. - Promote healthy trading.

Highlight emotional risks alongside financial ones.

Conclusion: Prioritizing Mental Health in Crypto

The Burnout Index reminds us that success in crypto isn’t just about profits—it’s about sustainability. Emotional health must be taken seriously if traders are to thrive in this space.

As market volatility continues, both individuals and the broader ecosystem must adopt habits and tools that promote mental resilience. In the end, the goal is not just to survive the market—but to stay well while doing so.