Cryptocurrency’s Behavioral Biases and Market Impact

Cryptocurrency is an area of finance that is much faster than any other. Information spreads rapidly via social media and decentralized networks. As a result, many behavioral biases influence this space, affecting crypto market trends.

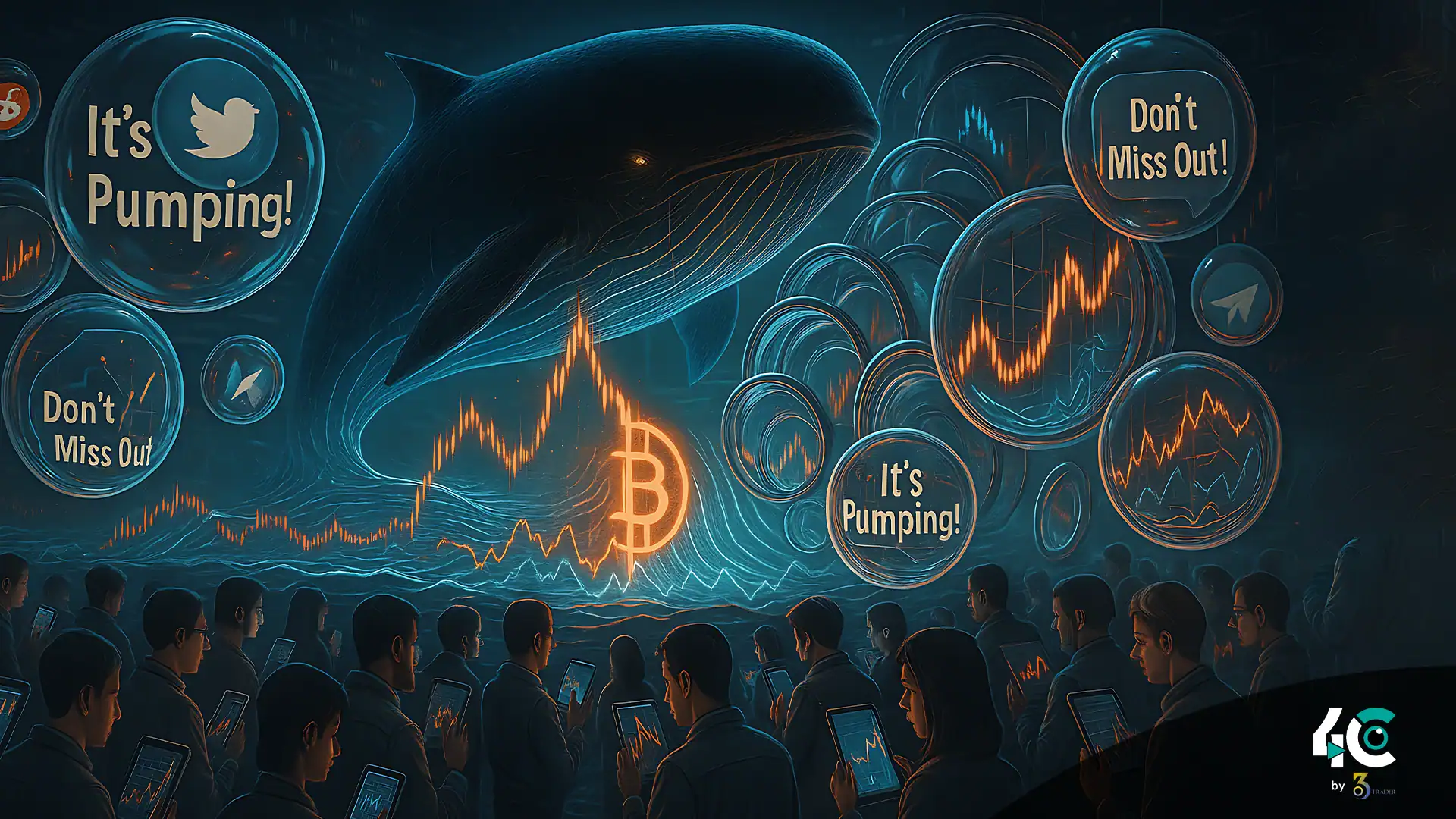

Retail investors are often inexperienced and emotional, easily swayed by echo chambers and the ultra-rich “whales.” These forces produce feedback loops that amplify price swings and herd behavior. This article explores how echo chambers on Twitter and Telegram, combined with whales’ market power, create speculative frenzy and lure in retail investors.

