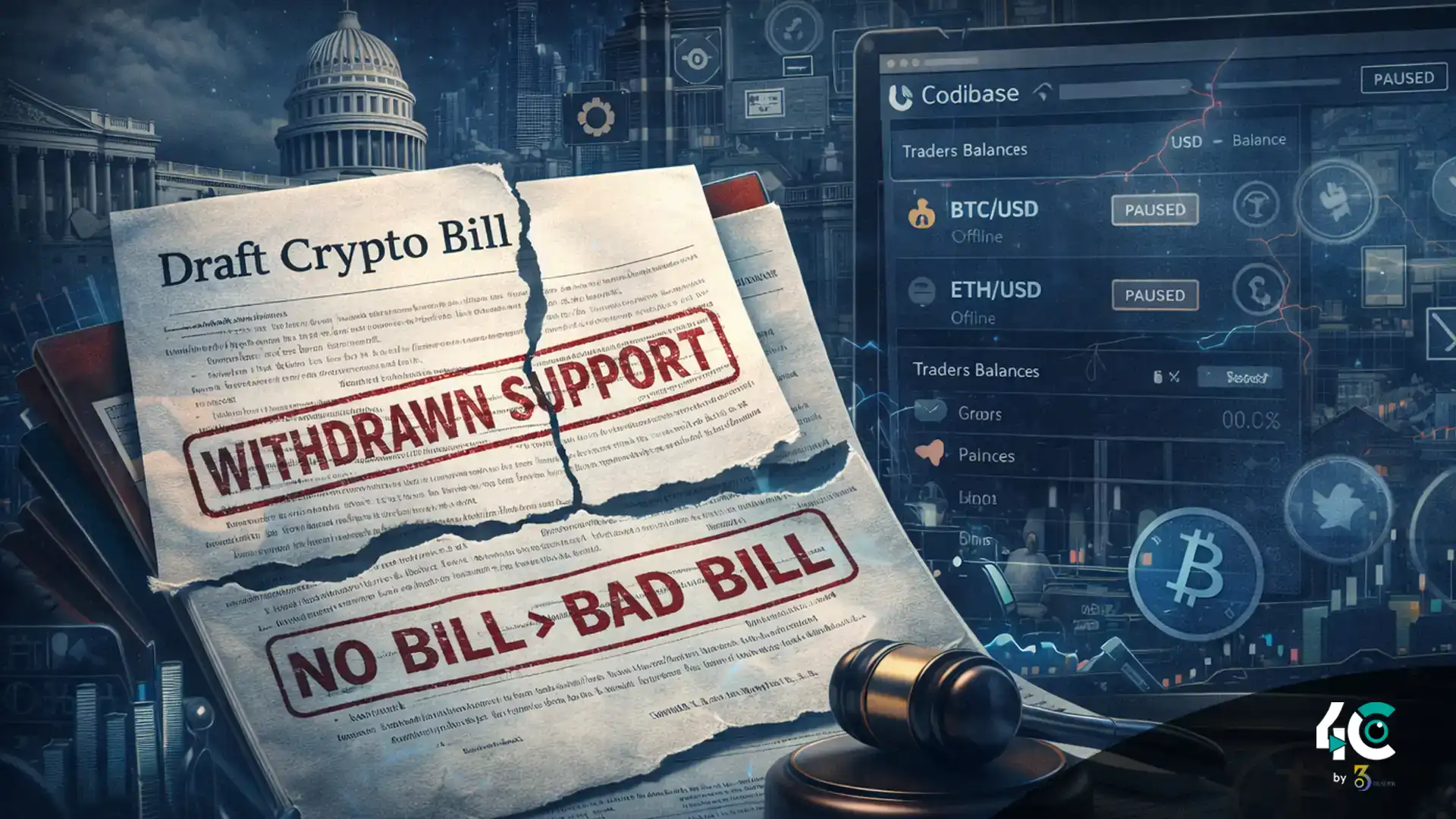

Coinbase Sounds Alarm on CLARITY Act: ‘No Bill is Better Than a Bad Bill’

Major U.S. cryptocurrency exchange Coinbase has publicly withdrawn its backing for the Digital Asset Market CLARITY Act, warning that the current draft could harm the crypto ecosystem rather than help it. CEO Brian Armstrong criticized the legislation on X, stating the bill is “materially worse than the current status quo” and that “we’d rather have no bill than a bad bill.”

Armstrong explained that after reviewing the Senate Banking draft over the past 48 hours, Coinbase could not support it in its present form, urging lawmakers to work toward a revised version that balances innovation and consumer protection.

Key Concerns Highlighted by Coinbase Leadership

Armstrong and Coinbase’s team raised multiple red flags about the CLARITY Act draft:

- Tokenized Equity Restrictions: The bill could effectively ban tokenized securities, limiting market innovation.

- Decentralized Finance (DeFi) Limits: Sweeping rules could curtail DeFi development, undermining a fast-growing sector.

- Privacy Risks: The legislation may grant regulators “unlimited access” to financial records, raising significant consumer privacy concerns.

- Regulatory Power Shifts: The draft could reduce the role of the CFTC while expanding the SEC authority—alarming given the SEC’s aggressive enforcement approach.

- Stablecoin Yields: The proposal could “kill rewards” on stablecoins, protecting banks from competition and potentially preventing users from earning risk-free yields.

Armstrong emphasized that these provisions could slow adoption and stifle innovation, arguing that stablecoins and crypto adoption must remain frictionless to benefit consumers.

Also Read : US Crypto ETFs Defy Market Slump as Investors Pour $31.7B Into Digital Assets in 2025

Industry Reactions Are Mixed but Hopeful

While some analysts, like ETF specialist James Seyffart, expressed concern over Coinbase’s withdrawal—calling the bill necessary for establishing a crypto market structure—other industry leaders remain cautiously optimistic.

Coinbase Chief Policy Officer Faryar Shirzad noted that bank lobbyists are influential in Congress but stressed that protecting consumer interests requires minimizing barriers to stablecoin and crypto adoption.

Ripple CEO Brad Garlinghouse also expressed hope, saying the issues “can be resolved through the mark-up process,” and called the bill “a massive step forward in providing workable frameworks for crypto, while continuing to protect consumers.”

Next Steps for the CLARITY Act

The U.S. Senate Committee on Agriculture, Nutrition, and Forestry has scheduled a markup hearing for January 27, just six days after the release of the legislative text on January 21.

Earlier this week, SEC Chair Paul Atkins expressed optimism, noting he is “bullish” on the bill’s prospects for enactment under President Donald Trump this year.

Industry observers will be closely watching how lawmakers respond to Coinbase’s concerns, particularly regarding stablecoin yields, DeFi limitations, and privacy protections—factors critical to fostering long-term crypto adoption.