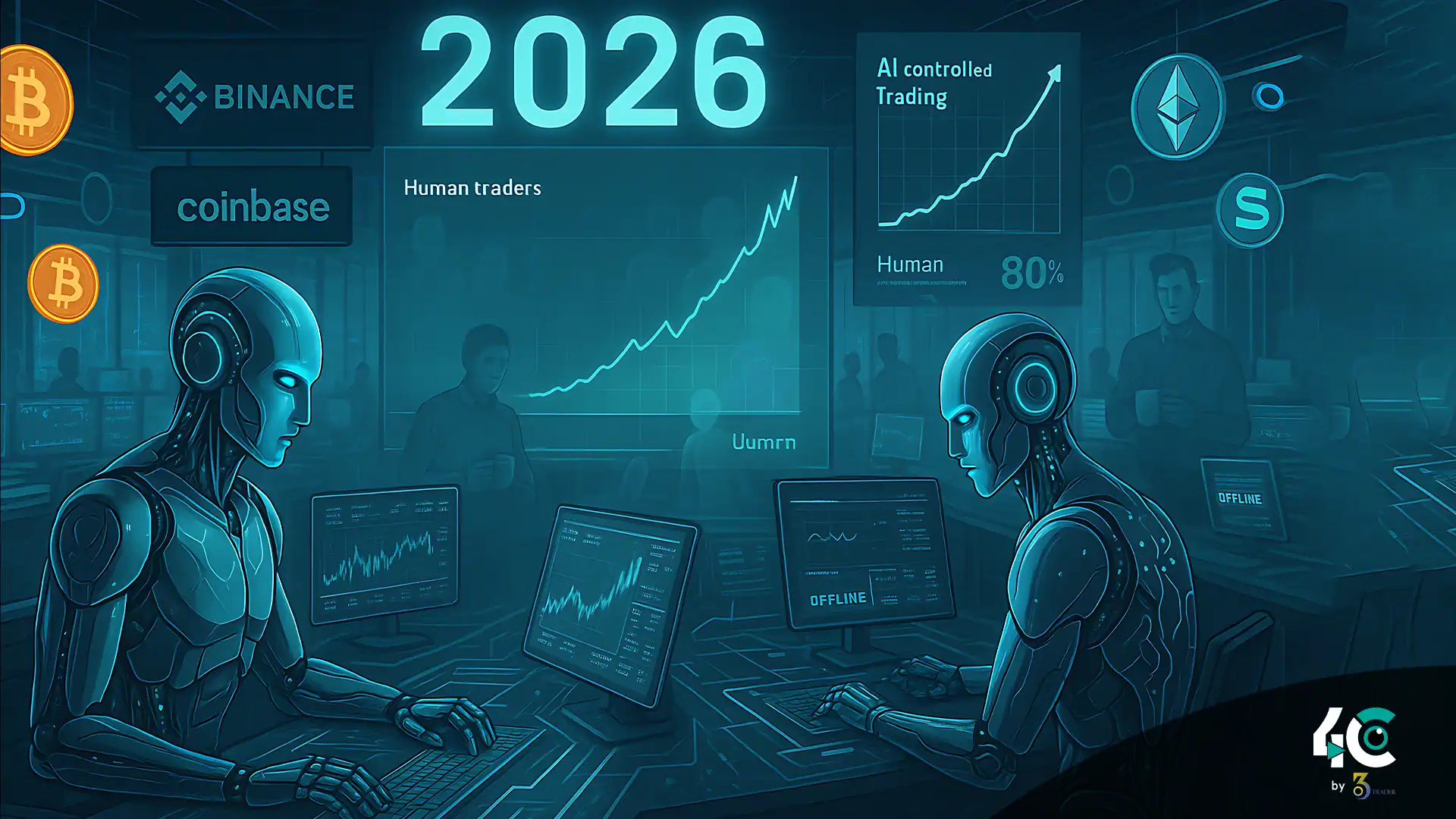

The Rise of the Machines: Why Bots Are Winning

Crypto trading is turning into an AI arms race where speed, data processing, and execution without emotion give bots the edge.

Key Reasons AI Bots Are Taking Over

- Millisecond Advantage—Capable of executing orders 1000 times faster than the human mind

- All day, all night trading—No sleep, no emotions, no errors

- Pattern Recognition—The AI looks for patterns that a human being might overlook

- Liquidity Sniping—This sniping technique is used to front-run retail traders before they have had a chance to execute their trade

A Cambridge University investigation approaches 2026 with estimates:

- Most retail traders are likely to be unprofitable compared to AI

- Robot to handle 60% of crypto volume

- The winners will only be elite quant firms and AI developers

3 Ways AI Bots Outperform Humans

1. High-Frequency Trading (HFT) Dominance

- AI executes thousands of trades per second

- Earnings from tiny price gaps (retail can’t compete)

- Crypto Minting: How many Bitcoin and Ethereum are minted daily?

2. Sentiment Analysis & News Arbitrage

- Good response that can be used by companies for investor signals

- Buys/sells before news breaks

- The rising number of users is a good sign

3. Adaptive Market Strategies

- AI learns from failed trades in real time

- Adjusts risk management dynamically

- Human traders stick to outdated strategies

Can Human Traders Survive?

The Bad News

- Manual trading is going out of fashion

- Retail trades destroy profits with emotions

- Exchanges prefer liquidity providers powered by AI

The Good News

- Humans are still better at macro trends

- If you’re equipped with knowledge, retail can utilize AI tools

- Niche strategies with low-liquidity altcoins are effective

How to Adapt (Before It’s Too Late)

- Try using AI tools such as 3Commas or Bitsgap to automate trades to some extent

- Put a focus on long-term investing. AI has always struggled with making these big macro plays on the 5-year time frame

- Stay Away from Day Trading—You’re up against algos with nanosecond latency

- Get acquainted with quantitative strategies, as the future will be all about math and not intuition

The Bottom Line

AI is not only making changes to crypto trading; it is slowly replacing traders themselves.