The Fund and Its Blockchain Breakthrough

The CMB International USD Money Market Fund (CMBI), launched in 2024, is a sub-fund of the CMB International Open-ended Fund Company, Hong Kong. This fund primarily invests in deposits and government-issued money market instruments denominated in US dollars, sourced from the United States, Singapore, Europe, mainland China, Hong Kong, Macau, and Taiwan.

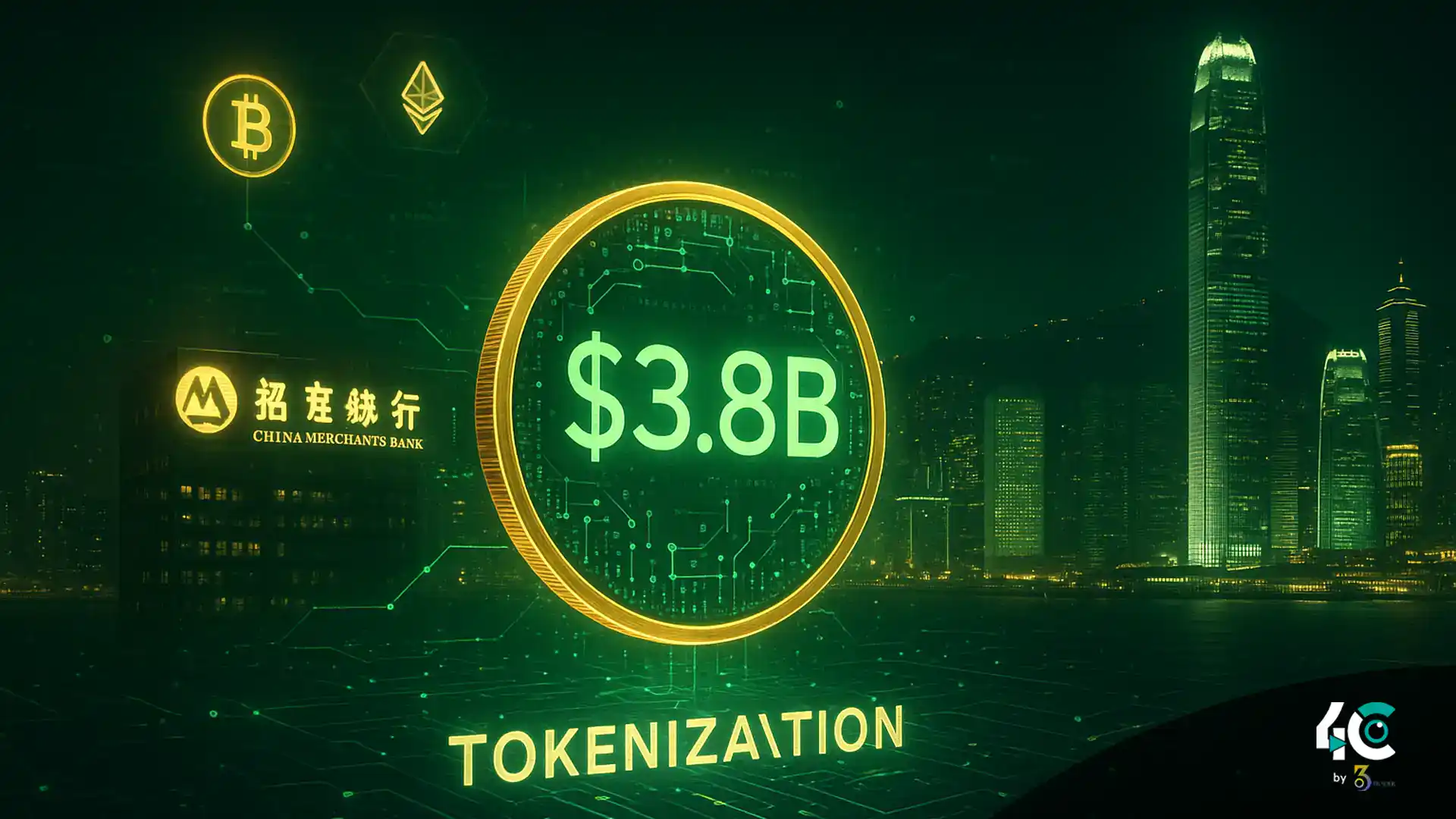

The fund has grown significantly since its creation. According to the latest data from the Hong Kong Stock Exchange, Assets Under Management (AUM) increased by 24%, from $2.9 billion in April to $3.6 billion in August. With the launch of BNB Chain, the fund is expanding both in value and geographic footprint, fueling the growth of DeFi.

CMBI and BNB Chain Blockchain Anniversary Celebration

Through this partnership, CMBI Asset Management is taking real-world asset tokenization (RWA) to new heights. The collaboration brings CMBMINT and CMBIMINT tokens to the BNB blockchain, offering accredited investors direct blockchain and investment access to this top-performing fund. Investors can now use fiat currencies or stablecoins to enter the fund and redeem their investment via the Singapore-based tokenization platform DigiFT.

Moreover, the collaboration with OnChain provides RWA infrastructure that allows for the utilization of the tokens in other DeFi applications. This offers investors various ways to lend and produce yield, in addition to the traditional benefits of a money market fund.

Also Read : Kazakhstan Shuts Down 130 Crypto Platforms Over Money Laundering

A Regulatory Cloud Over the Innovation

Pressure from Hong Kong lawmakers casts doubt on the project’s potential, a report says. Recently, it has been suggested that China’s securities regulator has instructed local brokerages to pause RWA projects in Hong Kong, amid ongoing concerns regarding this tokenization initiative.

The Hong Kong Monetary Authority has not commented on the matter, and BNB Chain did not respond to requests for comment by the time of publication. It remains uncertain whether this bold initiative will face regulatory hurdles as concerns over such projects continue to rise.