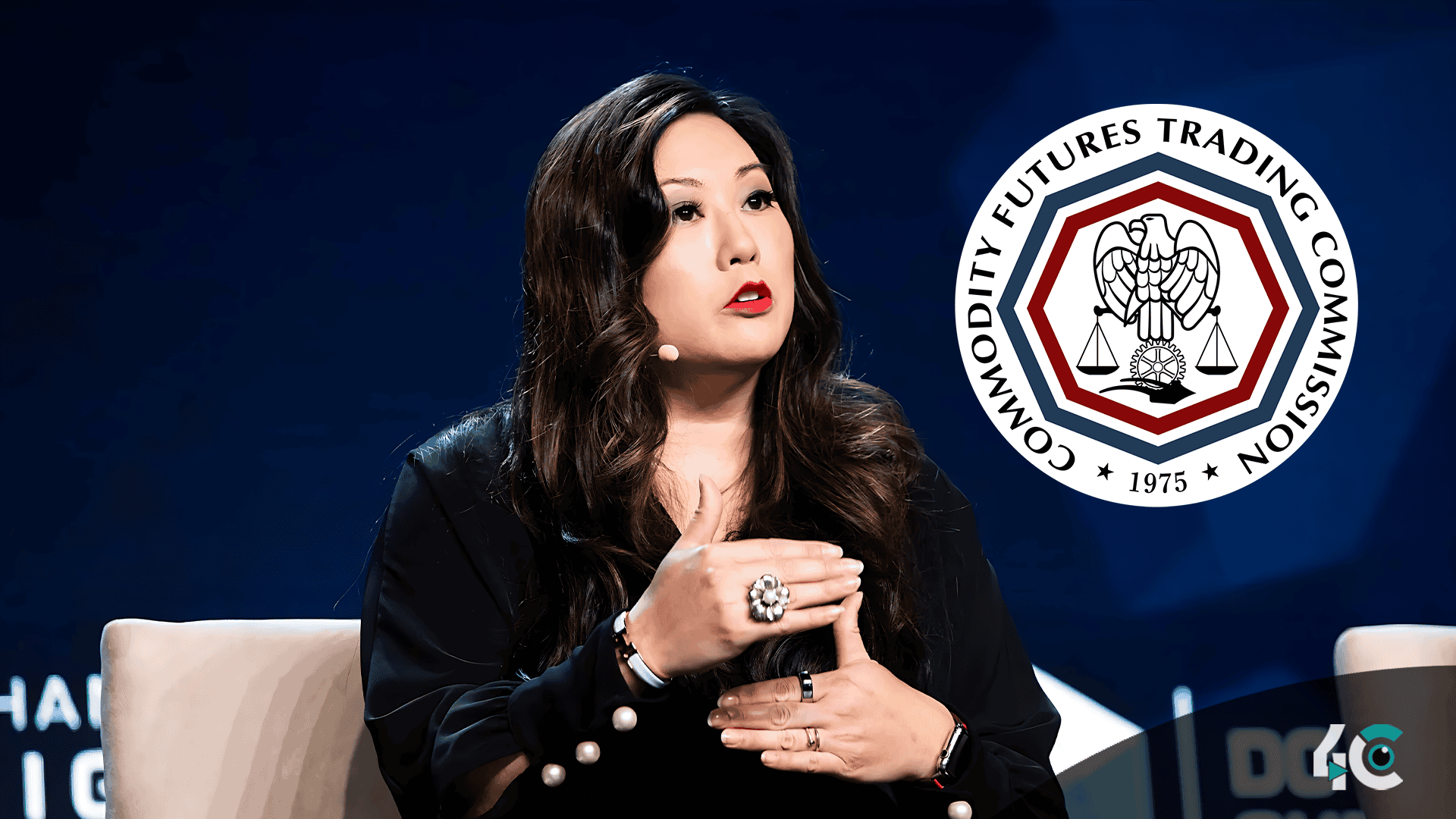

The US Commodity Futures Trading Commission (CFTC) is altering its enforcement policy under Acting Chair Caroline Pham, who has proclaimed a departure from “regulation by enforcement.” The reform intends to streamline the agency’s emphasis, ensuring that resources are devoted toward combating fraud while providing fair and transparent monitoring.

According to Pham, the CFTC’s Division of Enforcement will now focus on two main areas: retail fraud and complex fraud, such as market manipulation. This strategy adjustment aims to strengthen the commission’s ability to protect investors while reducing excessive regulatory burdens on legitimate enterprises.

Brian Young, interim head of enforcement, underlined that the reorganization would allow the agency to be more efficient in investigating fraudulent operations. “This new structure empowers our team to focus their expertise on securing justice for victims and upholding confidence in market integrity,” Young told me.

Pham, who took over as interim chair on January 20, has quickly implemented significant modifications to the agency’s enforcement strategy. The decision represents a change from the regulatory policies of former Chair Rostin Behnam, who stepped down earlier this year. The official nomination for Behnam’s replacement remains unknown.

The CFTC has been engaged in high-profile enforcement cases, securing more than $17 billion in monetary relief for fiscal year 2024. This contains cases against prominent cryptocurrency organizations like FTX, Binance, Voyager, and Celsius, as well as their former CEOs.

The shift in enforcement priority is consistent with broader developments among U.S. banking regulators. The Securities and Exchange Commission (SEC), for example, has just formed a task force on cryptocurrency regulation. Following a leadership change, Acting SEC Chair Mark Uyeda has also taken steps to separate the agency from a regulation-by-enforcement approach.

Looking ahead, the CFTC intends to engage with industry leaders through public roundtable talks to address major market concerns, particularly those relating to digital assets. According to reports, the agency is also looking into difficulties with cryptocurrency-based sports betting, particularly in relation to the forthcoming Super Bowl.

These advances are part of a larger effort to improve regulatory oversight, ensuring effective fraud prevention while creating a fair and predictable environment for enterprises participating in financial markets.