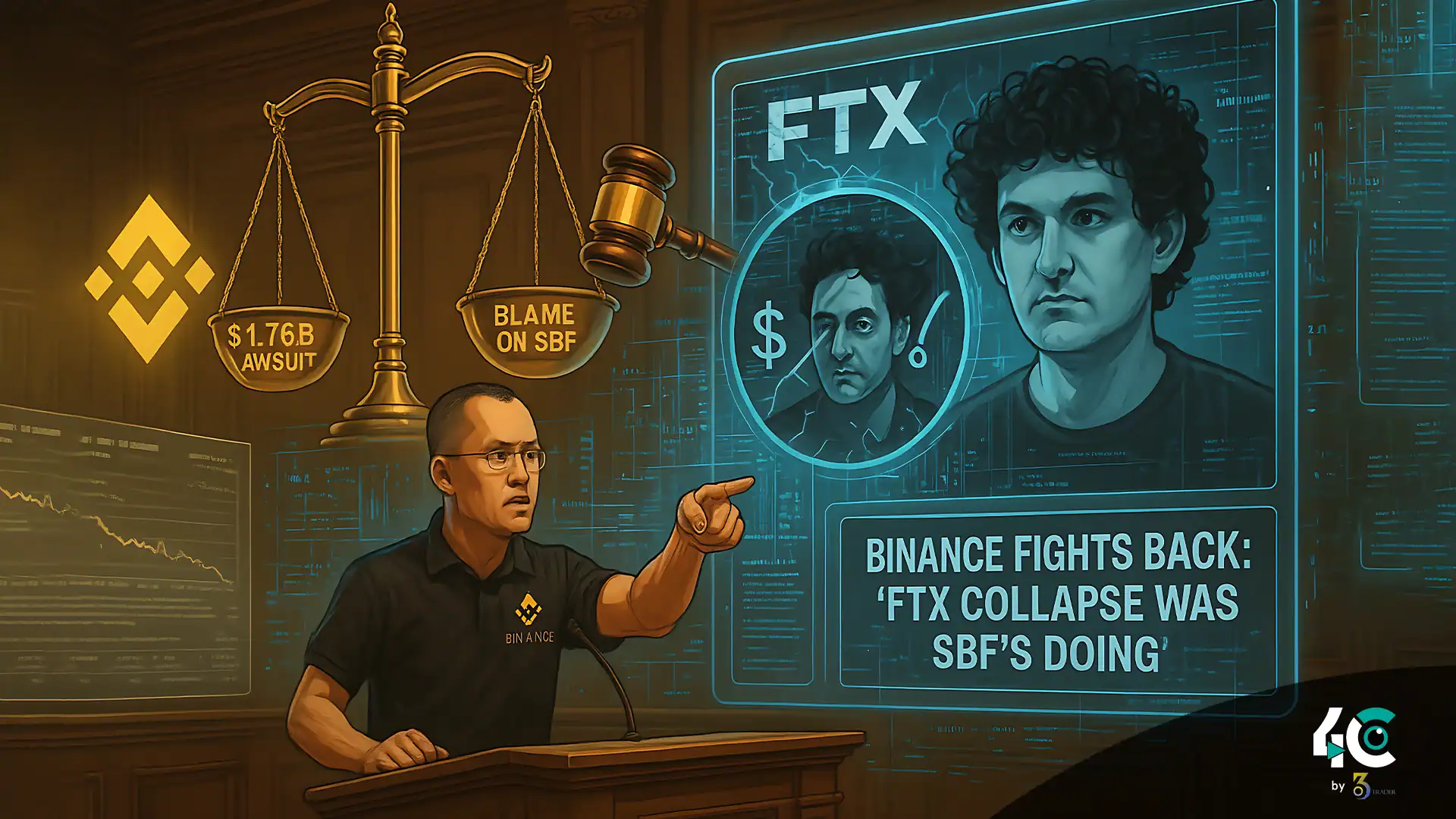

Binance Responds to FTX Lawsuit in Bankruptcy Court

Binance is fighting back against allegations in a $1.76 billion lawsuit by the bankrupt firm FTX, which claims Binance caused the collapse of the firm because of FTX’s own internal problems. They claim in their legal response that FTX founder Sam Bankman-Fried owed users a duty that has nothing to do with the exchange itself.

The Delaware Bankruptcy Court filed a motion on May 16 describing the lawsuit as “legally deficient.” Binance claims that FTX went down due to one of the largest corporate frauds in history, and this is due to Bankman-Fried being convicted on seven counts of fraud and conspiracy.

Buyback Deal and Collapse Timeline

FTX claims a 2021 buyback deal, where FTX bought back Binance’s stake for valuable assets, including FTT, BNB, and BUSD. The FTX estate asserts that FTX was already insolvent when it made the payment from customer funds. Binance sharply disagreed; FTX conducted its operation for another 16 months after the deal was made, which contradicts the claim.

Changpeng Zhao’s Tweet and Market Panic

A further important aspect is the tweet from Binance’s ex-CEO, Changpeng Zhao, released on November 6, 2022, announcing the liquidation of FTT tokens. FTX claims that the tweet set off panic and massive withdrawals, resulting in FTX’s collapse. Binance claims Zhao’s message referred not to private information but to public information in a CoinDesk article detailing problems at Alameda Research.

Jurisdictional and Legal Challenges

Binance further contends that the U.S. court lacks jurisdiction since not one of the concerned Binance entities is based in the U.S., and the very transactions in dispute occurred outside the U.S.

Binance has asked the court to dismiss all the claims with prejudice, thereby preventing a refile, and has referred to the lawsuit as speculative and retrospective. The FTX estate hasn’t offered a response yet, but the result of this case could affect the future of crypto litigation and clawback efforts significantly.