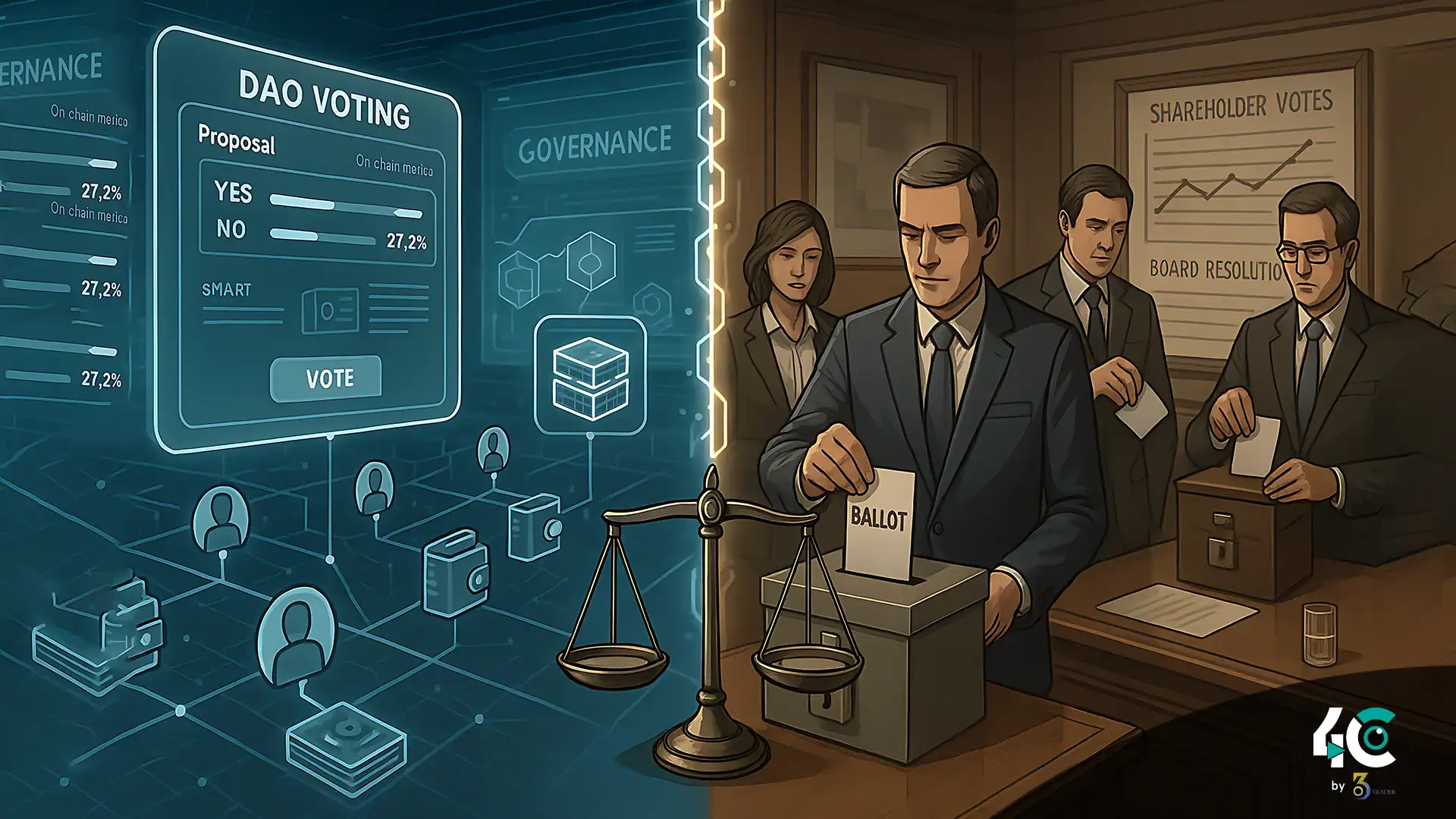

Governance Blockchain Foundations Vs Corporate Foundations

Shareholders cast votes at yearly gatherings or special resolutions, corporate governance conventionally occurs by centralized hierarchies. The people with the most shares are the most appropriate people to have the most power.

DAOs govern themselves with an on-chain voting system that is built on either smart contracts. This refers to a process in which the participants vote with tokens, and this is typically weighted by the number of tokens that each has, though the weighting may be altered via quadratic voting or other reputation-based means. Tokens are being used to do the process anywhere in the world irrespective of the person because it is transparent, cannot be changed, and is easily accessible to everyone.

