Bitcoin’s security is legendary, but not impenetrable. A new threat is quietly gaining traction—called the “Sleeping Miner” attack. Unlike a 51% attack, this method doesn’t require massive hash power. Instead, it exploits latency, stale blocks, and secret mining to execute profitable double-spends.

What Is the Sleeping Miner Attack?

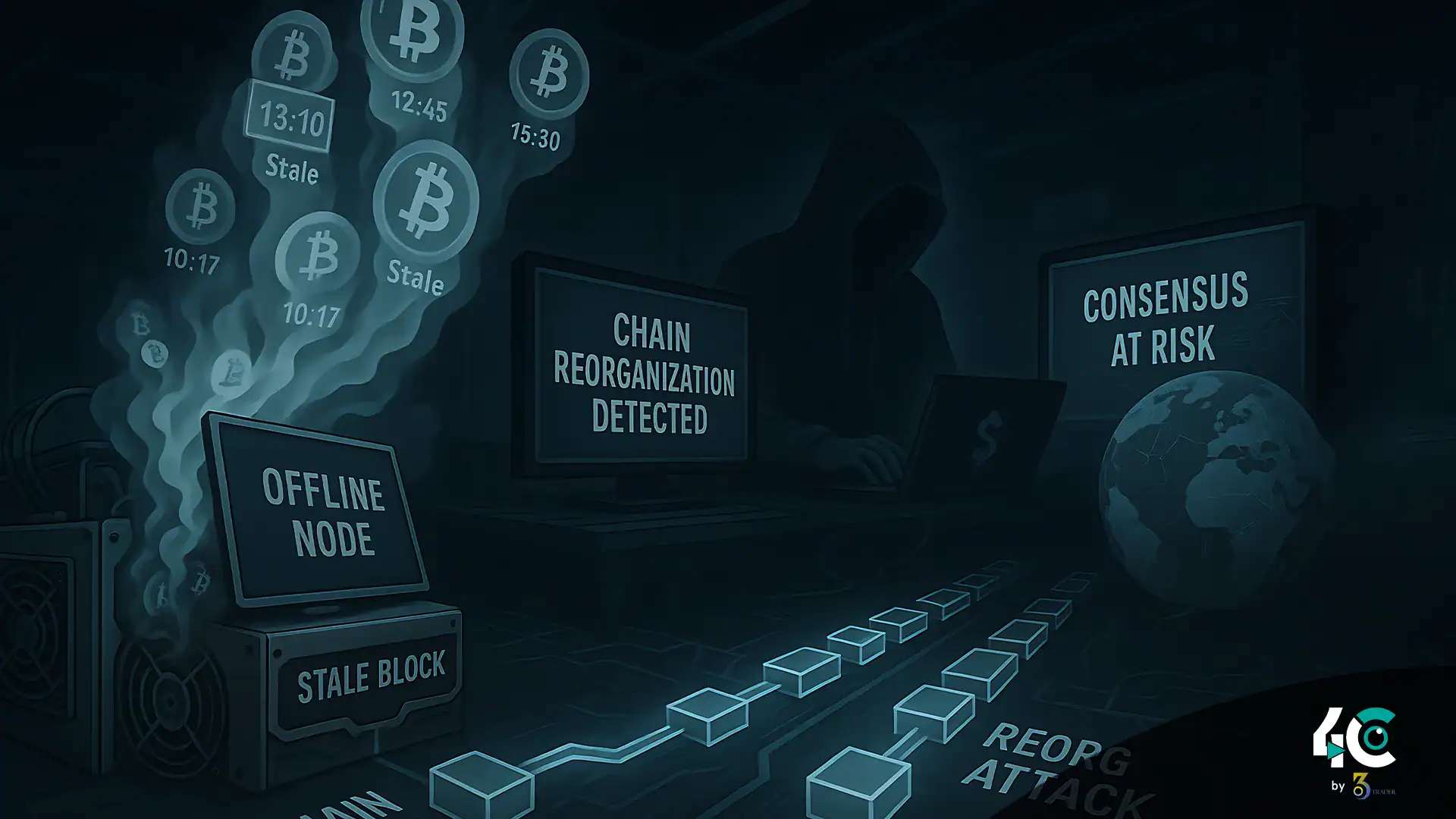

“Sleeping miners” operate in silence. They mine an alternate version of the Bitcoin blockchain in secret—never broadcasting their blocks to the network. Once the attacker has enough blocks, they unleash their private chain to replace part of the public chain. If it’s longer or has greater cumulative proof of work, the network accepts it as the valid one.

This rollback cancels recent transactions, allowing the attacker to double-spend coins that had already been “confirmed.” It’s a powerful deception rooted in Bitcoin’s own consensus rules.

How the Exploit Unfolds

- A miner begins building a secret chain of blocks without broadcasting them.

- They send BTC to a merchant or exchange through the public chain.

- The transaction gets included in a block and confirmed.

- While the recipient delivers the service or goods, the attacker’s secret chain continues growing.

- Once ready, the attacker releases their longer chain.

- Bitcoin nodes recognize it as the new main chain, orphaning the block that held the original transaction.

- The recipient loses the funds—and the attacker still has their BTC.

Why It’s Dangerous

This attack challenges the long-held belief that 6 confirmations are enough to secure a Bitcoin transaction. In certain conditions—such as poor network sync, private mining pools, or hash power rentals—this assumption no longer holds.

Small exchanges that credit accounts after just 1–2 confirmations are most vulnerable. Merchants, bridges, or protocols using Bitcoin-based security could also be at risk.

Not Just a Theory

This kind of exploit has previously hit smaller proof-of-work networks like Bitcoin Gold and Bitcoin SV. In 2021, Bitcoin SV was reorganized multiple times by a single miner, proving how real the risk is when a chain has lower decentralization.

Bitcoin’s size and network spread make this type of attack harder—but not impossible.

Who Should Worry?

- Exchanges crediting deposits after minimal confirmations.

- Merchants accepting large payments without full confirmation delays.

- Cross-chain bridges relying on Bitcoin finality assumptions.

How to Defend Against It

- Require 6 or more confirmations for high-value BTC transfers.

- Monitor for unusual reorgs or orphaned blocks using tools like ForkMonitor or Bitnodes.

- Push for greater transparency among mining pools.

- Improve node latency and block propagation speed.

Conclusion

The “Sleeping Miner” attack is a wake-up call for Bitcoin’s ecosystem. As attackers get smarter and more economically driven, stale blocks are turning into active weapons. Traders, developers, and exchanges must stay vigilant. In crypto, what looks confirmed today can disappear tomorrow. Always verify, monitor, and never underestimate a quiet chain.