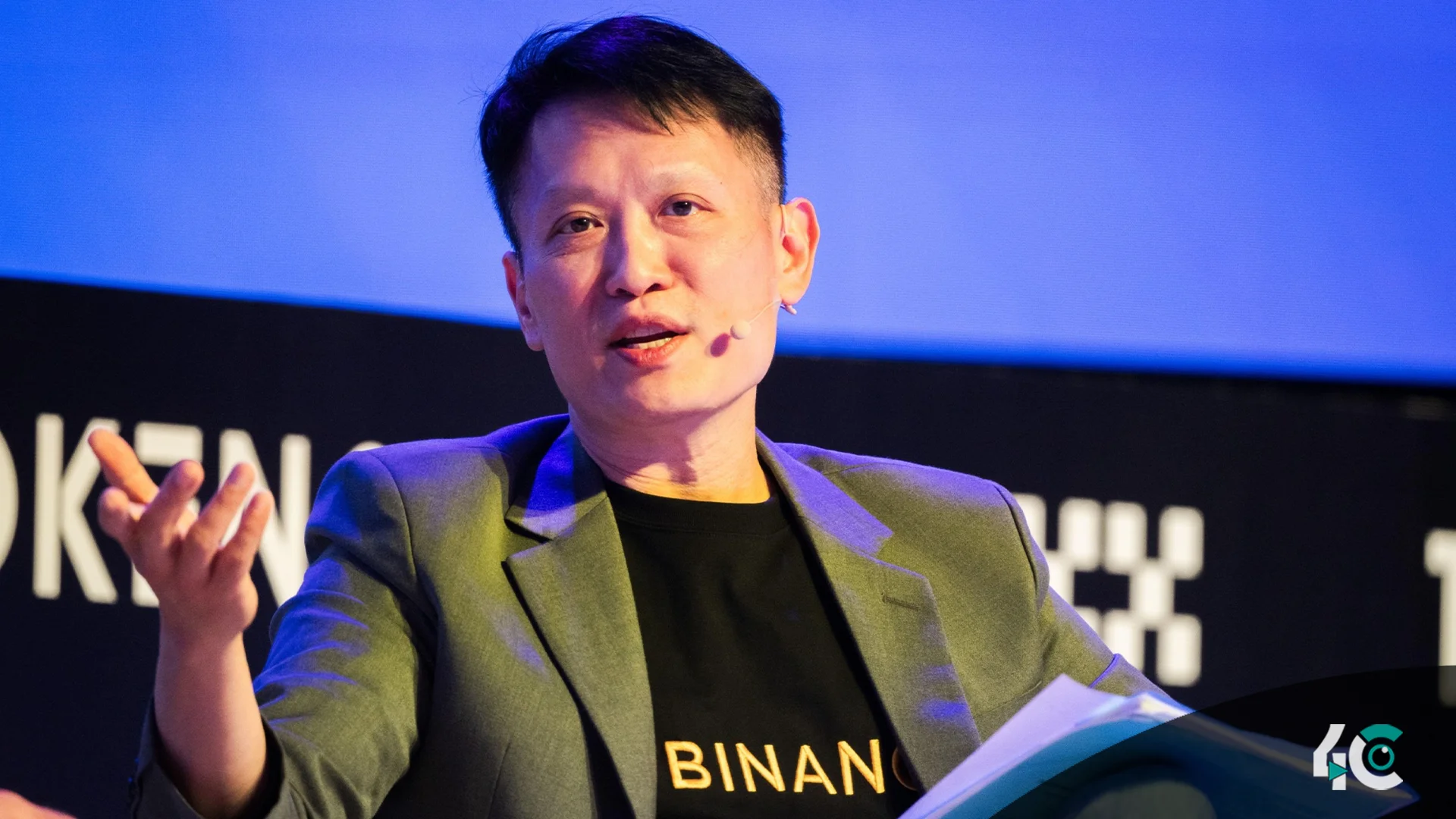

Binance’s CEO, Richard Teng, has spoken about the potential of the exchange reentering the US market following its exit in 2023. Despite the euphoria around President-elect Donald Trump’s crypto-friendly administration, Teng believes it is too early to talk about a return.

Teng told Bloomberg TV that Binance’s priority remains on global expansion rather than returning to the US market. He highlighted that the exchange is experiencing tremendous global expansion and is focusing on institutional investors, including sovereign wealth funds and high-net-worth people, as major drivers of future crypto growth.

“We are concentrating on global deployment and don’t consider re-entering the U.S. market a current priority,” Teng told me. “The discussion about re-entering is premature.”

Binance fled the United States in November 2023 after reaching a $4.3 billion settlement with the authorities over claims of money laundering and operating as an unlicensed money transmitter. This settlement also resulted in stringent oversight requirements, which Binance is attempting to comply with in several regions.

While Teng acknowledged the favorable climate for cryptocurrency under Trump’s administration, he stressed Binance’s immediate aims, which are to expand abroad. He also mentioned important cryptocurrency advances in other places, including the Middle East, where usage is rapidly growing.

The CEO’s remarks mirror Binance’s policy of remaining cautious as it expands its worldwide presence, with a focus on compliance and regulatory clarity in numerous locations.