Although both approaches are intended to facilitate collective choices, they are in fact quite different in their structure, ease of access, and implementation mechanisms.

Key Features of Blockchain-Based Voting

- Votes and results are stored on the blockchain for easy audits and tamper-proofing.

- On-chain voting allows global participation without intermediaries.

- Proposals are quickly advanced, debated, and resolved within a few days or weeks.

- Smart contracts can enable quadratic, conviction voting, or time-locked delegation voting systems.

But, challenges remain to overcome: these are low voting turnout, risk of concentration with large token holders, technical hurdles for non-techies, etc.

Strengths and Weaknesses of Corporate Voting

Strengths

- There is a wealth of case law, with decades of history, dealing with corporate governance matters.

- The boards and top executives are the stewards to ensure continuity and provide expertise.

- Centralized control minimizes the danger of chaos.

Weaknesses

- There are many things that hide accountability like proxy voting processes.

- Shareholders usually have a hard time exercising their rights due to cumbersome processes.

- Pressure to deliver quarterly earnings may detract from long-term strategy.

Examining DAO and Corporate Voting on Case Study

MakerDAO

MakerDAO manages its protocol through governance.

MakerDAO uses on-chain voting. It is a popular decentralized finance (DeFi) protocol that controls DAI. Token holders voted on proposals for collateral types, interest rates, and risk parameters.

Advantages

- Experiencing transparency in the decision-making process means that all the stakeholders know how the decision was taken and its process.

- Quick iteration helps respond to changes in the market.

Challenges

- People with many tokens can affect things.

- Low voter turnout weakens the legitimacy of the party. Many participants have tokens and do not vote.

Tesla Stockholder Vote: A Case Study

Tesla has normal corporate governance policies, in which every year shareholders vote on issues relating to executive compensation board.

Advantages

- Legal frameworks ensure binding decisions.

- Institutional investors engage closely, thereby shaping strategy.

Challenges

- Retail investors find it hard to utilize proxy services and comply with the deadlines.

- It’s unclear how the conversion of votes into actions happen. For this reason, many are sceptical about effectiveness.

Could Blockchain Reform Real-World Governance?

If blockchain-based governance meets current governance pain points, it could impact mainstream governance.

1. Enhancing Transparency

With on-chain voting, the actions are recorded permanently, removing all ambiguity. It could solve public scepticism related to corporate elections.

2. Increasing Accessibility

Due to the fact that blockchain systems allow anyone to participate from any place in the world, they democratize governance unlike shareholder meetings.

3. Encouraging Innovation

Voters can try new voting methods through smart contracts. For example, rich people’s influence is curbed by quadratic voting and liquid democracy delegates power to voters.

4. Reducing Costs

Corporations can cut their operating costs with the elimination of middlemen such as proxy advisors and registrars.

Adoption Faces Numerous Challenges

Using blockchain to enhance or replace governance isn’t going to work out.

- Legal Frameworks: Adoption problems emerge due to the inadequacy of development of legal frameworks for digital voting.

- Technical Problems: Many users are not familiar with the blockchain tools thus there is friction.

- Centralization Risks: If a small quantity of individuals holds large concentrations of tokens, DAOs may nonetheless show the same inequalities as firms.

- Security Issues: Hacks and exploits aimed at smart contracts undermine trust in on-chain systems and threaten their very existence.

Hybrid Models: Bridging the Gap

It is possible for hybrid models to enrich conventional governance through blockchain, rather than replacing it.

- By keeping these votes on the blockchain, corporations can improve transparency and stay compliant with the law through proxy voting on blockchain.

- Tokenized shares make voting and dividend payments easy to create on the chains.

- Governments and businesses can carry out pilot programs for blockchain voting in low-risk situations.

Estonia’s e-residency program is already a reality and so is blockchain-based voting in Zug, Switzerland.

Final Words: A Blueprint for What’s Ahead

Here is a paraphrased version of the sentence that you provided:

Blockchain-based governance might replace traditional corporate voting. It may take time for full adoption, but piece-meal implementation of blockchain components could offer efficiencies in real-world governance use.

The trials of DAOs with distributed decision making can provide insights on reforming. Blockchain & governance can facilitate a hybrid or wholesale transformation of the way society organizes and decides.

Conclusion

Blockchain-based voting that is used by DAOs is more transparent, accessible, and flexible than standard corporate voting. Nevertheless, issues such as low voter turnout, centralisation risk and regulatory uncertainty do exist.