The Looming Contagion Risk

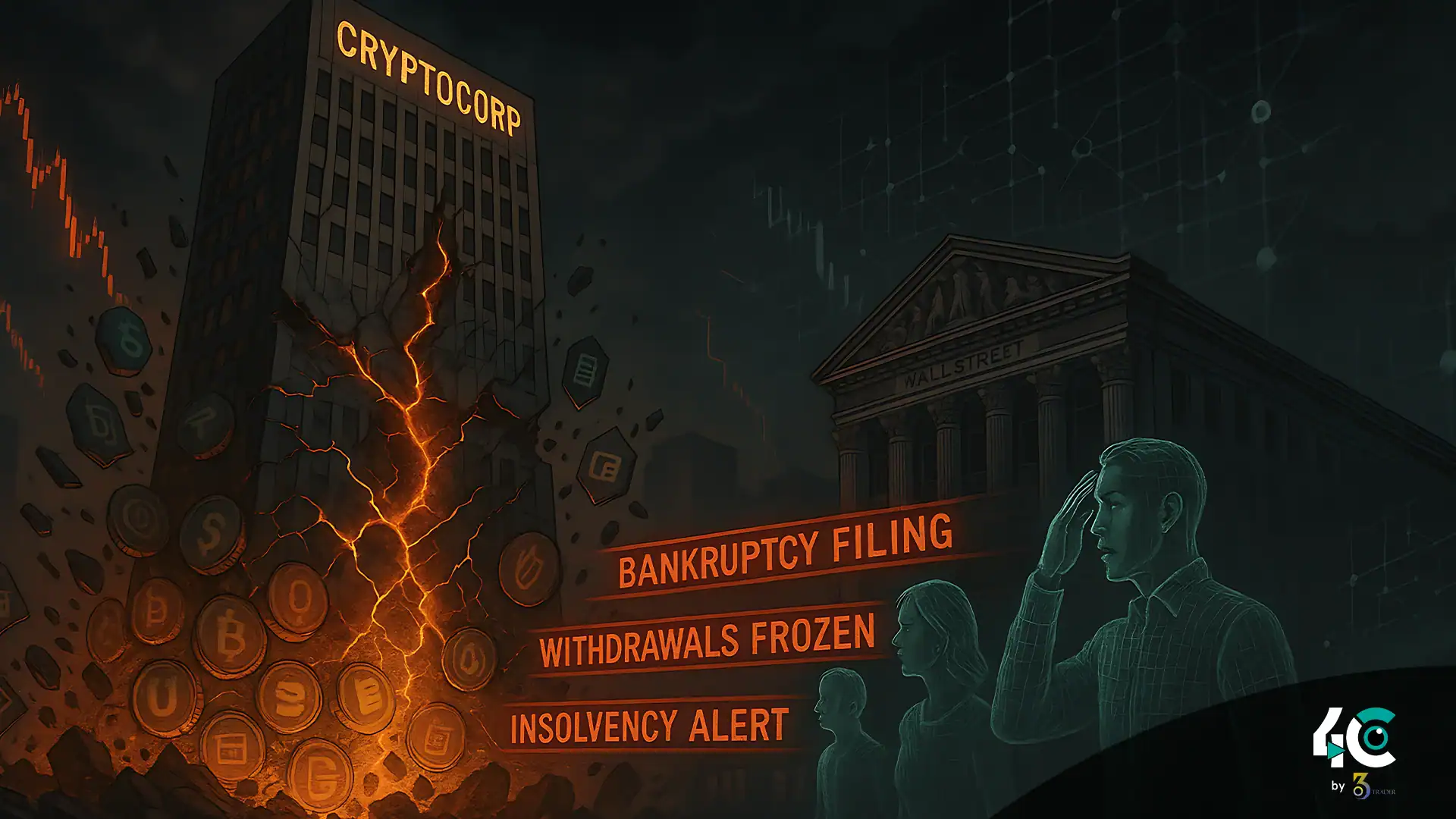

The fall of Lehman Brothers in 2008 triggered a global financial crisis. Crypto may now be one crisis away from a similar Lehman-style meltdown.

- Overleveraged institutions quietly hiding insolvency

- Web of dependencies between exchanges, lenders, and hedge funds

- Illusions of liquidity that collapse during panic

This house of cards won’t fall alone—it could drag the entire market down with it.

Three Crypto Contenders for Lehman-Style Collapse

1. A Major Exchange on the Brink

“Fake volume, fractional reserves, and hidden debt—sound familiar?”

Rumors swirl about insolvency at top-10 exchanges.

- If one fails, withdrawal freezes will ripple across the industry.

- Trust evaporates, sparking massive outflows and systemic stress.

2. A Shadowy Hedge Fund Overexposed to Derivatives

- Secret 100x leverage on crypto derivatives

- One liquidation could trigger a chain reaction of forced selling

Think back to Three Arrows Capital (3AC)—the next version could be even bigger.

3. A Stablecoin or Banking Protocol Collapse

One major stablecoin failure could inject over $10 billion in contagion risk.

Warning Signs of Imminent Collapse

- CEOs resigning “for personal reasons”

- Delayed audits or withheld financial disclosures

- Slowed withdrawals amid high demand

- Unrealistically high yield promotions hinting at Ponzi-like behavior

How the Crisis Would Unfold

- A major player halts withdrawals

- Counterparties get exposed—dominoes start falling

- Stablecoins lose peg as panic spreads

- Exchanges freeze trading

- Regulators rush in for strict enforcement and control

How to Prepare (Before the Storm Hits)

- Move crypto assets off exchanges into cold storage

- Diversify across multiple stablecoins—don’t rely only on USDT or USDC

- Use Bitcoin (BTC) and Ethereum (ETH) as safe havens

- Know your fiat off-ramps and set exit plans in advance

The Hard Truth

The crypto space still hasn’t addressed what caused the downfalls of FTX, Celsius, and 3AC.

- Greed

- Leverage

- Lack of transparency

Only those who prepare early will survive the next collapse.