The Coming Blockchain Bloodbath

The numbers don’t lie:

- There are over 1,000 active blockchains today

- Just 10 accounted for 90% of 2023’s TVL and developer activity

- History repeats itself (remember when 50+ “Ethereum killers” died?)

By 2030, consolidation is inevitable. The winners will need:

Enterprise-grade scalability

Regulatory compliance

Real-world adoption beyond speculation

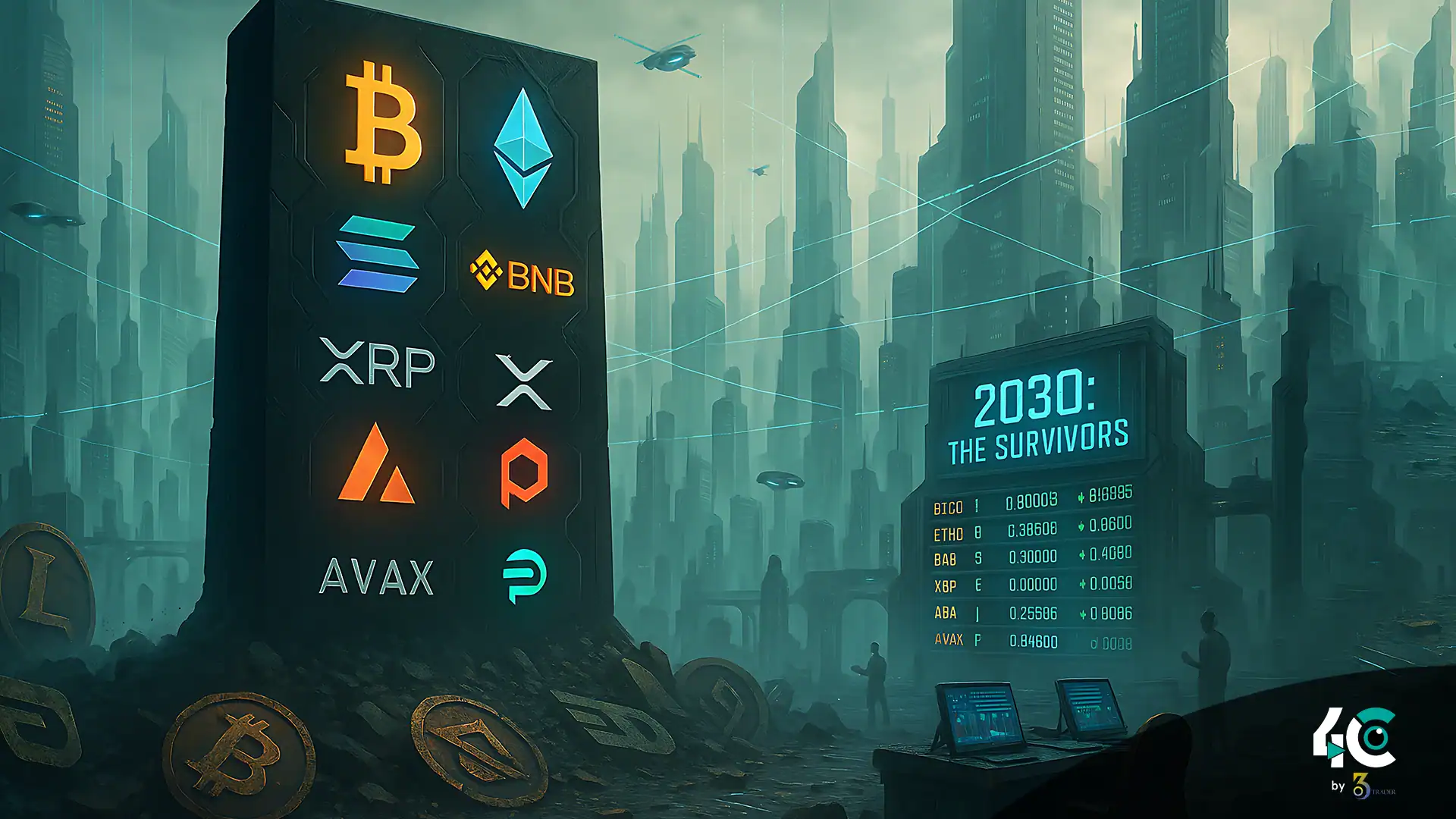

The 10 Blockchains Most Likely to Survive

- It stays because it is known as digital gold

- Main danger: Not changing from store-value use

- Reason for token retention: Dominant smart contract platform; Layer 2 ecosystem

- Competing startups and their enhanced scalability

3. Solana (SOL)

- It remains a fast-growing institutional support

- Biggest threat: concern over centralization, past downtime

- Reason for staying: Emphasis on interoperability; enterprise adoption

- Mainstream usability hindered by dysfunction

- Why it persists: genuine multichain vision, regulatory-friendly design

- Biggest threat: slow developer momentum

- Reasons for its durability: institutions, subnets

- USDT biggest threat: Could get squeezed between ETH and SOL

- Reason for retention: essential infrastructure, absence of rival

- Oracle monopoly may come under regulatory scrutiny

- Its stability comes from banking, and its lucidity through regulations

- Limited smart contract capability a major threat

- Why it stays: academic rigor, growing DeFi ecosystem

- The largest risk: too slow to innovate

10. A Dark Horse (TON, NEAR, Other)

- Potential rise due to Telegram’s TON user base

- Biggest obstacle: needs to prove real utility beyond hype

Why Most Blockchains Will Die

1. The Scalability Wall

Chains that are not capable of handling 100K+ transactions per second will become obsolete as adoption grows.

2. The Compliance Crisis

Networks that don’t meet MiCA / KYC standards will be banned.

3. The Liquidity Death Spiral

Chains with low total value locked (TVL) will see devs leaving, meaning less usage, and eventual death.

4. The AI Factor

Future blockchains may require AI integration to remain competitive.

How to Invest for the Coming Consolidation

- Concentrate on blockchains that have a total value locked of one billion or more and 100 daily active developers or more

- Do not create “ghost chains” with empty ecosystems

Watch enterprise adoption trends

Prepare for regulatory winners/losers

The Bottom Line

The crypto sector is developing, and just like the dot-com bubble, most projects won’t make it.

By 2030, we’ll likely see:

- Bitcoin and Ethereum as foundational layers

- 2–3 high-speed smart contract platforms

- Some specialty chains (privacy, oracle, etc.)

Everything else is either dead or niche.