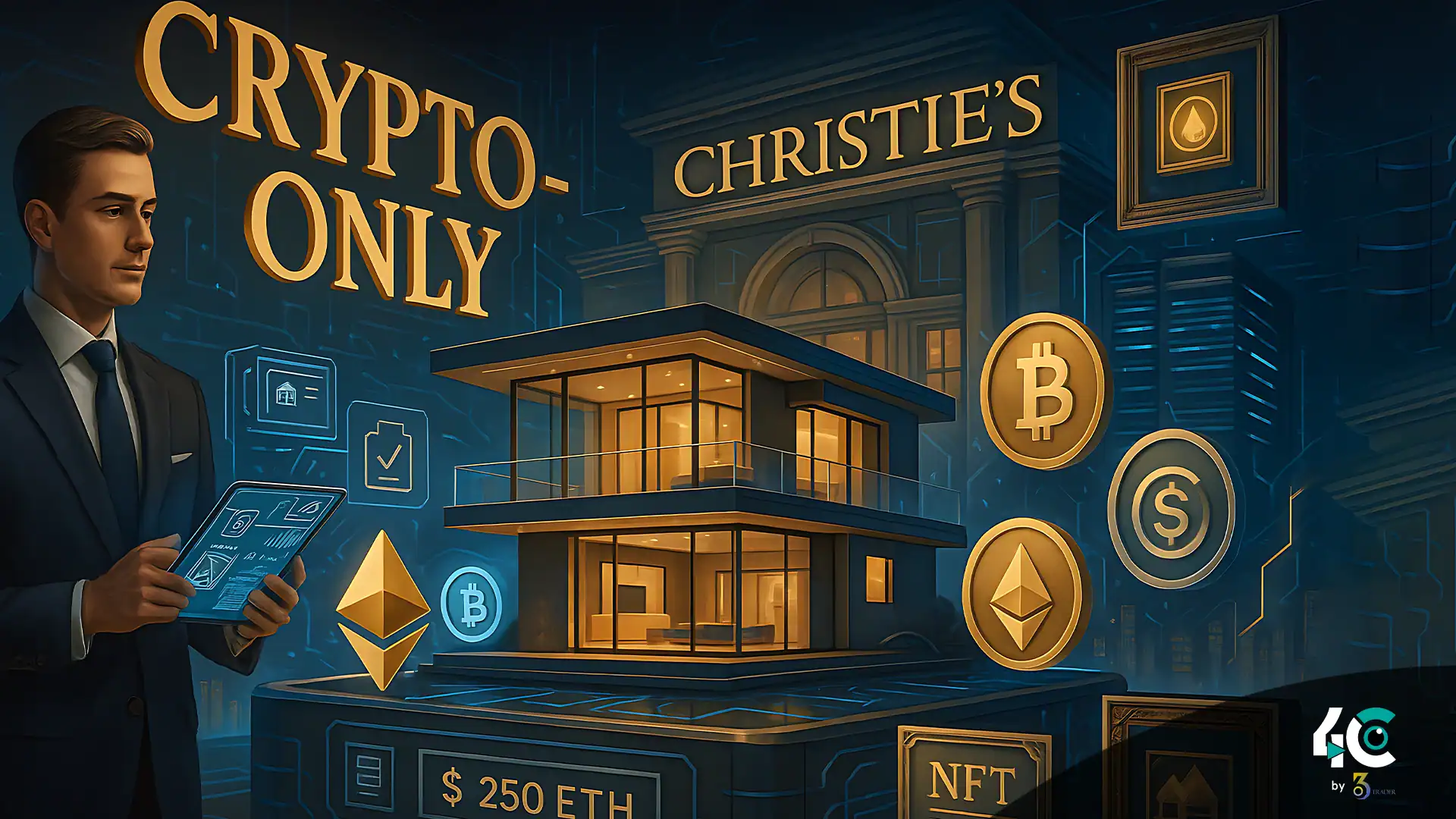

Christie’s International Real Estate, the luxury property arm of the legendary British auction house, has launched a crypto-exclusive division for ultra-wealthy clients seeking to buy property with digital currencies like Bitcoin and Ethereum.

According to The New York Times, the new initiative allows clients to bypass traditional banks and conduct all transactions on the blockchain. Buyers will benefit from increased privacy and efficiency, with a dedicated team of crypto experts, legal advisors, and financial professionals overseeing each deal.

“There’s an expanding appeal among buyers who only want to transact in crypto,” said Aaron Kirman, CEO of Christie’s International Real Estate Southern California. “So we created a team that directly caters to this growing demand.”

Luxury Homes Worth $1 Billion—Only Payable in Crypto

Christie’s has opened its premium listings—totaling $1 billion in value—to crypto-only offers. Properties include ultra-modern homes in Joshua Tree and the $18 million “Invisible House,” a mirrored architectural wonder in the California desert.

This isn’t Christie’s first foray into crypto real estate. The firm facilitated a $65 million Bitcoin-only deal for a Beverly Hills mansion, which proved that large, high-end property transactions can successfully be conducted on the blockchain.

Private, Pseudonymous Buying for Crypto Elites

Christie’s is catering to crypto investors who value discretion. Traditional property purchases often go through corporate structures or trusts. In contrast, crypto deals allow for pseudonymous purchases through wallet addresses—still traceable but not directly tied to personal identity.

Kirman noted that in several cases, sellers were unaware of the buyer’s identity, though all buyers were vetted for legitimacy and compliance. “We’ve been very successful in protecting our clients’ identities,” he added.

Real Estate’s Blockchain Future Is Closer Than You Think

While crypto transactions in real estate are still niche, insiders believe the tide is turning. Kirman estimates that within five years, one-third of U.S. residential real estate deals could involve crypto, as younger, tech-savvy investors shift their attention to tangible assets.

That shift is already catching the attention of regulators. The Federal Housing Finance Agency (FHFA) recently asked Fannie Mae and Freddie Mac to explore how cryptocurrencies could impact mortgage risk assessments—a signal that institutional finance is taking crypto seriously.

Conclusion:

Christie’s crypto-powered real estate venture is redefining how luxury properties are bought and sold. As crypto becomes a serious alternative to fiat in high-end markets, this move could be the start of a broader trend. With $1 billion in listings now open to crypto buyers, Christie’s is proving that blockchain isn’t just for digital art—it’s here to reshape real estate too.