The Rise of On-Chain Environmental Markets

Environmental markets generally suffer from transparency deficiencies, inefficiencies, and access problems. Carbon credit market and renewable energy certificates (RECs) can be cited as examples. Tokenization has the potential to fix these issues using blockchain technology’s access, transparency and immutability.

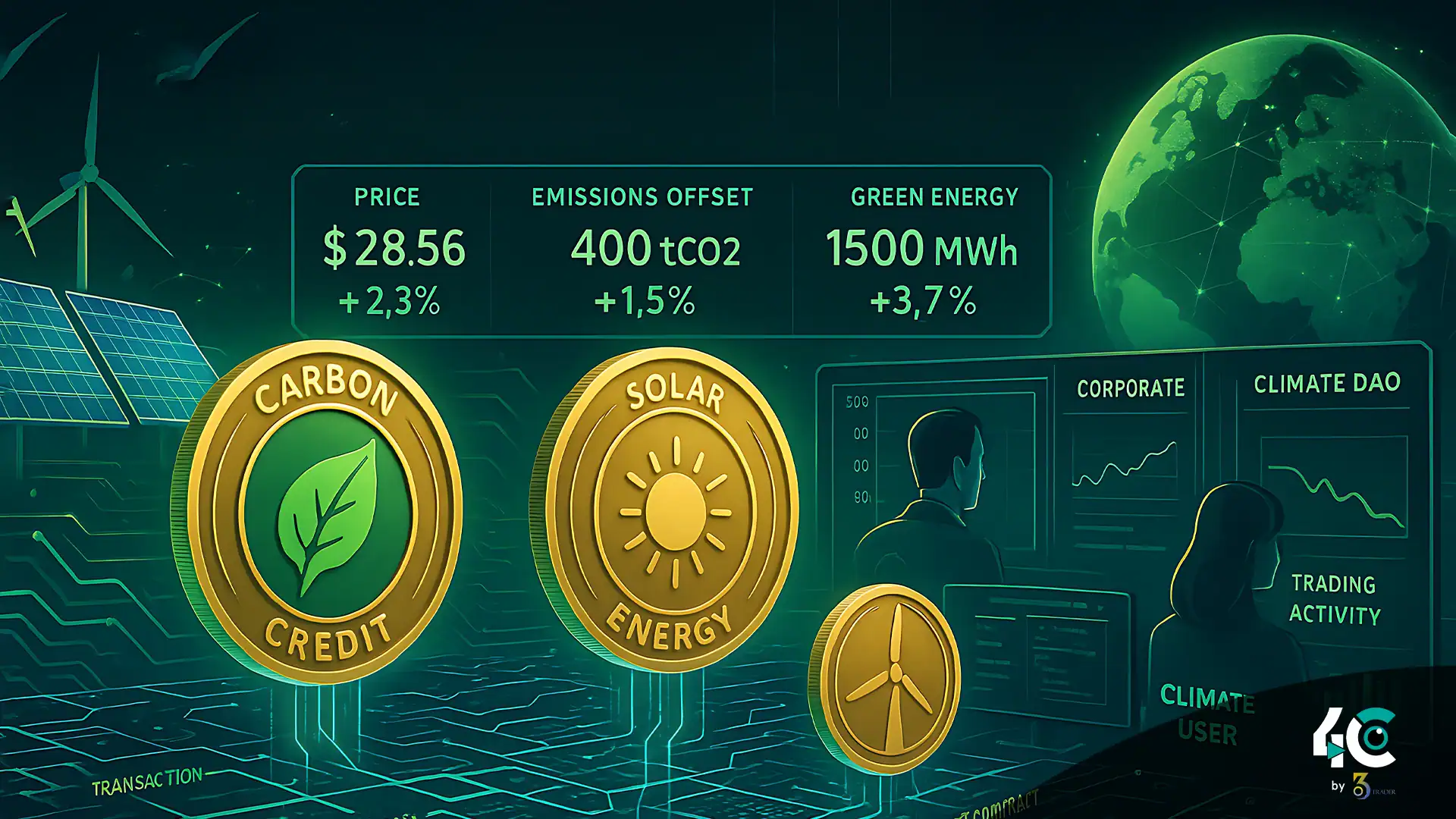

Tangible and quantifiable units of value that have been tokenized include one ton of CO₂ emissions avoided or one megawatt hour (MWh) of renewable energy. By staking, trading, and using DApps, they open up new ways to participate and bring innovations.