The Anatomy of Echo Chambers in Crypto

Social media is the heartbeat of crypto culture. It’s where people get news and form collective sentiment. But these platforms are filled with echo chambers—spaces where users reinforce similar beliefs without encountering opposing views.

How Echo Chambers Form

Social media algorithms often promote sensational or misleading content. Members of a crypto community cluster around coins like Bitcoin or Shiba Inu, becoming ideological maximalists.

- FOMO (Fear of Missing Out): When peers and influencers hype a token, questioning its legitimacy becomes difficult.

Consequences of Echo Chambers

Rumors and unverified claims gain traction, leading to irrational exuberance. A single tweet can spark a buying frenzy.

Critical voices are drowned out, and everyone changes their minds simultaneously, causing dramatic price shifts unanchored from fundamentals.

Whales: The Invisible Puppet Masters

Whales—wealthy individuals or entities—hold immense power in crypto markets due to their ability to trade vast sums. Combined with social media influence, this misleads retail investors.

Whale Tactics That Influence Markets

- Pump and dump: Whales accumulate tokens silently, spark social media hype, then sell off at a profit as retail investors buy in.

- Market manipulation: Massive buy/sell orders create illusions of scarcity or oversupply.

- Information leaks: Strategically releasing details online can manipulate perception.

The Phenomenon of Dogecoin: A Case Study

In 2021, Elon Musk—a whale-like figure—posted memes and endorsements of Dogecoin on Twitter. The coin surged over 12,000%, amplified by communities like r/WallStreetBets. Early investors profited while latecomers incurred losses. It showcased how whales and echo chambers can fuel unsustainable rallies.

Behavioral Biases at Play

Investor decisions are often driven by cognitive biases. Whales and echo chambers exploit these, compounding retail investor challenges.

Herd Behavior

Humans follow crowds, especially in uncertain conditions. Seeing others invest in a coin often prompts copycat behavior, regardless of value.

Confirmation Bias

Investors seek out data that supports their views while ignoring contrary evidence—amplified inside echo chambers.

Anchoring Effect

Investors fixate on an asset’s previous high price, creating unrealistic expectations during downturns.

Loss Aversion

People fear missing out more than losses, triggering impulsive decisions guided more by emotion than logic.

The Reinforcement of Echo Chambers and Whales Through Feedback Loops

Together, social media bubbles and whale activity create cycles that distort reality, spread misinformation, and destabilize markets.

Phase 1: Initial Hype

A whale selects a token and hints at potential through cryptic online messages.

Phase 2: Viral Spread

Influencers amplify the hype. Optimism saturates echo chambers.

Phase 3: Price Surge

Retail investors flood in, inflating prices. Whales sell at the peak.

Phase 4: Collapse

With no real demand, the price crashes. Retail investors suffer, and whales profit.

This loop occurs repeatedly across countless crypto projects, fostering instability and distrust.

Mitigating the Impact of Echo Chambers and Whales

Retail investors, platforms, and regulators all have roles in reducing harmful trends.

For Individuals

- Diversify your information sources: look beyond social media to technical charts, analyst reports, and whitepapers.

- Validate project claims with actual performance or development updates.

- Be patient—resist FOMO and stick to your goals.

For Platforms

- Exchanges should disclose large trades to highlight potential pump-and-dump schemes.

- Social platforms must flag misinformation and curb algorithmic promotion of conspiracies.

For Regulators

- Crack down on spoofing and wash trading.

- Launch investor education programs on cognitive biases and safe investment practices.

Final Thoughts: Breaking the Cycle

The fusion of echo chambers and whale-driven manipulation reveals a key crypto market dilemma—decentralization without accountability. Social media democratizes information access, but also amplifies misinformation, putting retail investors at risk.

Breaking this cycle demands collective action:

- Investors need critical thinking.

- Platforms must uphold transparency.

- Regulators should enforce rules.

Crypto’s fragility stems from repeated cycles of hype and crash. Only by promoting clarity, caution, and credibility can the ecosystem mature sustainably.

Conclusion

The retail investor’s crypto experience is distorted by social media echo chambers and the actions of ultra-rich whales, who create self-reinforcing feedback loops that exacerbate irrational behavior. Cognitive biases—like herd mentality or confirmation bias—are exploited to drive hype cycles and volatility. Retail investors should diversify their sources, resist FOMO, and verify unsubstantiated claims. Platforms and regulators must promote transparency, combat misinformation, and ensure accountability. Disrupting these cycles is essential to building trust in the crypto market.