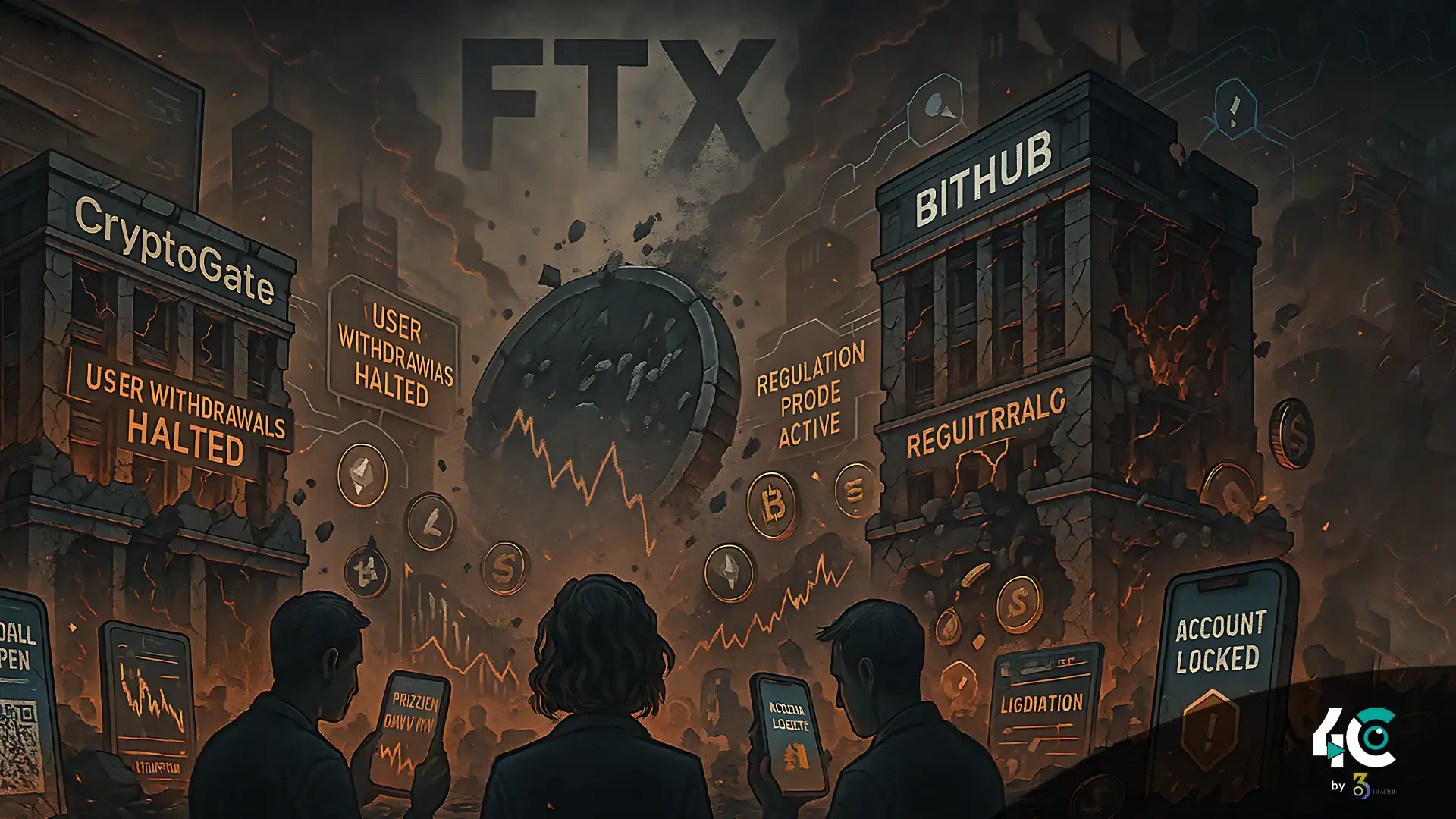

The FTX Playbook: Exchanges That Go Down in Flames

History doesn’t repeat, but it rhymes. Before FTX went down, there was a warning sign—the same as these exchanges are now.

- There’s a mysterious proof of reserves that has no real audits.

- CEOs selling off their own tokens.

- Withdrawals become delayed. “Maintenance” is used as an excuse.

Here are the 3 most vulnerable exchanges, and why you should be concerned

1. Positive Yield from an Exchange Is a Warning Sign

Why It’s Dangerous

- Development to enable Layer 2 stablecoin interactions has been commenced by the creator.

- No licensed auditors—only “self-reported” reserves.

- Insiders cashing out—team wallets dumping native token.

Red Flags

- Withdrawals may sometimes take over 72 hours.

- Not sure where yield comes from?

- Related to collapsed hedge funds.

Outcome: You will either see a slow-motion bank run or a “hack” exit scam.

2. The Zombie Exchange Is Still Walking

Why It’s Dangerous

- Trading volumes have dropped by 80% since the start of 2023.

- Already seeing layoffs and office closures (but still operating).

- SEC subpoenas leaked—investigation underway.

Red Flags

- Removing top cryptos for compliance.

- The CEO hasn’t done an AMA in over a year.

- You can still deposit, but no withdrawals.

Outcome: A slow death spiral, then frozen withdrawals.

3. Exchange Z: The Offshore Casino with Fake Liquidity

Why It’s Dangerous

- Based in a zero-regulation jurisdiction.

- Authentication-type verification by the registrant can reduce wash trading.

- No KYC—until you try to withdraw.

Red Flags

- Ads on X (Twitter) offering an “Elon Musk giveaway”.

- No real customer support, just bots.

- Every project by the CEO has rugged.

- The website will likely stop loading one day.

How to Protect Yourself

- Take your money out now if you are using any of these exchanges.

- Whenever possible, use decentralized exchanges (DEXs).

- Check the statistics of exchanges, their withdrawal speeds, their GeckoTrust score, etc.

- Ensure you don’t leave behind excess money on a centralized exchange.

Conclusion

No exchange is too large to face failure! FTX taught us. Here are some warning signs to watch out for so you can act before the “liquidity issues” start.