Key Use Cases in On-Chain Energy Markets

1. Tokenized Carbon Credits

We obtain carbon credits to balance the carbon footprint of any activity or thing. Through projects, people are being facilitated for participation in carbon markets and the blockchain is trying to make carbon tokens reliable.

Examples

- Toucan Protocol links traditional carbon offsets to the blockchain, creating Base Carbon Tonne (BCT) tokens that can be traded or plugged into DeFi protocols.

- The carbon credits will be tokenized backing for a carbon currency. Essentially, individuals will gain earnings from retirement credits that will reduce net emissions.

Benefits

- Increased liquidity and price discovery.

- Transparent tracking of credit origins and usage.

- Individual investors can enter the carbon offsetting space.

2. Solar and Renewable Energy Tokens

Solar energy and other renewables are being tokenized to provide direct benefits for the consumption and production of clean energy. Tokens are things like kilowatt-hours (kWh) of electricity that can be exchanged for a real-world result.

Examples

- Power Ledger is a platform that allows the peer-to-peer trading of renewable energy credits.

- WePower enables producers of renewable energy to create a token for future energy production, offering investors a fraction of the energy and an early investment opportunity.

Benefits

- Dependable energy distribution lessens dependence on grids.

- Token holders can gain energy at discount.

- Producers receive upfront capital to scale operations.

3. Utility Tokens for Water and Waste Management

Apart from energy, blockchain finds applications in water conservation and waste management. Researchers are experimenting with tokens that reward people for sustainable behaviours like using less plastic and recycling.

Examples

- Individuals that collect and recycle plastic can earn blockchain-enabled incentives through Plastic Bank, outreach that reduces the plastic in the ocean while boosting local economic value.

- Poseidon Foundation brings carbon credits into retail so customers can offset the carbon impact of their purchase at the point of sale.

Benefits

- Incentives and gamification encourage people to change their behavior.

- Tracks resource usage and impact in real-time.

- Creates solutions for worldwide sustainability issues.

Examples from Real Life: How Crypto Impacts Environment

The Carbon Bridge of Toucan Protocol

Toucan Protocol connects carbon registries to blockchains, allowing them to tokenize carbon credits. Credits earned in projects having similar characteristics (vintage or type of project) are pooled together in carbon pools.

Over 20 million tons of CO₂ have been mapped to the blockchain, bringing transparency and improved liquidity to the voluntary carbon market.

Peer-to-Peer Energy Trading by Power Ledger

People with solar panels can sell their unwanted power to their neighbours using a platform from Power Ledger. It cuts out the middleman. Pricing and settlement happen automatically with the help of smart contracts pricing making sure that producers get value for their produce.

The tests in Australia and Thailand resulted in reducing energy costs and increasing the use of renewable technology.

Climate Impact of the Sustaining Carbon of KlimaDAO

KLIMA tokens that will be backed by tokenized carbon is being offered by KlimaDAO. Holders can earn yield by staking KLIMA and retiring credits so that they are permanently removed from circulation.

So, many carbon credits got retired in this project, to fasten the process of net zero but also put money in people’s pockets.

Challenges Facing On-Chain Energy Markets

On-chain environmental markets are facing challenges, despite the promise.

- The government should, by regulation, acknowledge the existence of tokenized assets.

- The quality of the underlying assets must be sustained, such as the verification of renewable energy production.

- Are the fees too high? Will my transaction take long time? Both things matter.

- Many possible users are unaware of blockchain technology and its aid with sustainability.

Concluding Ideas on Crypto and Climate Action

On-chain energy markets are a unique blend of blockchain technology, and environmental benefits. Green Ventures aims to convert policy-related assets into valuable data assets through digital tokens. This allows policy implementations including carbon credits to be marketed as trading assets with strong ownership models. Tokenization aims to steer capital towards worthwhile green projects and ensure transparency in environmental markets while promoting sustainable behaviours of the public.

Despite the obstacles they face, the meteoric rise of these platforms demonstrates their clout. On-chain energy markets can meet global climate targets as companies and consumers as stakeholders come on board.

We are not just creating a better market system by combining cryptocurrency with environmentalism; we’re greening the future.

Conclusion

Modern environmental finance is on-chain energy markets. These markets can tokenize many markets, including carbon credits, solar energy, registered water, and others. With the help of blockchain technology, these initiatives provide solutions that enhance transparency, liquidity, access, and more – allowing individuals and organizations to engage in sustainability activities. Even though there are regulatory and technical hurdles, the projects Toucan Protocol, Power Ledger and KlimaDAO show us that using crypto in environmental markets could create remarkable climate outcomes and a decentralized green economy globally.